The recovery rolls on with expectations of tender price increases still firm. But a change of pace in activity is expected to emerge this year. Michael Hubbard and John OŌĆÖNeill of Aecom report

01/ Executive summary

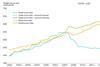

Tender price index Ō¢▓

Prices measured as an average across sectors increased to 6.3% on an annual basis in Q4 2014. The annual forecast from Q4 2014 to Q4 2015 is an increase of 4.6%.

║┌Č┤╔ńŪ° cost index Ō¢▓

Demand for labour remained strong with consequent wage inflation through 2014. Materials cost inflation largely reflects sector activity.

Retail prices index Ō¢▓

The annual rate of change fell to 2.0% in Q4 2014. Although still positive over the year, the rate of change continued to fall.

02 / Trends and forecasts

2014 saw aggregate construction demand pick up and remain strong throughout the year. For the first time since 2010, all calendar months (up to and including November) recorded positive year-on-year growth rates for new work. Increasing market activity during the past 12 months saw requests to submit tenders increase substantially. But many contractors stated that tendering activity and submissions actually declined over the period. This selectivity stems from capacity issues, client reputation and the discipline of applying chosen business strategies. Against this backdrop, it is little surprise that tender prices increased, as existing capacity and supply strove to meet raised output requirements.

Earlier momentum in the year saw tender price inflation peak in Q3 2014, with a 2.2% quarter-on-quarter movement. As output cooled marginally in the last months of the year, price levels posted a lower rate of quarterly change in the fourth quarter of 2014 at 1.5%. Equivalent annual rates of change were 6% in Q4 2014 as market exuberance eased. A similar trend played out at the end of 2013, when tender prices slowed but then picked up as output in 2014 moved up another gear. Demand for trades increased and tender prices rallied through last year.

Price spikes for key trades and materials in 2014 led to commensurate increases in industry rhetoric. Market data for wages, trades and materials among others suggest the industry has achieved some equilibrium. Some trades had localised supply and demand factors, which converged at times to create price spikes. Demand factors at a national level also resulted in strong wage increases for bricklayers and joiners, for example.

AecomŌĆÖs forecasts for tender price inflation remain unchanged into the new year at 3.5 to 5.5% in Q4 2015, and at 3.5 to 7.5% in Q4 2016. Expectations for price increases are still firm, but industry activity in 2015 is expected to moderate - primarily as house building activity levels - and in the absence of significant government policy interventions. Inflationary trends will remain manageable with a steady rate of new orders. Benefits of lower commodity prices will offset other rising input costs.

The recent break-out of tender prices is expected to be contained later in 2015 by multiple issues: pre and post-election uncertainty; eurozone weakness; and sliding commodity prices offsetting other upward cost pressures. Earlier parts of 2013 highlighted output price compression for contractors, where a general inability to secure higher output prices combined with costs that inched higher. Despite an expectation of overall growth, the pace of labour cost increases could weaken as sector conditions moderate, therefore freeing up resources. Cancellation or deferral of oil, gas and energy related projects will contribute to this trend. But labour costs should still see decent annualised growth rates in 2015.

AecomŌĆÖs recent contractor survey found that client reputation, securing resources and relationships, were cited as the top reasons that influence decisions to tender. In-house and bought capacity both contribute to these issues. 2014 also highlighted a broad consensus that subcontractors wield significant influence presently, underscoring the subtle shifts in power evident in the past year.

Historically, the construction industry does tend to broadly mirror general economic conditions. ItŌĆÖs reasonable therefore to observe forecasts for the UK economy and infer what may happen to construction output in the near to medium-term. Dominant themes influencing UK economic forecasts include slower growth in emerging economies and now the eurozone; variance to prevailing monetary policy across the globe; and geopolitical uncertainties. Additional complexities for the eurozone recently emerged as the Swiss central bank removed the defence of its currency peg to the euro. Doubtless stock markets will reflect this increased nervousness and likely further weakness in the euro itself.

The extent to which these themes affect the UK construction industry depends on how well the industry progresses in 2015 due to present momentum. ContractorsŌĆÖ secured turnover provides reassurance that 2015 will return decent levels of output; 2016 presently offers less certainty. Current sentiment in the market is a continuing approach of selective tendering by contractors and incremental tender price inflation. Assuming relevant demand conditions are met, the UKŌĆÖs haven status for investors should help to support activity.

Pre and post-election periods in the UK will bring uncertainty, particularly where an inconclusive result in May adds to existing parliamentary inertia. The referendum in Scotland provided a glimpse into the effect of political uncertainty on markets. But any reliance on government spending for workload is not likely to offer a better story for much of 2015. Irrespective of a changing or uncertain outlook, diversification in workload will provide insulation from the vagaries of market cycles.

A / Aecom index series (Previously Davis Langdon)

03 / Focus: higher education

Throughout the 20th and early 21st centuries the education sector has found itself to the fore in any governmental-driven reform agenda. The last two decades have been a period of continuous change in the tertiary and quaternary, or Higher Education sector. From the 1992 expansion of institutions that can be defined as universities, to the more recent Browne report, which represents one of the most significant interventions since the enactment of the equally contentious Robbins report.

It is possible that the reforms proposed by Browne and the forthcoming removal of the student cap will present Higher Education Institutions (HEIŌĆÖs) with numerous opportunities and challenges - not least to their estates. Indeed the impact of universities on UK plc was recently examined in a report published by Universities UK (2014), revealing the HEI sector to be an economic titan.

The most up-to-date figures for 2011/12 demonstrate that HEIŌĆÖs generated ┬Ż73bn of economic output, both direct and indirect. This represents 2.8% of UK GDP, up from the reported 2.3% in 2007. Furthermore, UK HEIŌĆÖs accounted for 2.7% of all UK employment, equating to 757,268 full-time positions, many of which were outside major urban centres.

Comparisons may be drawn with other ŌĆ£publicŌĆØ sectors such as health, without a defined locus or significant geographic concentration. Indeed while the NHS estate is slightly larger than the UK HEI

estate at c30 million m2, the UK HEI estate is comparable at 26 million m2, with 28% concentrated in London and the South-east.

But universities in the 2011/12 year (prior to the effects of the Browne reforms) garnered approximately 49% of their total income from public sector sources (central government, agencies or research councils).The remaining 51% came from the private sector, including international sources and student fees, up significantly from 39% in 2007/08. Diversity within the sector is appreciable, ranging from those with a total student cohort of 700 to over 40,000; a consequent range in annual turnover from ┬Ż8m to ┬Ż800m exemplifies the heterogeneity within the sector.

Capital investment in HEI estates amounted to approximately ┬Ż2bn in 2012/13 (excluding residential) - a 9% increase in total capital spend from 2011/12. This, however, has not resulted in an increase in the size of the overall estate, which has remained stable, rather, an on-going and accelerating modernisation of the estate with new buildings replacing old.

The total number of students entering Higher Education decreased last year, which represented an abrupt halt to substantial rises in student numbers witnessed from 2000 to 2010. This is not thought to be a harbinger of decline, but is more a short-term reaction to the increase in fees, with numbers thought to continue the recent trend and pick up from next year.

The challenges for HEIŌĆÖs are plentiful, with income currently decreasing in real terms and greater competition to recruit the most academically able students and staff with a demonstrable track record of attracting research funding. Long-term, public sector funding for capital development and investment will continue to decrease as a proportion of total spend, with institutions increasingly having to self-fund such investment via private-sector debt, off-balance sheet financing or delivery of a net trading surplus.

Set against this context, HEIŌĆÖs capital development plans are becoming ever more complex because of the increasing stringency of the statutory and planning environment and growing competition between HEIŌĆÖs to provide modern, flexible, sustainable and relevant estates; estates that will strike the correct balance between the twin demands of capital and operational expenditure. The requirements of multi-disciplinary research adds to the demands. The cumulative effect of this is to raise development requirements, refurbishment or new-build, a trend which is unlikely to abate in the medium-term.

The current recovery within the construction sector adds commercial complexity as programmes and projects are procured and delivered in a climate of high demand, particularly in and around the South-east.

Further, contracting organisations have become more discerning in their pursuit of opportunities with a diminishing appetite for the significant transfer of risk. HEIŌĆÖs need to fully realise to both their and the construction industryŌĆÖs mutual benefit the counter-cyclical nature of higher educationŌĆÖs contribution to GDP and the added advantage conferred by the growing proportion of their funding which is not dependent on the state, and which is increasingly conflicted by competing priorities.

Securing certainty (and this often means affordability) of delivery, predictability of outcome (out-turn not entry cost), over a five to 10-year programme of works, is likely to be a key concern for HEIŌĆÖs over the forthcoming decade, in this age of increasing self-sufficiency.

This desire is perhaps matched in the construction sector to secure continuity of demand and thus workload. In practical terms this means the adoption of progressive procurement practices: no retention, no LADŌĆÖs, project bank accounts, for example.

In a time of increased construction activity, to attract suitable contractors with the requisite skill-set and experience will increasingly require a demonstrable track record of collaborative working, of both client and professional teams.

This has the potential to mitigate the worst excesses of the industry, the historical predilection for adversarial interactions and unsophisticated procurement practices.

The long-term nature of capital investment envisaged by many of 160+ universities and colleges represents a unique opportunity to forge alliances through partnerships and frameworks to generate and maintain the appetite and capability within the construction industry to deliver extended capital programmes.

04 / Activity indicators

Latest output data published by the Office for National Statistics (ONS) in December underscored the trend of new work through 2014. A three-month moving average (MA) of 6.4% annual change meant that 2014 was a very different year to 2013, where new work output struggled to take-off. New work annual growth rates peaked in Q2 2014 at around 8% (three-month MA).

New work output among sectors saw housing finishing the year with the strongest growth figures. But the private industrial sector had the largest turnaround in fortunes, starting the year with negative rates of annual change but then motoring through 2014 with an annual growth rate of almost 15%. Without detracting from its performance in 2014, we should remember the comparative sizes of sectors. The commercial sector is six times larger than the private industrial sector.

New building work directly related to business investment rebounded strongly from early 2014. But a near 55% fall from 2008 shows the level from which investment had to be increased to return to trend rates.The stand-out sector was housing, which looked like finishing 2014 with an annual growth rate of 20%. Private housing sector yearly growth rates for new work throughout 2014 regularly exceeded 30% but tailed away in Q4. Commercial, infrastructure and public sector new work reached the end of the year posting smaller equivalent figures than the beginning of 2014.

Revisions to UK GDP growth were announced in December. Instead of growing at an annual rate of 3%, the ONS made downward adjustments for annual growth of 2.6% in Q3 2014. Larger revisions were made for the first two quarters of 2014. These adjustments to official data showed that the UK is subject to the external issues affecting most economies, despite its better rate of growth. Also worth highlighting was a change to published construction all work output figures recorded for 2013, which saw a -12% adjustment. Industry capacity issues have generated notable changes to some pre-construction lead times. The incremental effect of workload building up through 2014 led to Q3 and Q4 experiencing a significant pull on resources.

B / Annual growth rates for the industry sectors

05 / ║┌Č┤╔ńŪ° cost index

Oil benchmark prices continue to generate significant numbers of headlines in economic markets. Oil prices fell precipitously in the months leading up to the end of 2014, reaching $46/barrel for US crude oil in the middle of January. After an extended period of comparative price stability around the $100/barrel mark, perceived fundamental changes in the outlook for the global economy and excess oil supply propelled benchmark prices over 56% lower in just six months.

Consensus opinion indicates that the acute fall in the oil price is not the result of supply or demand effects on their own. But research by Fathom Consulting suggests that the Chinese economy recently contracted more than official estimates. Consequently, the oil price therefore adjusted primarily to lower global demand, given ChinaŌĆÖs overall effect on demand requirements. It is though hard to believe that US shale oil production since 2012 has not contributed to recent trends and current price levels, particularly as the US announced a review to its four-decade long ban on exports of its domestically produced light crude oil. Supply and demand issues are therefore combining to help benchmark prices down to levels not seen since early 2009.

Evidence indicates that an overall slower global economy is reducing demand. Unrestrained supply from the Organisation of the Petroleum Exporting Countries (OPEC) producers and radical increases in US shale oil output support the supply-side of the price equation. Further, leading members of OPEC recently indicated their unwillingness to reduce supply, just as Russia and Iraq announced record production levels. Oil majors are expecting a range of $50 to $60/barrel over the next couple of years, with futures contracts supporting this view. A falling, or significantly lower oil price also has implications for related capital projects. An extended period where the oil price was high certainly helped to support investment, which increased output and supply.

The flow through to petrol pump prices in the UK should follow in Q1 2015. Falling below ┬Ż1/litre (unleaded) will be a closely watched benchmark. Lower pump prices help the input cost drivers of a construction industry reliant on travel, transport of materials and equipment operating costs. But benchmark oil price falls are tempered by the fact that the UK has the highest component of tax (59.3%) within the forecourt price of all countries within the Organisation for Economic Cooperation and Development (OECD).

AecomŌĆÖs building cost index increased by 2.0% on a yearly basis to Q4 2014. Average wage rates increased between 5 and 7% on a yearly basis towards the end of 2014. This capped a robust year for construction industry wage inflation and was in spite of a slower inflationary pace at the start of the year. Rates of change for electrical trades, joiners and specialist fit-out trades remained the disciplines with the highest rates of growth. Roofing trades finished the year strongly, responding to sequential demand from the housing sector. Resources associated with high specification joinery finishes still attract cost premiums over prevailing rates of wage growth.

Regionally, wage levels across UK regions all grew strongly over the year. Although sector activity and wage rates varied on a monthly basis through 2014, rates of change over the year displayed good synchronicity as no region pulled away from the others.

The south-east region still sees higher average rates, with an overall spread of ┬Ż70 to ┬Ż90 per week difference between the South-east and the lowest weekly rates elsewhere in the UK. Transient price spikes are expected to become less severe as wage growth moderates in line with a levelling in construction activity.

C / US field production of crude oil

No comments yet