The good news for subcontractors is that orders are definitely on the move. But more work brings risks of its ownŌĆ” we examine the state of play for specialists, while we reveal the busiest firms in each trade in our annual specialists league tables

ItŌĆÖs been a long time coming, but specialist contractorsŌĆÖ fortunes are definitely looking up. The latest state-of-the-trade report from umbrella body the National Specialist ContractorsŌĆÖ Council (NSCC) - of which more later - may contain some depressing findings, but it also includes clear indicators that business is improving.

For instance, the report, published earlier this month, states that 49% of NSCC members reported an increase in orders in the previous quarter, up from 27% six months earlier. Conversely, just 25% reported a decrease in orders, compared with 38% earlier in the year. The figures for enquiries are similarly optimistic and the balance between those seeing increases and decreases in orders is now the healthiest that the NSCC has seen since the end of 2004.

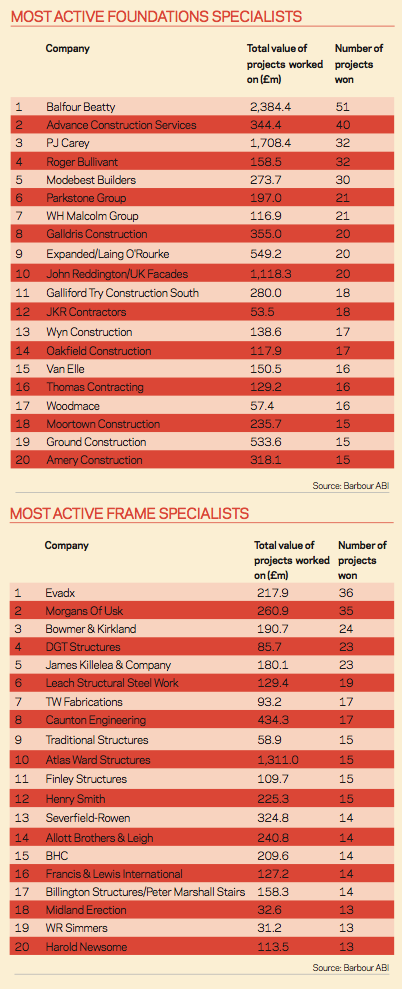

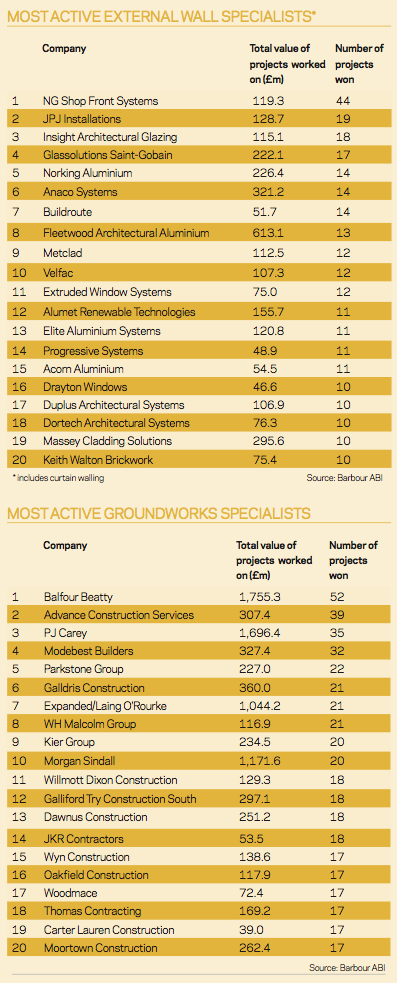

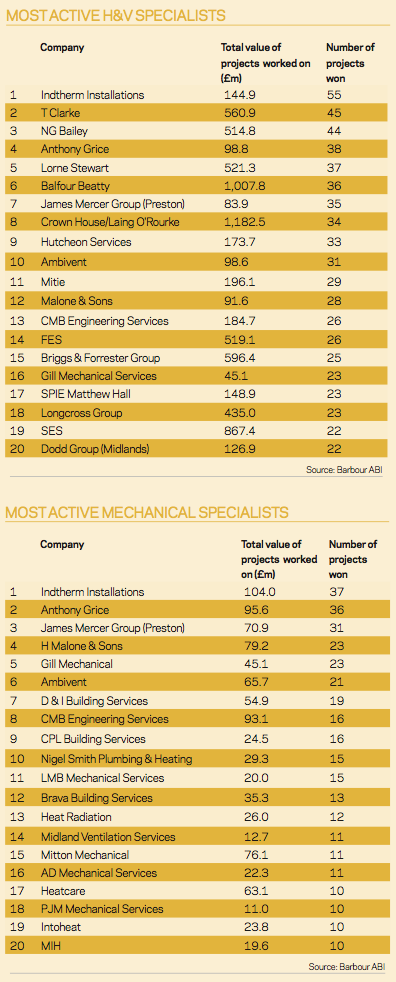

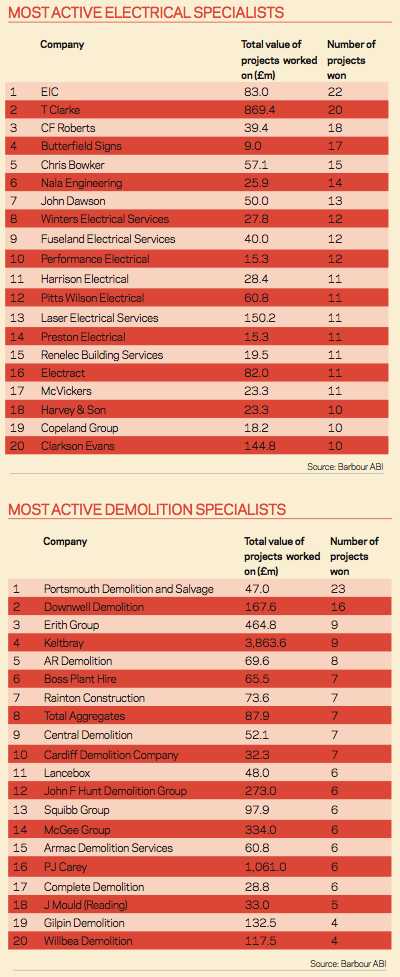

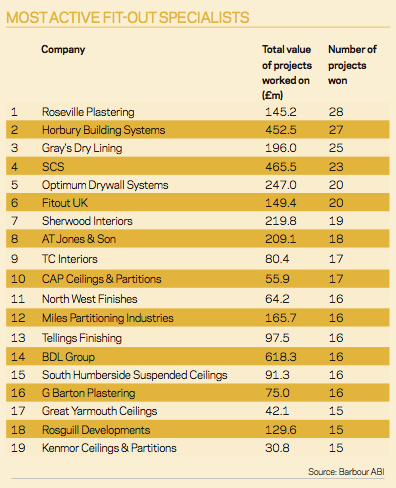

WhatŌĆÖs more, ║┌Č┤╔ńŪ°ŌĆÖs ranking of the most active specialists by discipline, produced in partnership with Barbour ABI, shows that firms are winning more work in most disciplines than at the same time last year (see tables overleaf).

ŌĆ£I think that we are now returning what we might call normality,ŌĆØ says Brendan Kerr, chief executive at engineering specialist Keltbray. ŌĆ£Our financial year came to an end at the end of October and weŌĆÖve secured probably 50% of our workload for the year ahead. That compares with 30-35% in the last couple of years.ŌĆØ

NSCC chief executive Suzannah Nichol adds: ŌĆ£People are still saying that itŌĆÖs tough, margins are tight, but theyŌĆÖre busy and they can see a glimmer of hope. WeŌĆÖre not there yet, but people do feel a bit more positive.ŌĆØ

However, a rising market presents dangers as well as opportunities, especially after such a long downturn. So just what challenges do specialist contractors face? And how should they and the wider industry respond to the recent changes in market conditions?

An expensive recovery

One of the most testing issues facing specialists is the well-documented rising cost of materials. Manufacturers have been as surprised as anyone by the growth seen in the last two quarters and have found it difficult to keep pace with demand, and this has inevitably led to price inflation. Clearly thatŌĆÖs an issue for clients commissioning new work, but for specialists working on fixed-price contracts it is particularly dangerous.

I think that the attitude of a lot of clients is that people should be grateful for getting the work. Material costs are causing a real problem

The problem is twofold. First, if companies are working on a contract that was entered into earlier in the year, when the recovery looked rather more anaemic, they still need to deliver at the price promised and consequently risk making a potentially substantial loss on the job. And second, new work will effectively require firms to take a punt on when prices will start to level off: assume that prices will stabilise and you risk bidding too low and getting locked into a loss-making contract; assume that they will continue to go up and you risk bidding at an uncompetitive rate and failing to win the work.

ŌĆ£Increasing material costs are obviously going to add to risk,ŌĆØ says Rudi Klein, chief executive of the Specialist Engineering ContractorsŌĆÖ Group. ŌĆ£I donŌĆÖt think that there is a great deal of sympathy for the problem. I think that the attitude of a lot of clients is that people should be grateful for getting the work. Material costs are causing a real problem.ŌĆØ

Similarly, the cost of labour is starting to rise, which may be a very good thing for the workers concerned - wages have been flat for at least four years - but it does add to a companyŌĆÖs costs. ŌĆ£WeŌĆÖre starting to see wage inflation coming into the picture,ŌĆØ says David Frise, chief executive of the Association of Interior Specialists. ŌĆ£Inevitably you have to bring new people in to cope with the workload and thatŌĆÖs when you find that prices are rising. If youŌĆÖre still working on a job that you got earlier in the year then thatŌĆÖs a problem.ŌĆØ

New market, same old problems

Even as the market is returning, specialist contractors are still finding it more and more difficult to get paid on time, with all the associated cash flow problems that entails. The NSCC survey found that just 6% of respondents were being paid within 30 days. Meanwhile, 72% said they received payment within 30 to 60 days, down from 82% in the previous quarter, while 19% said they were paid between 60 and 90 days, up from 17% in the previous three months. ŌĆ£Late payment has never been worse,ŌĆØ says Nichol. ŌĆ£There has been a switch. Everybody is embarrassed now about paying late - they know that itŌĆÖs wrong - but that doesnŌĆÖt stop them doing it. Main contractorsŌĆÖ business models are predicated on them paying late and they donŌĆÖt know how to change.ŌĆØ

I think that there is a general recognition that the market is on the up and that costs are following

According to Klein, this isnŌĆÖt just a cash flow problem. Rather it is stifling growth by preventing specialists from taking on more staff, something that is clearly vital when workloads are rising. ŌĆ£One firm with a turnover of around ┬Ż35m told me that they are owed ┬Ż1m and said that if they could get what they are owed they could employ more people,ŌĆØ he says. ŌĆ£And if they had more people they would be able to bid for more work. If you were to project that across the whole industry, youŌĆÖre looking at ┬Ż2-3bn thatŌĆÖs outstanding. The problem with payment is a cancer in the industry.ŌĆØ

Dangerous times

And so an unholy trinity emerges. With growth returning, specialists are bidding for and winning more work. However, rising costs mean that fulfilling contracts is more expensive and long payment periods mean that the gap between money going out the door and coming back is extending. All of which combines to increase cash flow problems and consequently the risk of insolvency.

ŌĆ£The greatest risk of insolvency is right now,ŌĆØ says Klein. ŌĆ£When all of a sudden firms are grasping opportunities that are presenting themselves, there is a danger that they overstretch. And theyŌĆÖre not in any position to ride out that process because after five years there is no fat there at all.ŌĆØ

However, there are some signs that, as the industry emerges from the downturn, some clients and main contractors are reassessing their attitudes towards specialist contractors, and are starting to recognise that for specialists to continue as going concerns they do need to turn a profit. ŌĆ£There seems to have been a realignment of thought,ŌĆØ says Frise. ŌĆ£YouŌĆÖre seeing a much better vibe coming on payment. IŌĆÖm not saying that itŌĆÖs got better, but theyŌĆÖre talking a better talk. The view is that they need to cherish their specialists a bit more than they have done.ŌĆØ

This changing attitude may well come from bitter experience. Sean Wickens, business development director at NG Bailey, says: ŌĆ£Maybe theyŌĆÖve had a M&E contractor on site one day and then theyŌĆÖre not there the

next. With a lot of our customers there is an understanding that we need to make a margin out of what weŌĆÖre doing.ŌĆØ KeltbrayŌĆÖs Kerr adds: ŌĆ£I think that there is a general recognition that the market is on the up and that costs are following.ŌĆØ

But while there are inherent dangers in a rising tide, it is still a welcome sight. And as development levels pick up, specialists that have weathered the recession and emerged on the other side should find themselves in a stronger position. Indeed, they may well be able to start getting pickier about the clients and main contractors they are willing to work with. ŌĆ£I think that weŌĆÖll see a flip to a sellerŌĆÖs market,ŌĆØ says the NSCCŌĆÖs Nichol. ŌĆ£I thinkt that weŌĆÖre on the cusp of that. What I hope is that the opportunity is taken and that we get a smarter construction industry as a result.ŌĆØ

Bouncing back

Joel McInern is the founder and managing director of AJE Facades and former group commercial director at interiors, cladding and dry-wall contractor MPG Group. MPG entered into a company voluntary arrangement - a legal agreement with creditors to repay debts - in December last year following two contract disputes, one of which related to its work for Galliford Try on the Olympic village. MPG entered administration in July this year. Here, McInern explains how he used his firmŌĆÖs insolvency as a springboard to build a new business.

ŌĆ£The reason I went out on my own is that I saw an opportunity. There are so few small specialists out there at the moment and thatŌĆÖs the way to survive. I think larger companies are still struggling and will do for a while simply because of their overhead burden. IŌĆÖm aiming the business at London and the home counties. Most of our work at the moment is in London for Ballymore and the St James Group. WeŌĆÖre also doing some smaller work for main contractors.

ŌĆ£IŌĆÖm dealing with the clients that I dealt with before at MPG who I know very well and IŌĆÖve brought a lot of my supply chain with me as well, which the clients are comfortable with. The other thing that theyŌĆÖre comfortable with is that because this is a start-up company there is no legacy debt; there are no hidden secrets. I put a lot of equity into the company myself and the clients know that; they know that I have more to lose than they do.

ŌĆ£The clients arenŌĆÖt throwing millions of pounds of work at me, theyŌĆÖre giving me half a million here and ┬Ż700,000 there. TheyŌĆÖre obviously spreading their exposure. I donŌĆÖt think that developers will ever give out too much work to one company again. Before, they relied on four dryliners in the whole of the South-east to do all of their work. It just wasnŌĆÖt sustainable.

ŌĆ£There are four of us as staff, but we subcontract a lot of the work out, so weŌĆÖve got around 65-70 operatives. WeŌĆÖve just taken a little office in Harrow, which again is about starting afresh. You need to keep your overheads down and not get ahead of yourself. I think that the lessons that have been learned over the last five years will stick because it has cost business owners emotionally and in our pockets.ŌĆØ

Rankings methodology

These rankings were collated by Barbour ABI and show the most active specialists across nine sectors between November 2012 and September 2013. The rankings are based on the number of projects awarded to each firm in the period and, where more than one company has won the same number of projects, they are then ranked according to the total construction value of the projects they are working on.

Source

1 Readers' comment