Exclusive: บฺถดษ็ว๘โs analysis of accounts reveals CLM achieved 33% margin on turnover of ยฃ495ณพ

CLM, the private sector delivery partner for the London 2012 Olympics, achieved a 33% margin over the past six years on a turnover of ยฃ495ณพ, บฺถดษ็ว๘โs analysis of the firmโs accounts reveals.

Accounts filed at Companies House reveal CLM - a joint venture between Laing OโRourke, CH2M Hill and Mace - made a pre-tax profit of ยฃ162m between 2006 and the end of 2011 on a turnover of ยฃ495ณพ - a margin of 33%.

The pre-tax profit margin has grown every year - from 4% in 2006, 16% in 2007, 32% in 2008, 35% in 2009 and 2010 and then 41% in 2011.

So far, ยฃ114.4m of the pre-tax profit has been paid to the three constituent firms of the CLM consortium in dividends

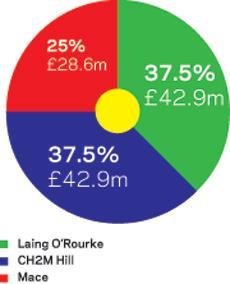

Based on the each firmโs shareholding in CLM, Laing OโRourke and CH2M Hill - which each own 37.5% of CLM - have received ยฃ42.9m each in dividends over the period. Mace - which owns the remaining 25% of CLM - has received ยฃ28.6m in dividends.

CLM has previously defended its fees which, as บฺถดษ็ว๘ revealed last month, are now expected to total ยฃ650m - up from the ยฃ400m originally quoted by ministers - by pointing to savings of over ยฃ1bn made on the project.

But last month Labour MP Margaret Hodge, chair of the Public Accounts Committee, said she would quiz Olympic Delivery Authority bosses on the figures after the Games.

Peter Smith, a procurement expert and editor of the blog , said the profit margins raised questions over taxpayer value-for-money.

โIf the only way to produce success is to pay such high margins, the question is, can the public sector afford this or can we get such high-quality performance at what we might consider a more reasonable cost?โ he said.

Steve McGuckin, UK managing director at consultant Turner & Townsend, said that in the current market firms would only expect to make margins of 33% in mineral and mining projects outside of the UK.

However, he added that the contract had been agreed in a strong market, where fees would have been higher than they are now, while CLMโs costs may have reduced in the wake of the recession, helping to maintain a healthy profit margin.

โIn my mind a deal is a deal. It could have gone either way,โ he added.

Jon Sealy, UK managing director at consultant Faithful & Gould, said if CLM had been structured in such a way as to leave much of its overheads sitting with its parent companies, the profit margin would appear better than it really was. โI think that looks very healthy. But it all depends on the business model,โ he said.

A CLM spokesperson said its contract with the ODA was โentirely performance basedโ. โProfit has been earned by targets being met and savings made as a result of the successful management and delivery of the venues and infrastructure for the [Olympics],โ he said.

โCLMโs performance resulted in significant budget savings being achieved on the programme which the ODA has recognised.

โThe 2011 reporting year saw the completion on or ahead of time and budget of all of the big five venues on the Olympic Park, meeting major milestones for CLM and resulting in a higher level of profit being achieved for 2011.โ

CLM: Going for gold

For the six years to 31 December 2011

Pre-tax profit ยฃ161.8ณพ

Revenue ยฃ495ณพ

Margin 33%

Sharing out the pie

ยฃ114.4m of the pre-tax profit has been paid to the three constituent parts of the CLM consortium in dividends so farโฆ

2 Readers' comments