The UK tax system provides a number of statutory reliefs and payable credits which, while valuable, are often overlooked by property owners and occupiers. An awareness and consideration of these can improve post-tax returns and free up valuable working capital, reports Paul Farey, director and fiscal incentives lead at Aecom

01 / Introduction

Development and investment in real estate is a capital-intensive process with sophisticated cost-modelling and management techniques that have evolved over time.

Surprisingly, many appraisals remain naive in terms of taxation and are carried out “above the line” with no consideration given to the post-tax position, available reliefs or payable credits.

The UK tax legislation, while complex and voluminous, provides benefit to construction stakeholders primarily through capital allowances and land remediation relief, as well as other eligible taxable deductions including repair works, enhanced deductions where research and development is involved; and the ability to relieve or mitigate irrecoverable VAT incurred.

For taxpaying companies the benefit is crystallised by means of a reduction in the liability to corporation tax for UK businesses; or income tax for individuals, partnerships or non-resident landlords. Where payable credits are available for qualifying expenditure, the repayment from HM Revenue & Customs (HMRC) can mitigate the initial capital outlay.

This article sets out some of the typical reliefs available, when they are applicable and what they may be worth, as well as some of the key considerations.

02 / Available reliefs

Capital allowances

Capital allowances (CA) are the most prevalent relief available in the form of plant and machinery allowances. Eligibility for plant and machinery assets is determined by statute, case law and HMRC guidance.

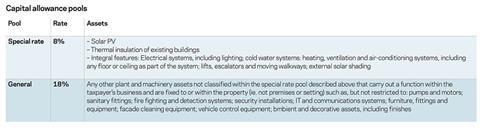

Qualifying expenditure incurred on eligible plant and machinery assets is allocated to specific “pools”: either the special rate pool or general (main) pool, with allowances claimed at rates of 8% and 18% per annum respectively on a reducing balance basis.

Machinery assets are easily recognised and can be interpreted from dictionary definition, whereas “plant” assets tend to be defined by their particular function within the taxpayer’s business and precedent case law.

Whether an asset is eligible as plant may vary from one business to another, depending what the taxpayer’s trade is. There are also considerations around how an asset is fixed to the property as well as deemed ownership.

Enhanced capital allowances (ECA) provide 100% relief (‘first year allowance’) in the year of expenditure for certain approved and listed energy and water-saving technologies, as well as plant and machinery installed in enterprise zones under specific conditions.

Lossmaking UK companies can surrender ECA in favour of a 19% payable credit.Since the withdrawal of industrial buildings allowances (including hotel allowances) in 2011, capital allowances for building structures are only available in the form of business premises renovation allowances (BPRA) and research and development allowances (RDA).

BPRA provides 100% relief for the capital costs associated with bringing vacant property in disadvantaged areas back into commercial use.

Strict rules apply in terms of the qualifying criteria and expenditure covered, with the relief only scheduled to apply in its current form until April 2017.

While many structural works do not benefit from capital allowances, the legislation does permit certain works to qualify where they are “incidental” to the installation of plant and machinery assets within existing buildings.

Land remediation relief

Land remediation relief (LRR) was introduced in 2001 and provides 150% relief against UK corporation tax for expenditure incurred in remediating contaminated land. It is not a form of capital allowances relief, but an enhanced deduction as an incentive for bringing brownfield sites back into use.

LRR allows developers and property investors to benefit from major savings on construction expenditure, as it provides a broad definition against which expenditure can be claimed on both land remediation and also on land which has remained derelict since 1998.

Land remediation includes carrying out works and preparatory activities to the land and buildings for the purposes of preventing, minimising, remedying or mitigating the effects of any relevant harm linked to the reason for which the land is in a contaminated state.

Land and buildings are in a contaminated state if substances in, on or under it are causing relevant harm or there is strong possibility of relevant harm.

There are strict rules around the relief and the taxpayer or a connected party cannot have caused or contributed towards the contamination: known as the “polluter pays” principle.

Remediation of naturally occurring contaminants is outside of the regime, with the exception of Japanese knotweed, arsenic and radon. Asbestos will be a major consideration when dealing with alterations or refurbishments of older property stock.

LRR is only available to UK companies as a relief against corporation tax and the 150% benefit of qualifying expenditure is realised as follows:

- Companies incurring capital expenditure (for instance, holding the property as a fixed asset) will elect to expense the qualifying expenditure and get a 150% deduction against taxable profits in the year the expenditure is incurred.

- For companies developing out of trading stock and incurring revenue expenditure, the base costs are automatically expensed for tax purposes once the property is sold, so the benefit will be an additional 50% of the qualifying expenditure.

- Where the taxpayer is lossmaking, the relief can be surrendered in favour of a 16% payable credit.

The claimant company must have a major interest in land (ie. a freehold or leasehold in excess of seven years) and no relief is provided for Landfill Tax costs.

Repairs and revenue deductions

So far, the focus has been on relief against capital expenditure incurred: where construction is undertaken by a developer holding the property as trading stock, the expenditure will be “revenue” in nature, meaning that all costs are tax-deductible against sales proceeds once the building is disposed of.

Where works are carried out to existing buildings or structures, some of these may be classified as a repair in nature (repairs and maintenance, “R&M”), as they do not extend, enhance or alter the nature of the underlying asset. Expenditure incurred on repairs can be classified as revenue expenditure and treated as an expense of the business, with a full deduction for tax purposes in the year expenditure is incurred.

The distinction between capital and revenue can be something of a grey area, particularly where modern equivalent materials or technologies are used.

The challenge can be further exacerbated where repairs are not carried out ad hoc, but tackled as part of a larger programme of refurbishment. In such cases, it is necessary to differentiate between true repairs and those works which enhance the property, segregating the costs as appropriate.

Research and development

Historically, the UK’s spend on research and development (R&D) has lagged behind that of other countries. As part of the government’s move to improve innovation and increase productivity, measures were introduced to encourage R&D activity. Capital expenditure incurred on qualifying R&D activities, including constructing facilities, is relieved through Research and Development Allowances (RDA) within the Capital Allowances Act 2001.

For operational (trading) expenditure, the R&D tax relief regime has been around since 2000, but many companies do not take full advantage of the tax savings offered.

Studies show that awareness of the benefit is still very low among small and medium-sized enterprises (SME), while among large companies the take up is skewed towards traditional hi-tech industries and scientific research companies.

The rates of relief are generous, particularly for SME, who can claim a 230% super deduction of qualifying costs or a 14.5% payable credit, if lossmaking.

Large companies can currently deduct 130% of qualifying expenditure, but from 1 April 2016 this will be fully replaced with the Research and Development expenditure credit (RDEC), providing an 11% “above the line” credit.

In order to benefit, taxpayers must show that their project work seeks an advance in science or technology and be able to articulate the intended outcome. They will need to demonstrate how the project overcomes scientific or technological uncertainty.

Designers and engineers are often unknowingly at the forefront of this: tackling changes in building regulations, overcoming particular site challenges, targeting carbon reduction measures, working with improved material

technologies and construction processes.

In addition property owners and occupiers demand the latest standards of robustness, durability, fire resistance, thermal performance, sound insulation, stability, efficiency and sustainability.

Value added tax

Value added tax (VAT) is an indirect tax introduced in 1973. It is administered by traders throughout the supply chain with the final cost borne by the end consumer.

Most commercial property development is standard rated at 20%; VAT is paid on goods and to suppliers and charged on sales: the difference is accounted for and submitted to HMRC and there is no real risk to taxpayers, save for cashflow issues and debtors.

Where supplies are exempt (for instance, outside the scope of VAT) there is the risk of irrecoverable VAT on suppliers’ costs, goods and materials. This is more likely to be an issue for occupiers in or associated with sectors such as financial services, education, healthcare and charitable concerns. Early consideration is therefore essential to identify and budget for potential liabilities and consider where it can be mitigated or deferred.

Residential development, whether private, social or student accommodation, is a complex area, but it does allow for zero rating in certain circumstances. Pre-planning can help to target the areas for opportunity, particularly in mixed-use development and to ensure that contractors invoice at the appropriate rate of VAT.

For fitting-out works, consideration will need to be given to “blocked materials” such as white goods, carpets and bespoke furniture for which no recovery of VAT paid is possible and will represent a real cost to the project.

03 / qualifying expenditure

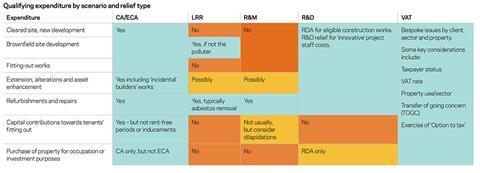

Qualifying expenditure can be incurred by taxpayers under a variety of scenarios throughout the property cycle. Available relief will depend on a number of factors specific to the taxpayer not least the nature of expenditure incurred and the taxpayer’s business. The appetite to claim reliefs, allowances or payable credits will be based on tax status and the level of taxable profits to be sheltered.

The table below attempts to highlight some of the typical ways in which expenditure (either capital or revenue) can be incurred on property and which of the identified tax considerations may give rise to relief, cashflow or planning opportunities.

For mixed-use developments, it is possible that there may be contradictory factors to consider and segregation of costs may be necessary to properly allocate identified benefits.

The UK tax legislation is unsurprisingly complex (in excess of 20,000 pages) and with recent high-profile media attention, a significant proportion is aimed at anti-avoidance measures. Property financing and holding structures are increasingly complex and restrictions exist around transactions involving connected parties, sale and leaseback arrangements or arrangements structured to deliver a tax advantage.

When assessing qualifying expenditure, it is important to determine the appropriate basis for relief and ensure that all direct and indirect costs are captured. For development expenditure, gross costs should include overheads and profit, preliminaries, professional fees and management charges.

The remoteness of costs to eligible assets should be considered prior to attribution. Work within existing buildings may generate enhanced levels of relief once incidental builders’ works and attendances are taken into consideration.

04 / Commercial office model

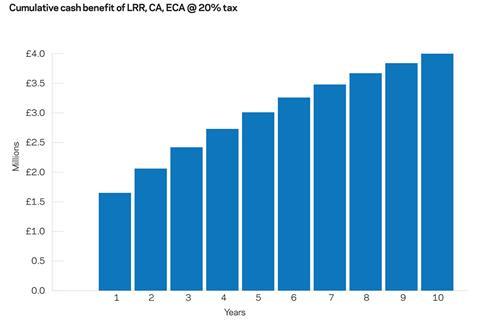

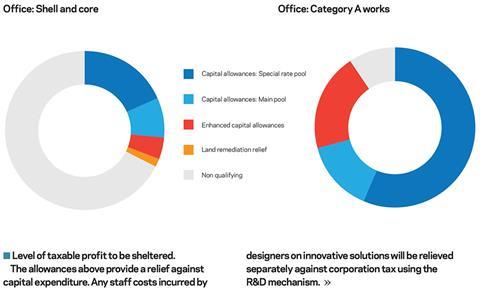

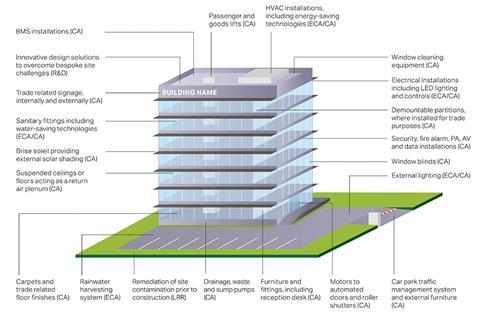

The graphic shows some of the potential benefits available to a taxpayer incurring capital expenditure on a new office development. The example references the London Offices Cost Model published in �ڶ����� in September 2015.

Many aspects of the development will give rise to a potential benefit for tax purposes: from innovative aspects of the design (R&D); tackling on-site contamination (LRR); through to passive and active plant and machinery assets (CA), some of which may be on approved energy and water technology lists (ECA).

The cost model provides a build up to shell and core construction costs of £58.4m, with an additional £8.95m of capital expenditure towards category A fitting out works. Around one-third of the shell and core works qualifies for relief through LRR and CA, with most of the qualifying expenditure allocated to the CA special rate pool, due to the mechanical and electrical (M&E) services content.

The category A fitting-out works are significantly more beneficial in terms of qualifying expenditure, with extensive M&E services spend and the LED lighting and control system potentially benefitting from ECA. Where works are undertaken for direct occupation, a clear link can be made between installed assets and their function within the taxpayer’s business, strengthening the “plant” classification, most of which will fall within the general pool for CA. Around 85% of the capital cost can be qualifying expenditure for CA purposes.

Using the headline income and corporation tax rate of 20%, available LRR, CA and ECA for the shell and core plus the category A fitting out give rise to a total undiscounted cash benefit of over £5.4m. The flow of cash benefit over time is shown by the graph on the previous page:

In practical terms, the real cash value will depend on the timing of available allowances and the claimant’s tax position. Some of the particular factors include:

- The overall level of qualifying expenditure identified

- Where the qualifying expenditure is incurred: i.e. against higher-yielding relief such as LRR

- Use of annual investment allowance (AIA) and first year allowances, such as ECA to accelerate initial benefit

05 / Comparison with other sectors

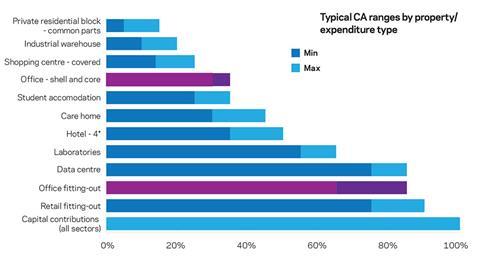

Available reliefs will vary by property and taxpayer circumstance; however, systematic differences will also apply by sector, based on typical construction specifications. Expected capital allowances ranges for construction capital expenditure are shown in the graph - minimum levels are reflected by the solid bar, with typical upper levels in the shaded bar. Capital contributions towards tenant fitting-out works can be structured such that all or none of the payment can benefit from relief. For comparison, the shell and core office model and category A fitting-out works are highlighted in contrasting colours. Higher levels of capital allowances relate to expenditure where there is high services content, such as data centres, or a strong correlation of installed assets to business function, such as retail fitting-out. Capital allowances are not available on dwelling houses, meaning ordinary residences are precluded, although allowances are available for eligible assets within common parts and external works. Many residential developments will benefit from valuable cash savings through LRR in tackling site contamination works.

06 / Planning opportunities

Despite the extensive cash saving opportunities afforded, most construction projects are undertaken with little or no regard to the post-tax position. In many cases a detailed forensic review of expenditure incurred can give rise to:

- Significant cash savings against current or future tax liabilities

- Improved cashflow through deferral of taxes due

- Reduced capital cost where payable credits are available.

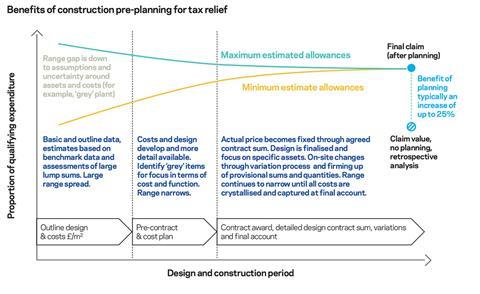

Pre-planning of construction projects can enhance the benefits through targeting assets and categories of spend which attract higher or accelerated levels of relief. The graphic, below right, sets out an approach which generates reliefs that can be up to 25% higher, when compared with peer projects with analyses conducted post-development and without planning. By means of example, incorporation of low-energy (or water-saving) technologies may be driven by planning or building regulations. In complying with this, there will be additional indirect benefits of operational performance, such as reduced running costs, supplemented by tax benefits through ECA or payable credits. Unfortunately most procurement strategies are driven by shorter-term capital cost considerations rather than a whole-life approach, let alone any tax considerations.

Many European appraisals are modelled post-tax and therefore early engagement with project stakeholders is a consideration that improves the final level of tax allowances with a commensurate reduced risk of disallowance from any potential HMRC enquiry.

Proactive liaison with the appropriate project stakeholders can:

- Identify potential opportunities and pitfalls and develop an appropriate strategy

- Consider the impact of proposed funding and holding structures on available reliefs

- Collate information to support future negotiations with HMRC, particularly around cost breakdowns, attribution of on-costs or understanding of asset function to support “plant” arguments

- Estimate potential benefits for management reporting and irrecoverable costs for budgeting

- Comment on tax impact of design or procurement options, especially in respect of variations

- Appraise energy and water-saving technologies with engineers and contractors to optimise the

ECA position

- Advise on impacts of lease incentives with potential tenants and modelling of resulting tax impacts

- Consider the VAT implication of transactions, whether exempt or standard rated, including TOGC and options to tax. Appraise the level and impact of irrecoverable VAT for budgetary purposes.

Early engagement need not be intrusive and allows information collation in real time as the development progresses with the project team in harness. The resulting benefits are improved cashflow, tax savings or reduced capital cost through payable tax credits.

No comments yet