Construction firms’ final salary pension liabilities of £33bn are set to attack their balance sheets, stop investment and hold back growth for years to come. Yet far from confronting the problem, many are simply ignoring it and hoping it will go away. Will Hurst reports

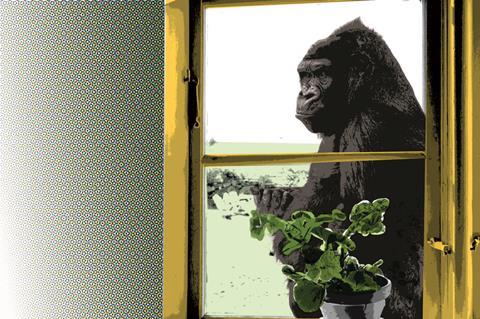

Imagine you awoke one morning to find an enormous silverback gorilla in your garden eyeing you through the window. What would you do? There are a few sensible responses to such an alarming scenario but closing the curtains and ignoring the situation is surely not one of them.

Yet that is the metaphor cited by one expert to highlight what many companies are doing in regard to their hugely indebted final salary pension schemes.

Final salary or ‚Äúdefined benefit‚ÄĚ schemes - a generous type of plan where retirement income is based on a percentage of your salary every year for the rest of your life - have largely been closed to new members due to their cost but they remain a massive headache for many construction firms.

This was thrown into stark relief last week when ļŕ∂ī…Á«Ý revealed that consultant Currie & Brown had been struggling with a hefty ¬£31m pension deficit. Consultant Dar Group was able to to acquire the firm without taking on the debt, thanks to the fact that Currie & Brown had undergone a pre-pack administration that transferred the deficit to the government-backed safety net, the Pension Protection Fund, immediately prior to the firm‚Äôs sale. Under this arrangement, members who are yet to retire will see their annual payments limited.

This is like asbestos was for the industry - a toxic legacy for companies

Richard Farr, BDO

But Currie & Brown is simply one example. According to figures from the Pensions Regulator and the Pension Protection Fund, the total liabilities of the construction industry’s 200 final salary pension schemes were £33.4bn as of June last year - the latest figure available.

This figure has risen two-thirds in just five years - from £20.4bn in 2007 - and represents just a small part of the UK’s total final salary pension scheme liabilities, estimated at £968.5bn last year.

Though the assets of construction industry pension schemes marginally exceed their liabilities, 7% are being investigated by the regulator because they are in potential trouble.

As pensions expert and BDO partner Richard Farr - who came up with the gorilla metaphor - says: “There’s a serious problem in the construction sector with defined benefit schemes and Currie & Brown is a small example of that.

‚ÄúThis is like asbestos was for the industry - a toxic legacy for companies.‚ÄĚ

It is actually another renowned UK consultant - Halcrow - which better illustrates the gorilla scenario, some would argue. At the time of its sale to American infrastructure and engineering giant CH2M Hill last September, Halcrow was struggling with a pension deficit worth ¬£149m on an ongoing or cash basis, ļŕ∂ī…Á«Ý can now reveal. Worse still, it would cost Halcrow ¬£410m to offload the liability, according to an estimate by risk management firm Towers Watson.

At the time of the deal, trustees of the scheme appealed to then Halcrow chief executive Peter Gammie to use the sale process to fill the black hole amid what they then described as the firm‚Äôs ‚Äúworsening‚ÄĚ financial position.

In the event, it is shareholders, not the scheme, who stand to benefit from the sale, leaving the deficit largely unchanged (see case study overleaf).

The root of the problem

So just what do final salary pension schemes mean for the construction industry and what do companies need to do to prevent them spiralling out of control?

The roots of the problem lie in the popularity of such schemes in the seventies, eighties and nineties. Construction was particularly vulnerable as a labour-intensive and low-margin sector offering final salary pensions as part of a range of unionised benefits.

Back then, final salary pension pots grew rapidly and were widely seen as an asset rather than a liability. It seems hard to believe now that firms were even encouraged to take ‚Äúcontribution holidays‚ÄĚ during the dotcom boom of the nineties and tap the funds for investment capital, storing up further problems for the future.

Today, after more than a decade of poor stock market performance, poor gilt returns and, crucially, a population living significantly longer than anticipated when such schemes were dreamt up, the schemes are a recipe for disaster.

The pensions crisis has been exacerbated by recent factors such as the 2008 financial crash and the current eurozone woes, as well as by low interest rates and unpredictable inflation.

While the results pose a threat to both contractors and consultants, many believe that the latter are more exposed because they generally have more directly employed staff and a higher proportion of well-remunerated white collar workers.

‚ÄúThese are millstones around construction firms‚Äô necks,‚ÄĚ says Richard Saxon, a former chairman of architecture practice BDP and former RIBA vice-president.

He argues that final salary schemes are a particular problem for construction firms because of their low margins - a situation which makes paying off the debt an extremely slow business. In the meantime, the deficit simply ‚Äúattacks your balance sheet‚ÄĚ and makes your business less attractive to potential suitors.

‚ÄúYou have to top up the pension fund from profits - it‚Äôs a time bomb under all sorts of companies,‚ÄĚ he adds.

‚ÄúThrough mergers and acquisitions, you often find out that a firm is worth less than the deficit on its pension. A firm may regard you as viable in all other respects, but if there‚Äôs a huge pension hole, this may put them off.‚ÄĚ

BDO’s Richard Farr says that to tackle this firms must identify and calibrate the level of risk and monitor it continuously, while developing a strategy to deal with it. This takes both cash and careful management, as a whole host of big names, including consultant Atkins and contractor Lend Lease, have discovered.

According to Atkins’ latest annual report, published last July, the firm had a pension pot funding deficit worth £293m in cash terms as of March 2010.

The firm said this week that it had completed a consultation process with final salary scheme employees in January over a proposal to remove the link between employees‚Äô accrued pension and future increases in salary. A spokesperson said: ‚ÄúAs a result of the changes agreed with each member during the consultation process, these staff have now become deferred members of the pension plan.‚ÄĚ He added that members would enjoy various benefits including inflation-linked returns.

As for Lend Lease, it has made at least two major changes to its pension schemes in the UK in the past four years to reduce its deficit. The company adjusted its generous defined benefit ‚Äúindex-linked‚ÄĚ scheme last summer while its final salary scheme closed in 2008.

A Lend Lease spokesperson told ļŕ∂ī…Á«Ý: ‚ÄúThe decisions we have taken over our pension scheme have reduced the deficit so that it is comfortably within our means to manage. Going forward we expect to continue to offer our staff attractive pension contributions.‚ÄĚ

Some firms of course may be tempted to park problems with final salary schemes because of the 20-30-year timeframes they operate within, and many chief executives and financial directors believe they have more pressing issues to deal with. Farr understands this temptation but argues against it, warning that it is vital to be pro-active. “These deficits are going to stop investment, stop companies growing, force re-capitalisation and force the selling off of firms, he says.

‚ÄúMost firms put their heads down and hope it will go away, but it won‚Äôt. I guarantee it will get worse. There is a trillion pound hole in the UK economy because of pensions and the next five to 10 years will see a massive risk-transfer, either to insurance companies or to the PPF.‚ÄĚ

The worst thing you can do, it seems, is ignore the gorilla.

Additional reporting by Iain Withers

CASE STUDY - HALCROW

Worries among Halcrow pensioners over the firm’s final salary scheme deficit led to one of them appearing at the High Court to raise questions over the firm’s recent takeover by US infrastructure and engineering giant CH2M Hill.

Stephen Brichieri-Colombi, a 68-year-old former water specialist at the firm, was determined that the deficit - worth £149m in accounting terms - should be filled using much of the £124m CH2M Hill put down for Halcrow’s shares, rather than having the sum paid out to shareholders.

He says: ‚ÄúI had something like 1,500 emails over about six weeks from probably 200 people who were worried about what was going on.‚ÄĚ

Such arguments were initially echoed by the pension scheme trustees. In a series of emails, the trustees warned Halcrow chief executive Peter Gammie - himself the company director with the largest shareholding - that the scheme was ‚Äúsignificantly underfunded and had been for many years‚ÄĚ.

Gammie, however, rejected this, arguing the deal would improve the existing covenant in place to uphold Halcrow‚Äôs obligations. He said CH2M Hill was a far better parent for the scheme, warning the trustees in an email that ‚Äúcurrently, Halcrow shareholders have no ability to invest in the business in a meaningful way or to support it financially.‚ÄĚ

Colombi’s objections were heard by Mr Justice Vos at the High Court hearing held to sanction the takeover deal last November.

The judge voiced concern over the failure to tackle the deficit, arguing that the Halcrow Trust‚Äôs remit meant it could ‚Äúbe expected to regard the preservation of pension benefits for its past and present employees as a major priority.‚ÄĚ

Even so, he approved the deal, noting it had overwhelming support from shareholders and that Colombi had not produced ‚Äúhard evidence‚ÄĚ of damage to the scheme.

The Pensions Regulator has also declined to intervene following an inquiry into the situation, although it is still monitoring the deficit through the trustees.

Colombi is determined to keep up the pressure and has now established the Halcrow Pensioners Association, which has its own website and a growing body of members. ‚ÄúThe purpose of the HPA is to keep the trustees on their toes and to try to ensure they act in our interests,‚ÄĚ he explains. ‚ÄúWe are not giving in.‚ÄĚ

A spokesperson for Halcrow said: “CH2M Hill has stood behind the agreed recovery plan and the schedule of contributions to address the Halcrow Pension Scheme deficit.

‚ÄúSince the acquisition, the previously agreed payment schedule has been honoured every month, including the planned uplift in contributions in 2012.‚ÄĚ

No comments yet