Costing Steelwork is a series from Aecom, BCSA and Steel for Life that provides guidance on costing structural steelwork. This quarter provides a market update and guidance on fire regulations for steel

UK construction new work output fell by 7.3% on a yearly basis at the beginning of 2024, which was the second consecutive quarterly reduction in construction activity. The Office for National Statistics has continued to record growth in repair and maintenance output, which showed a rise of 9.2% across the same period. The trend of new-build reduction alongside expansion of repair and maintenance activity has been a feature for several years now. In context, new-build work remained 9% lower in Q2 2024 when compared against early 2020. In the same period the extent of repair and maintenance has increased by 35%.

Construction sentiment indicators have shown a marked improvement compared with 2023. Despite construction orders being relatively subdued, sentiment is at its highest in two years. Respondents to surveys have reported increased momentum and strengthening sentiment across residential, commercial and civil engineering sectors.

Deloitte’s London office crane survey this summer reported that volumes of new commercial office starts exceed the 10-year average for the third consecutive year. The Bank of England base rate has had its first rate cut from the maintained high of 5.25% to 5.00%, representing the start of restored confidence and the alleviation of the previously muted outlook. This will have a major impact on funding but also on mortgage rates, which have been a blocker to residential development.

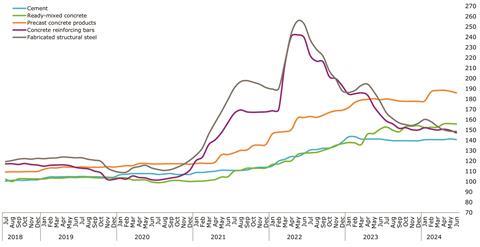

Aecom’s building cost index – a composite measure of materials and labour costs – continues to show inflationary increases. The Department for Business and Trade’s composite building cost indices suggest that material prices are 3% lower than this time last year. However, it is worth noting that manufacturing output prices have failed to keep up with input cost inflation. The subdued demand has helped to keep output prices down, and with input prices now reducing there is a likelihood that output prices will remain static as manufacturers look to recoup losses.

Figure 1: Material price trends

Price indices of construction materials 2015=100. Source: DBEIS

Shipping costs have shown an accelerated increase in June, with in some instances prices rising by around 50% from May to June; this is tracked against an annual increase in global shipping costs of 180%. Primarily this is driven by disruption to the Red Sea distribution route as a consequence of tensions in the Middle East. Prices for metals-based materials categories saw a jump in costs in May, with much of this being down to speculative pricing based on a perceived improvement in Chinese demand rather than any definable increasing factor.

The pressure on inflation for workforce wages has started to ease, with the rate at April being 2%. Labour capacity, which has been acutely impacted by insolvencies – most specifically in the MEP trades – will continue to be a persistent factor influencing general inflation.

The workforce contraction within the industry is evident in the number of unfilled vacancies, which is progressively rising. The CITB estimates that the sector needs to attract an additional 50,300 workers per year from now until 2028 in order to meet the anticipated demand.

Overall tender price inflation trends have remained relatively static over the first half of 2024. Aecom’s baseline forecast for tender prices has shown some pick‑up, increasing from 0.8% in Q4 2023 to 1.7% in Q4 2024, with the uplift in forecast increasing from 1.5% in Q4 2024 to 2.4% in Q4 2025. A composite measure of building input costs rose by broadly 3% in the year to June 2024. The consumer prices index fell to 2.0% in the 12 months to June 2024.

Insolvencies have continued to be a hallmark of the construction industry for the last two years, and this is continuing to be the case into 2024. The high rates of insolvency will persist in putting pressure on costs and will see insolvencies as an identified risk on which many main contractors will be reluctant to absorb the impacts.

While not reflected in published indices, the market has the potential to have a bounce-back. There are a number of factors that could potentially underline this, namely: there being a new government in the UK, interest rates starting to reduce, and funding becoming more available.

However, it is too early to predict any potential uplift beyond the tender price index table, and the increase in order books has not been seen as yet.

Figure 2: Tender price inflation, Aecom Tender Price Index, 2015=100

| Forecast* | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

|

1 |

120.4 |

120.0 |

131.2 |

145.4 |

145.8 |

148.9 |

152.8 |

|

2 |

121.0 |

122.6 |

134.5 |

146.6 |

146.6 |

149.7 |

154.0 |

|

3 |

119.1 |

125.3 |

138.1 |

146.8 |

147.4 |

150.5 |

155.2 |

|

4 |

119.1 |

127.5 |

142.3 |

145.6 |

148.1 |

151.7 |

156.3 |

Other market considerations

There are a number of current topics within the steel industry that are impacting design and have the potential to influence costs.

The potential uplift in workload has the ability to put increased pressure on order books. However, this may not start to materialise until 2025. It would be largely driven by the London commercial office sector, which is showing strong signs of recovery. Industry capacity and supply chain would be impacted, particularly in respect to workforce.

The industry evolution towards low or net zero carbon aspirations for buildings has meant a conscious move to rolled sections in preference to fabricated sections. As the production of steel plate is decarbonised, there is likely to be a point when fabricated sections will become more viable from a carbon perspective, because of their efficient design tailored to specific applications.

Sourcing cost information

Cost information is generally derived from a variety of sources, including similar projects, market testing and benchmarking. Due to the mix of source information it is important to establish relevance, which is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building, with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents variances in the key cost drivers. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 3), highlight the existence of different market conditions in different regions.

To use the tables:

1. Identify which frame type most closely relates to the project under consideration

2. Select and add the floor type under consideration

3. Add fire protection as required.

For example, for a typical low-rise frame with a composite metal deck floor and 60 minutes’ fire resistance, the overall frame rate (based on the average of each range) would be:

£169.50 + £112.50 + £29.50 = £311.50

The rates should then be adjusted (if necessary) using the BCIS location factors appropriate to the location of the project.

Figure 3: Indicative cost ranges based on gross internal floor area

| TYPE | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

||

|

Steel frame to low-rise building |

153-186 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

257-290 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

290-343 |

Steelwork design based on 110kg/m2 |

|

Floors |

||

|

Composite floors, metal decking and lightweight concrete topping |

88-137 |

Two-way spanning deck, typical 3m span with concrete topping up to 150mm |

|

Precast concrete composite floor with concrete topping |

134-188 |

Hollowcore precast concrete planks with structural concrete topping spanning between primary steel beams |

|

Fire protection |

||

|

Fire protection to steel columns and beams (60 minutes resistance) |

24-35 |

Factory applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes resistance) |

29-48 |

Factory applied intumescent coating |

|

Portal frames |

||

|

Large-span single-storey building with low eaves (6-8m) |

111-146 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

135-173 |

Steelwork design based on 45kg/m2 |

Figure 4: BCIS location factors, as at Q4 2023

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

126 |

Nottingham |

102 |

|

Manchester |

103 |

Glasgow |

93 |

|

Birmingham |

99 |

Newcastle |

90 |

|

Liverpool |

98 |

Cardiff |

93 |

|

Leeds |

91 |

Dublin |

90* |

*Aecom index

Steel For Life sponsors

Fire regulations for steel

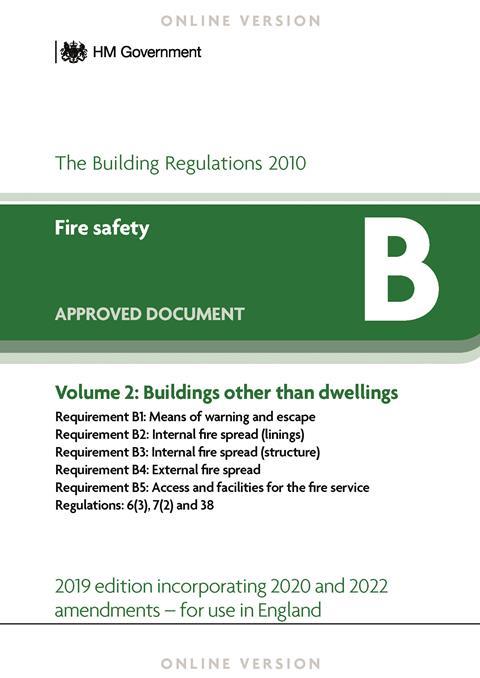

�ڶ����� regulations on fire safety in steel framed buildings are devolved across England, Wales, Scotland and Northern Ireland, but are generally similar – and all are performance-based

The tragic Grenfell Tower fire and the subsequent independent review of the �ڶ����� Regulations and fire safety by Dame Judith Hackett DBE, FREng in 2018, followed by the more recent Luton car park fire, have resulted in the industry asking questions about fire regulations and the fire resistance periods for buildings in the UK.

�ڶ����� regulations outline the legal requirements for the construction of buildings, which include the obligations for the performance of the building in the case of fire. These are a devolved power and each country (England, Wales, Scotland and Northern Ireland) within the UK is responsible for setting its own regulations.

The regulations in each country are similar and the requirements are performance-based. They state how the building should behave to ensure the health and safety of those people working in and around the building, but they do not say what methods should be used to meet these requirements. Engineers and designers can decide on the approach, provided they can demonstrate that their design meets the legal performance-based requirements.

For example, regulation B3.1 of the �ڶ����� Regulations for England states that: “The building shall be designed and constructed so that, in the event of a fire, its stability will be maintained for a reasonable period.”

To help engineers and designers, each national government has published guidance on how to comply with the performance requirements of its �ڶ����� Regulations, which are found in the following documents:

- Approved Document B, volume 2 – �ڶ�����s other than dwellings (for use in England)

- Approved Document B, volume 2 – �ڶ�����s other than dwellinghouses (for use in Wales)

- Technical Handbook – Non-domestic (for use in Scotland)

- Technical Booklet E – Fire safety (for use in Northern Ireland).

The minimum periods of structural fire resistance in Approved Document B (England) for multistorey buildings are given in table B4 in that document. The fire resistance periods are based on the height of the building and its occupancy. For example, an office building over 30m tall requires 120 minutes’ fire resistance and a sprinkler system, while an unsprinklered assembly building between 18m and 30m tall requires 90 minutes’ fire resistance.

Single-storey buildings do not normally require structural fire resistance because section 7.3 of Approved Document B (England) excludes buildings that only support the roof. However, there are some exceptions to the rule.

The fire resistance of steel members in fire has been the subject of much research over the past 40 or more years, to the extent that probably more is known about the performance of steel structures in fire than any other material.

All structural steel members have some inherent degree of fire resistance which is a function of the size of the member, the applied loading and its exposure to the fire. To determine the performance of steel members in fire, tests are carried out in a furnace where the temperature follows a standard time-temperature relationship. This temperature profile is referred to as the standard fire and bears no relationship to a real fire. Unlike a real fire that cools as the material is consumed, the temperature in a standard fire increases with time. The fire resistance periods obtained from a standard fire test are a measure of the adequacy of the performance of the member in a fire but have no direct relationship with the duration of an actual fire.

Standard fire tests on steel members have shown that the limiting (failure) temperature is not fixed but depends on the temperature through the profile of the members and the design load. For small sections that are exposed on all four sides to fire, the fire resistance period can be as low as 12 minutes but for larger sections with some degree of protection from, for example, the concrete slab, the fire resistance period can be as much as 50 minutes.

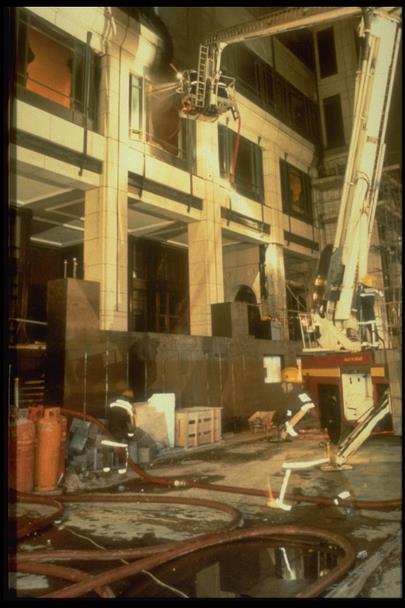

Observations from real fires such as the fire that occurred at Broadgate phase 8 on 23 June 1990, on a partly completed steel framed building with composite floors with limited or no fire protection to the main steel members, showed that the interactions between structural members can result in a higher-level fire resistance than those based on individual members.

This inherent structural behaviour was further supported by a series of full-scale fire tests on an eight-storey steel framed building with composite floors, which was carried out in the 1990s at the �ڶ����� Research Establishment’s Cardington facility.

The introduction of the fire design methodology in the Eurocodes, which include EN 1991-1-2, EN 1992-1-2, EN 1993-1-2 and EN 1994-1-2, has provided designers with greater flexibility to the design of steel and composite structures. The options now available to meet the requirements of the �ڶ����� Regulations range from consideration of isolated member behaviour, subject to the standard fire, to a consideration of the physical parameters influencing fire development coupled with an analysis of the complete structure.

Want to find out more about fire guidance in the devolved nations and how steel frames behave in fire?

It will include guidance on compliance with fire regulations, the properties of steel at high temperatures, and the limitations of standard fire testing.

To register your attendance, scan the QR code.

This Costing Steelwork article produced by Patrick McNamara (director) of Aecom is available at .

The data and rates contained in this article have been produced for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the article content.

No comments yet