The sixth article in the Steel Insight series focuses on industrial buildings and supermarkets, and how steel frames can help meet cost, delivery time and sustainability requirements

01 / INTRODUCTION

Industrial is a key sector for structural steelwork. Standard steel portal frame construction dominates the sector, but other steel solutions, such as trusses, long span beams and fabricated sections may also be used to achieve the required long spans.

The efficiency and cost effectiveness of the standard steel portal frame in this sector is reflected in the latest Construction Markets survey commissioned by the BCSA and Tata Steel. It shows that in 2012, steel frames accounted for 96.1% of all industrial shed building construction in the UK compared with 0.1% for insitu concrete, 0.9% for precast concrete and 0.1% for timber frames.

Previous Steel Insights have provided general guidance for quantity surveyors when cost planning structural steel-framed buildings, as well as a detailed study of two typical commercial buildings to explore not only the cost but also the programme and sustainability benefits of structural steel solutions. Recent articles have focused on particular market sectors and the typical costs and key cost drivers for steel frames within them, with Multi-Storey �ڶ�����s published 27 July 2012 and Education �ڶ�����s published 26 October 2012.

This article continues the sector focus through a consideration of the typical design and construction characteristics of industrial buildings and will review how theserequirements can be efficiently met through the utilisation of a structural steel frame, as well as the key project specific cost drivers that should be considered during cost planning to ensure realistic frame costs are achieved.

The article also examines the issue of sustainability with respect to frame selection, which is a further key factor in the owner occupier industrial sector, both as a method to reduce costs in use and as a key corporate driver.

The article will conclude with the updated cost models for all building types, including updated location indices and a forward view of the market for early 2013.

02 / INDUSTRIAL BUILDINGS: TYPICAL CHARACTERISTICS

The industrial sector comprises buildings with a wide range of uses, from out of town retail buildings and supermarkets, distribution centres and warehouses to science parks and light industrial buildings.

While these buildings have different functions and processes occurring within the space, their common design drivers of long spans, clear internal space and high bays to provide highly flexible internal layouts and to maximise floor plate efficiency result in a small range of typical structural design solutions across the sector.

The most commonly adopted structural solution to address these requirements is a steel portal frame. Portal frames are relatively lightweight structures that provide large clear internal spans and flexible space. The frame comprises columns and rafters, with localised haunches at the eaves to minimise rafter section size and at the apex to accommodate the connection between the rafters. Unlike other frames, the building envelope provides restraint to the structural steelwork, resulting in a very efficient structure. They typically include metal cladding and roofing but can accommodate a range of cladding materials where planning or aesthetic considerations are important.

A steel portal frame can efficiently deliver large spans from 25m to 40m with standard spacings between frames of 6m to 10m but typically 8m. Where multi-bay portals are required, a valley beam is often provided to remove alternate internal columns in a hit-and-miss arrangement to minimise the impact of the structure on the internal space.

Steel portal frames can also be constructed to a range of building heights to provide the high eaves required for certain building functions. For example, distribution centres typically include overhead craneage and therefore require a clear internal height of 10m to 13m or more, while supermarkets and warehouses are more likely to require 4m to 6m clear height depending on the storage racking system used.

As well as being able to provide clear internal height, the flexible nature of the space provided by a portal frame can also allow ancillary spaces to be incorporated easily within the main structure. Both industrial buildings and supermarkets will require a range of ancillary spaces from back of house offices to welfare and storage areas to be incorporated alongside the primary building function and in high eaves buildings it is common for these to be situated on first floor mezzanine floor space to avoid using the more valuable open plan spaces.

In addition to these benefits, a steel portal frame delivers a number of other advantages in the industrial sector. In particular, the lightweight nature of the frame can reduce the size of the required foundations and therefore the extent of the associated excavation, substructure and ground risk. This can be particularly beneficial on previously developed or urban sites, where substructure costs are a significant proportion of overall building costs.

A further key requirement of the sector, particularly for retail buildings, is speed of delivery of the building. A steel portal frame can offer programme advantages over other frame materials through both a quicker frame erection time, as elements can be delivered to site prefabricated and tend to be similar or repetitive, and also as noted above, potentially through reduced construction periods for substructure due to lighter frame weights. This can result in quicker delivery as well as reduced finance and cost of preliminaries.

While services provision is not the same issue for industrial buildings as it is for other sectors, if required, services can be integrated by providing openings in the webs of the rafters or alternatively using cellular beams for the rafters. However, in most cases, there is sufficient space below the frame to accommodate the services without compromising the operation of the building. It is most common to see the cellular beam arrangement on out of town retail buildings speculatively built to appeal to a range of potential tenants or purchasers.

While steel portal frames are the typically adopted frame type for the majority of industrial buildings, other steel solutions are available where there are more particular requirements. For example, steel trusses can be utilised for large distribution centres that require long spans as they can span from 50m to 80m and provide for services distribution within their depth. Where very long spans are required, space frames can be adopted; these are three dimensional trusses that span in two directions, are lightweight and can span up to 100m.

For developments that incorporate retail space on the ground floor but commercial or residential space at upper floor levels - a configuration that is becoming more common in the sector as a consequence of planning policy - long span beams can be used to provide ranges of 12m to 18m and offer relatively open plan retail space at ground floor level but also retain a grid that is compatible with other functions above.

03 / KEY FRAME COST DRIVERS FOR INDUSTRIAL BUILDINGS

Given the existence of a number of common characteristics and requirements across the sector, it is not surprising that many industrial buildings and supermarkets have similar frame costs.

Typically the frame cost range (excluding cladding rails and purlins) for low eaves (4m to 8m high) single storey industrial units adopting a steel portal frame solution will be between £45 and £65 per m2 GIFA (BCIS location index 100), however for high eaves buildings (10m to 13m high) the cost range will be higher as they have a higher steel frame weight per m2 GIFA and a range of £55 to £75 per m2 GIFA is more appropriate, as reflected in the cost table on page 6 (Figure 4).

However, as with all building types, it is still necessary during cost planning to consider a number of characteristics that can vary from site to site and project to project but which may impact on the structural frame cost of any individual building.

For all building types, location, site constraints and site configuration should always be considered as the specific site will have a direct impact on the proposed building, influencing both the achievable design and the costs of construction. The characteristics of a proposed site will vary between an urban location and an out of town industrial complex or business park. The standard cost ranges are based on an out of town, less constrained location, which is typical for the majority of industrial buildings, so adjustments will be required for tight or city centre sites, which are likely to attract additional logistics and cost of preliminaries.

Site configuration can also impact on the structural design through floor plate arrangement. Where the structural grid has to change across the building to account for site factors or adjacent buildings, the efficiencies of repetition across the frame may not be realised. More repetitive structures provide material cost and on site erection efficiencies, so factors that reduce the level of repetition need to be assessed during planning as they may result in additional costs above those captured in the standard frame cost ranges.

�ڶ����� height is a particularly important cost driver for industrial buildings and should be a key consideration during early cost planning when estimates are likely to be based on a frame weight per m2 of floor area. While the gross internal floor area may be the same, the weight of the steel frame will vary between a low and high eaves building on a kg per m2 basis, resulting in different overall frame costs per m2 GIFA.

Typical structural steel frame weights for low eaves buildings (4m to 8m high) are around 40kg per m2 GIFA including fittings, but are usually around 50kg per m2 for high eaves buildings (10m to 13m high). For high eaves buildings it is therefore important to seek guidance from the structural engineer as to the proposed frame weight for the building as it could be around 20% higher than for a low eaves single storey portal framed building. Furthermore, should the proposed building have a very high bay configuration, with clear heights of up to 20m, adjustments will need to be made to the high eaves typical cost range to account for the further increased steel frame weight.

�ڶ����� height is generally driven by the building function and this is also a key driver of the requirements for ancillary accommodation and the structure needed to provide it, which will also impact on the overall building frame weight. For high eaves buildings, the extent of the proposed upper floor areas should be considered as this can vary significantly between different buildings, with ancillary space potentially being provided across as many as three mezzanine levels. The frame costs for these buildings will therefore need to be looked at carefully on a building by building basis with adjustments likely to be required to standard cost ranges.

A further cost consideration for industrial buildings is the required level of fire protection for the structure. Typically, fire protection is only required in single storey buildings where it is needed to satisfy boundary conditions or where there is a need to access the roof (e.g. for plant access). However for buildings with upper floor levels, mezzanines or internal offices the fire strategy will need to be clarified with the design team during cost planning to ensure that the extent and method of protection required is captured.

At the early design stages it is also important to gain an understanding of any design features that may require variations to the standard steel portal frame. For example, the incorporation of northlights for architectural, planning or site orientation reasons can result in an increase to the frame cost by as much as 35% due to the additional steelwork required to form the more complex roof profile.

04 / STRUCTURAL FRAME TYPES AND SUSTAINABILITY

A developing trend in recent years within the industrial and supermarket sectors is for the decision of building materials to increasingly be considered from a sustainability and long term value perspective, as well as the more traditional drivers of buildability, cost and programme.

This has not only been driven by government legislation and key requirements of building operational carbon performance, as set out in Part L of the �ڶ����� Regulations, but also by owner occupier clients within the sector who have a strong incentive to reduce costs in use across the life of the building and through a recognition from the supermarket sector that sustainability can be a point of differentiation in the market.

It is therefore becoming more typical during the early design stages for assessments of sustainability to be undertaken across the main building elements to ensure that the material choices aide the achievement of the sustainability requirements for the project, whether driven by Part L or corporate goals. As part of the review of key building elements, the structural frame material choice is likely to be reviewed and it is therefore important to have an understanding of the relative sustainable performance of structural steel frames in the industrial sector.

Research on the relative sustainable performance of different structural frame types for both a distribution centre and supermarket has been carried out by

AECOM and Sweett Group in the Target Zero project (), which considered the performance of a number of frame types in terms of both operational carbon emissions and embodied energy.

The Target Zero analysis demonstrated that in terms of operational carbon emissions, the frame material adopted does not have a significant impact on the overall performance of either the warehouse building (less than 3.5%) or supermarket (3.8%).

For the warehouse building, the report found that there was less than 1% variance in operational carbon emissions between a steel portal framed building and a precast concrete column and glulam beam structure, yet there was a 12% cost premium associated with the glulam and concrete option in terms of overall cost and an 83% premium on the cost of the structural frame itself.

Similarly, for the supermarket, it was also found that there was less than 1% variance in operational carbon emissions between the two considered frame options of a steel portal frame and a glulam structure, however there was a 2.4% cost premium for the glulam option overall driven by a 20-25% difference in the cost of the structural frame.

This research suggests that while some recent supermarket developments have incorporated a glulam or part glulam structure for sustainability reasons, despite the potential cost premium, the frame material choice actually only makes a very small difference to the overall operational carbon emissions of the building and the difference between the performance of the steel and glulam frames was less than 1% for both building types. Therefore, varying the frame material is unlikely to be a particularly cost effective way of achieving sustainable targets for proposed industrial or supermarket developments.

Indeed, the Target Zero studies demonstrated that for both the distribution warehouse building and the supermarket, consideration of the building lighting strategy was the most important factor in delivering cost-effective carbon savings, as lighting is typically the greatest energy demand in this sector. Indeed, the use of more efficient lighting systems alone delivered the 2010 Part L compliance target of reducing regulated carbon emissions by 25% for the distribution warehouse.

During the design stages, it is becoming more common to undertake assessments on the relative sustainable performance of different structural frame options by considering embodied carbon impacts alongside operational carbon emissions.

Embodied carbon assesses the total carbon dioxide emissions associated with the building but excluding the operational carbon occurring during the building use.

While Part L of the �ڶ����� Regulations sets out assessment methodology and compliance requirements for operational carbon, consideration of embodied carbon is currently omitted, which can result in assessments following different methodologies.

However, it is important that assessments are undertaken firstly on a whole building level rather than on an elemental basis and secondly on a whole lifecycle (or cradle to grave) basis.

Consideration of the whole building ensures that the intensity of material usage and the consequential impacts of frame choice on substructure are considered. It can often be overlooked that a significant proportion of a building’s embodied carbon is in the substructure and that different framing materials have different implications for their design and embodied carbon impact, with lighter frames typically reducing the extent of foundations and excavation.

In addition, the whole building lifecycle should be assessed to determine the total embodied carbon impact. Some types of assessment omit the construction and end of life impacts and effectively assume that all materials perform in the same way. This is an oversimplification as there are differences in the end of life outcomes of materials, for example concrete is recovered and crushed for aggregate, steel and other metals are reused or recycled and a high proportion of timber goes to landfill.

The Target Zero reports demonstrated that while operational carbon emissions were similar between the different frame types, there were significant differences between the embodied energy performances for both the distribution warehouse and supermarket.

The adoption of the precast concrete and glulam structure for the distribution warehouse would have resulted in a 14% higher embodied carbon impact than the use of a steel portal framed structure and the glulam framed supermarket had a 2.4% higher embodied carbon impact than the steel portal frame.

This difference is largely due to differences in the end of life outcomes of steel and timber. Structural steel has high recycling and reuse rates compared with the 16% recycled and 80% landfilled rates for timber (Trada, 2008). As the timber in landfill decomposes it releases carbon dioxide and methane and while modern landfill sites are designed to collect methane, gas capture rates are typically 51% of all gas generated.

05 / SUMMARY AND CONCLUSION

Steel portal frames have historically, and continue to be, the typical structural frame solution for industrial buildings, from warehouses to distribution centres. They provide a number of advantages, including long span and flexible layouts, value for money and programme benefits in a sector where speed of delivery is often a critical project success factor.

As well as these traditionally identified advantages, it is also important to consider the sustainable advantages of structural steelwork across the lifecycle of a building; particularly as demonstrating sustainability in construction is becoming an increasingly important corporate driver.

The review of the Target Zero findings has shown that frame material had a minimal impact on the operational carbon performance of either the distribution warehouse or supermarket; however in both cases the steel frame was demonstrated to perform better in terms of embodied energy on a cradle to grave assessment.

06 / COST MODEL UPDATE

Steel Insight Article 3 analysed two typical commercial buildings to provide cost and programme guidance when considering the options available during the design and selection of a structural frame.

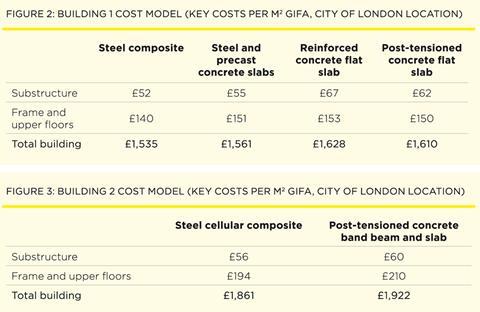

�ڶ����� 1 considered a typical out of town speculative three-storey business park office with a gross internal area of 3,200m2 and a rectangular open plan floor space. Cost models were developed for four frame types; steel composite, steel and precast concrete slab, reinforced concrete flat slab and post-tensioned concrete flat slab.

�ڶ����� 2 considered an L-shaped eight-storey speculative city centre office building with a gross internal area of 16,500m2 and a 7.5m x 15m grid. Cost models were developed for two frame types; steel cellular composite and post-tensioned concrete band beam and slab.

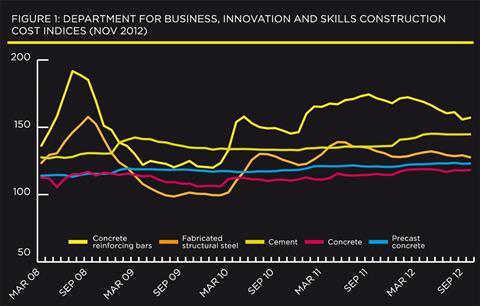

Steel Insight Article 5 reviewed the August 2012 Business Innovation and Skills (BIS) material price indices and concluded that there had been little movement in materials prices across Q1 2012 and Q2 2012 with the exception of concrete reinforcing bars, which had shown a c.6% decrease in material price since February 2012.

This reduction in the concrete reinforcing bars material price and the subsequent small fall in tender returns was reflected in the updated �ڶ����� 1 and 2 cost models, with the total building cost of �ڶ����� 1 Option 3 (reinforced concrete flat slab) reducing marginally from £1,631 to £1,628/m2 GIFA.

As Figure 1 shows, since July 2012 the indices for cement, concrete and precast concrete have remained largely constant, while fabricated structural steel material prices have reduced by c.1.2% and the concrete reinforcing bar material price has fallen by a further c.2%.

To date, the further small fall in the concrete reinforcing bar material price and the slight reduction in the fabricated structural steel material price have not been reflected in recent tender returns and the cost model tables for both �ڶ�����s 1 and 2 above (Figures 2 and 3) have therefore remained constant across the period.

As Figure 2 shows, the steel composite beam and slab option remains the most competitive for �ڶ����� 1, with both the lowest frame and upper floors cost and lowest total building cost. For �ڶ����� 2, as shown in Figure 3, the cellular steel composite option has both a lower frame and floor cost and lower total building cost than the post-tensioned concrete band beam option, with lower substructure costs, a lower roof cost and a lower floor-to-floor height resulting in a lower external envelope cost.

Continuing the trend of the last two years, little movement has been seen in the tender pricing levels of structural steelwork across the last quarter and this is reflected in the structural steel frame cost table, where there has been no movement to the cost ranges for any of the building types (Figure 4). Similarly, the BCIS location factors have remained constant for all locations across the period (Figure 5), which reflects the static nature of the sector generally and the lack of any real signs of economic recovery across the UK over the last months of 2012.

Looking forward into 2013, it is difficult to see any imminent signs of market recovery; construction output fell throughout 2012 and is forecast to fall further across 2013, which is likely to lead to tender returns remaining depressed as competition for a reduced number of projects remains strong. With the public sector cuts continuing to impact on construction, growth in the private sector is not forecast to grow until 2014 at the earliest and until a recovery in output materialises, current forecasts suggest that tender returns will remain largely stable across 2013.

To use the table a) identify which frame type most closely relates to the proposed project b) select and add the preferred floor type c) add fire protection if required.

As highlighted in previous Steel Insights, before using such ‘standard ranges’ it is important to confirm the anticipated frame weight and variables such as the floor-to-floor heights with the design team to determine whether they are above or below the average and to adjust the rate used accordingly.

Similarly, all of the other key cost drivers of complexity, site conditions, location, function, logistics, programme and procurement strategy should be considered in turn.

New steel website proves a hit

Since its launch in October, the steel construction sector’s new website, www.steelconstruction.info, has proved popular with both design teams and contractors. The site, developed by the BCSA, Tata Steel and the SCI, brings together guidance on all aspects of steel construction in one place. It contains over 100 interlinked, freely downloadable articles written by industry experts, covering best practice in design and construction with steel, including topics such as cost, sustainability and health and safety. To find other articles such as the Steel Insight series and the Target Zero guidance on sustainable low and zero carbon buildings, please visit www.steelconstruction.info.

Also find us on:

Twitter

Facebook

LinkedIn

THE STEEL INSIGHT SERIES

This article was produced by Rachel Oldham (associate) and Alastair Wolstenholme (partner) of Gardiner & Theobald. It is the sixth in a series that will provide guidance on the realistic costing of structural steelwork. If you are considering using structural steelwork for your building, bridge or structure, we recommend an early dialogue with a specialist steelwork contractor. They can offer a range of support and advice, including budget estimates and value engineering. Steelwork contractors can be sourced according to project size and technical competency. This searchable function along with comprehensive design information on structural steelwork and the previous Steel Insight articles are available at

No comments yet