The industry is still looking strong, with growth and confidence holding up, but some weaker areas are beginning to show even as supply constraints continue.

01 / Executive summary

Tender price index ▲

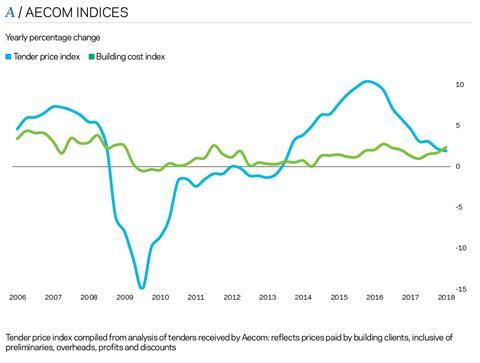

Tender prices increased by 1.9% over the year to the second quarter of 2018. Inflationary pressures remain, despite a lower industry output.

�ڶ����� cost index ▲

A composite measure of building input costs recorded a 3.7% yearly rate of change in the

second quarter of 2018. Input cost trends are keeping commercial pressures on the construction supply chain.

Consumer prices index ▲

The annual rate of change dropped to 2.4% in June. The yearly rate of change was below market expectations but still above its target of 2%.

02 / Trends and forecasts

If the construction industry is beginning to decelerate, in spite of a minor rebound in the second quarter of this year, what challenges will the supply chain face in a transitioning market and, furthermore, once it enters a new phase? The nature of external risks – some known and some unknown – is shifting, and adroit handling of a unique set of circumstances will be crucial over the short and medium terms. The knock-on effects to internal company risks from these external factors will also increase, with greater focus on strategic and operational delivery.

Concerted efforts over recent years to improve low margins and underlying financial performance across the industry are set to face additional challenges in the medium term. Market positioning strategies will be reviewed to protect against fallout from a decelerating market. Repeat business, stronger supply chains, sector focus and lower-risk procurement routes will all be mentioned. Nevertheless, the lingering problem of low margins is set to continue, with industry and economic cyclicality a powerful driver of trend direction.

Internally, contractors’ working capital will receive additional management attention. A tighter squeeze on working capital is expected from reduced trading volumes, as overall industry output extends its current trend. This is compounded by rising input costs and more scrutiny on industry payment practices as a result of recent adverse industry events. There is a lower probability of radically improving the working capital situation, through higher turnover for example, as the forward pipeline becomes more variable. The temptation to lower prices to secure work and generate cash becomes that bit greater in those circumstances.

Supply chain under scrutiny

Cash generation to support working capital management has often played a central role in main contractor business models, as the Carillion story brutally exposed. Some will argue Carillion was atypical. However, since its collapse, the whole supply chain’s financial strength has come under additional scrutiny from client organisations. Increased examination of payment practices by industry observers adds to the pressure around working capital for principal contractors. What of self-imposed margin floors? Additional struggles with this are likely if broader market dynamics change adversely and competition increases – in respect of price, number and type of tenderers.

In addition to working capital, operational challenges remain, ranging from wage inflation and skills retention to project delivery, while maintaining staff levels to deliver current workload. A tight labour market remains an encumbrance for many construction firms.

Organisational restructures, including cost-reduction initiatives, are taking place to prepare and adjust for a changeable period ahead. A balance is sought between anticipating capacity and sources of new work, yet still remaining competitive. Part of any decision here is that it might be quicker and more prudent to restructure and hone sector focus rather than to chase volume in the wrong areas with current structures. Movement into adjacent markets is an option, as it was post-2010, but this needs consideration as it has led to margin impacts in recent years for some contractors.

Procurement dilemmas

Views on procurement will shift as the market readjusts. For buyers of construction, it will be hard to resist the temptation to use single-stage tendering to achieve the lowest price. Divergent views still exist among clients with respect to single-stage and two-stage tendering, although single-stage can introduce a different palette of commercial and delivery risks. Any significant pick-up in its use away from two-stage will signal a telling change in buyer market dynamics.

Procurement dilemmas across the supply chain still emanate from a mixture of capacity, risk apportionment and selectivity. Gaining supply chain interest can be a basic issue in itself.

This can sometimes lead to single-supplier bidding among subcontractors, owing to limited capacity or a selective approach to taking on work. Views on pricing of risk will also filter through the supply chain because of a range of future scenarios around political and economic risk. The story of the next 12 months and beyond then is an expected collision between a supply-constrained industry and an increasingly price-orientated market.

03 / Activity indicators

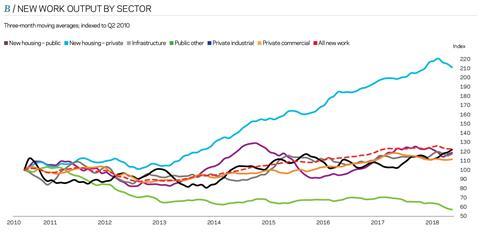

The construction industry’s all work annual growth rate rose to 1.6% in May 2018, up from -1.2% in April, according to the Office for National Statistics’ (ONS) latest data release. The improvement in growth reversed a series of anaemic or negative figures posted since the start of the year.

New work returned a similar series of yearly changes, underscoring the rebound in the second quarter. The leading sectors were private housing and infrastructure. The private industrial sector has also witnessed a sizeable increase in work compared with the same time a year earlier, but this is tempered in its contribution to the overall output data as it is the industry’s smallest sector by volume.

Despite the talk of a rebound in the second quarter, and the corresponding feel-good factor it brings, a different complexion is visible when smoothing out monthly data noise. Looking at the aggregate numbers for new work in May 2018, the industry was neither expanding or contracting based on this smoothed yearly rate of change. That is significant as the moving average indicator traverses a positive/negative median line. This is the first time for such an event since the second quarter of 2013, when a crossover occurred to the upside, setting in train five years of continuous industry expansion.

Further monthly volatility in upcoming output data can be expected. Monthly data might therefore make headlines. It is the trends that usually reveal the story. Short-term cyclicality should not be overlooked as a reason for the improved data in recent quarters. Restocking cycles after a period of destocking, better weather and consumer expenditure are likely to have given the economy a boost.

Positive outlook

Many activity indicators continue to see industry sentiment and confidence holding up, despite some reversals in recent months. Future scenarios for activity, employment prospects and broad outlook are also generally positive. The Federation of Master Builders’ latest trade survey shows that enquiries, workload and employment prospects have improved notably for small and medium-sized enterprises. Larger firms also express similar outlook over the short term, with little differentiation to the theme across the UK.

Enquiries throughout the supply chain have stayed comparatively high but there is said to be a lower rate of conversion into orders for more firms at present. Data for new orders in the first quarter of 2018 support this anecdotal evidence, as yearly change and quarterly change metrics were both negative, at -6.6% and -4.6% respectively.

Quarter-on-quarter movements in new orders saw a mixed picture across the larger construction sectors, with private housing increasing by 18.6%, commercial falling by 12.2% and infrastructure posting a -43.6% downward slide. Movements on a yearly basis were in the same direction for each of these sectors.

Headline sentiment surveys for the industry mainly set out a confident mood. Respectable underlying momentum in present workload offers support to these aggregate views. More signs of construction industry confidence were revealed in ICAEW’s UK Business Confidence Monitor for the second quarter of 2018. Construction saw its survey confidence measure rise to the highest level in 12 months, but as the survey notes, construction’s rise only takes it to a moderate overall survey value compared with other economic sectors. An area of concern highlighted in this survey is the very high level of staff turnover and concern in securing non-management skills. These measures were the highest among all the surveyed economic sectors.

Another data release by the Insolvency Service revealed a concerning rise in the number of insolvencies of construction firms, spiking to a 7% year-on-year change in the first quarter of 2018, and then over 11% in the second quarter. The recorded value for insolvencies

in the quarter, at 812 for the UK (excluding Northern Ireland), has only before been higher once in 2014 and in early 2013 before that. This could be fallout from the Carillion debacle, but might be a canary in the coal mine, as commercial and financial headaches catch up with parts of the supply chain.

04 / �ڶ����� costs and prices

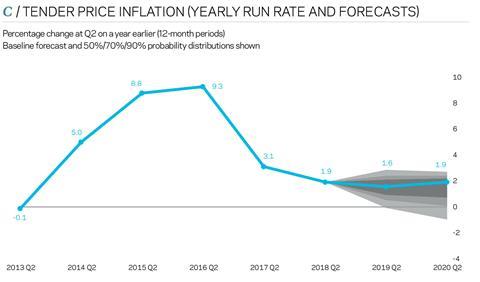

Tender prices rose by 1.9% in the year to the second quarter of 2018. Price inflation trends have slowed and levelled out after a number of years at above-average rates of change. Selling prices are unable to keep pace with the rate of input cost inflation, keeping commercial pressures elevated. Although there has been some pass-through into output prices, there is set to remain an inability to recover all input cost pressures, particularly as competition increases on a weaker overall outlook on future work. Clearly, this assumes a continuation of current input cost trends.

Materials and labour input costs are rising year-on-year, with expectations of some further increases over the second half of 2018. Anxiety around industry resources eased a little over the second quarter of 2018, but this proved to be short-lived after more recent indicators reported that significant concerns around labour and staff resources remain a key issue for many firms.

Supply chain cost and capacity influences will continue to be prominent cost and price drivers for principal contractors in the near term. Supply chain prices are expected to keep following a positive year-on-year path as constrained capacity and market dynamics dictate the price to secure staff and labour. Extended lead times also highlight the pressure on resources and that sufficient work is available for current market capacity. Further indicators of supply chain tightness – insolvencies data, for example – also signal the continuing difficulties to secure resources.

Wage growth offers a reliable indicator of supply and demand dynamics, given its historical correlation with industry output. Wage growth has held up over the year, despite a big dip in the second quarter because of bad weather. Nevertheless, at broadly 3% for an aggregate measure, this is still good progress. Some differences in trends among site disciplines are evident, but nominal wage levels continue to be sound. Adjustment is expected as output changes, though. However, acute labour supply conditions will provide support to wage growth for many trades, as current labour market dynamics move outside the old frames of reference.

Materials prices have experienced a short-term fillip. Along with underlying strong demand from industry, anecdotal evidence suggests an element of stockpiling of key components by the supply chain in 2018 as a response to impending disruption from customs changes. This may have added to price support for materials but is unlikely to have propelled them higher on this factor alone, as underlying demand remains strong. Materials cost inflation is expected to maintain an upward trajectory for the remainder of 2018, with trends further out being influenced by industry and sector trends.

There is minimal evidence of adverse tender spreads and limited indication of notable discounting yet, although some variability in pricing is becoming evident. Overheads and profit allowances are still elevated at 6% on average, which is an increase from 5% seen through 2017. To this end, the supply chain has been good to its word in seeking higher on-cost allowances. So far, there is stability in overall pricing but with some increasing variability within principal contractor preliminaries allowances. Nevertheless, prelims percentages, on average, are still following a course plotted in recent years. Similarly, unit rates are displaying stability and falling within expected ranges on the whole. Preliminaries offer more opportunity for main contractors to manage their price offer in the first instance, rather than heavy discounting to unit rates, given that they largely originate from supply chain pricing.

Aecom’s baseline forecasts for tender price inflation are 1.6% from the second quarter of 2018 to the second quarter of 2019, and 1.9% from the same quarters in 2019 to 2020. Increases in the rate of tender price inflation over the year ahead are set to be influenced by pushback from contractors to accept risk transfer, contractors’ unwillingness to countenance below-cost tendering to secure workload, clients’ reluctance to move towards lowest-price tendering, further consolidation and capacity limitations of the supply chain, adverse movements in the sterling exchange rate, and damage to confidence from global economic shocks such as tariffs and political volatility.

With modest expectations of future activity and elevated input costs from tight supply-side constraints propelling tender price inflation over the short term, higher downside risk is expected to prices over the forecast periods. A large component of this view is influenced by approaching political turbulence. An extended period of downside risk will introduce new challenges, and whether to manage these through tender price channels.

The price forecasts are based on key assumptions: construction output continues a downward trend towards a long-run mean; future work is secured for contractors but with more flexibility on terms and conditions rather than significant price reductions; UK economic conditions – both cyclical and Brexit-related – are a source of greater turbulence; government capital expenditure does not increase; and sterling sees on-going fluctuations and remains lower for longer.

No comments yet