Strong output demand has stretched the industry across the supply chain, with increased tender prices triggered by capacity constraints only the most salient sign of strain. Michael Hubbard of Aecom reports

01/ Executive summary

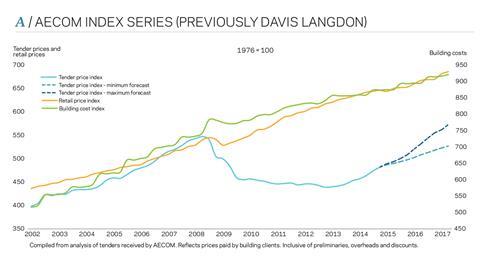

Tender price index ▲

Prices measured as an average across sectors increased to 6.6% on an annual basis in Q1 2015. Prices are forecast to increase by 4.9% from Q1 2015 to Q1 2016.

�ڶ����� cost index ▲

Continuing demand for labour contributed towards the current annual rate of cost inflation. Materials demand remained firm.

Retail prices index ▲

The annual rate of change fell to 1% in Q1 2015. RPI is mirroring CPI trends.

02 / Trends and forecasts

Total annual output data published by the Office for National Statistics (ONS) confirm what we all knew: 2013 and 2014 were vastly different years for the UK construction industry. A 7.4% increase in 2014 over 2013’s anaemic total output levels represents the rebound that leads to a full-blown industry recovery.

That said, what explains the notable fall in all work output (constant prices) across the UK in the ONS data published in March and April? All work output fell by 1.3% over the same time as last year - and this is in addition to the 3% fall year-on-year in January. This is the first time a drop has occurred in this yearly growth metric for 20 months. A higher denominator in the yearly growth rate calculation explains some of the fall. Or does the data release simply reflect more discernible changes in underlying trends for total industry output?

Economic data is like a picture: one can see what one wants to see. Overall, there are numerous ways in which the data can be viewed. Latest data suggests that all work output grew on a yearly basis at 2.6% in January 2015 (three-month moving average). Alternatively, new work and all work output trend growth rates (three-month moving average) fell continually throughout 2014, reaching their lowest figures in February 2015. Both are true. Either way, market activity now results from new work growth rates posted last year.

Strong output demand over the last year has stretched the industry. The issues are felt by all firms across the delivery chain - from clients to subcontractors. Capacity constraints almost always manifest themselves in prices. Increased tender prices have become the primary symptom of these supply-side issues. Tender price levels increased by 6.6% at Q1 2015 on an annual basis, according to Aecom’s index for Greater London. Regionally, tender price increases are strong too although variations in rates of change are evident. Aecom’s median forecasts for tender price inflation are 3.5% to 5.8% in Q1 2016, and 3.5% to 7.5% in Q1 2017.

Rates of tender price increases are almost the same now as those experienced in 2007/08. If pricing is evidence of better days, then the industry is in rude health. At face value though, this may conflate correlation and causes. In the years before the recession both supply and demand increased strongly. This time, output data comparisons confirm that tender price changes are probably more a function of reduced capacity than larger increases in demand - in other words, capacity constraints are the predominant driver behind the current rate of price inflation. Although demand has risen above its long-run average, if measured by new work output, the industry labour force is still somewhere around 300,000 people smaller than its 2008 peak. The industry is experiencing a balancing act, with price growth stronger presently than volume growth. Still, the pursuit of value not volume is an overriding objective for many contractors. Volume is either not a sensible approach or it is simply not achievable with a lack of available resources.

Construction businesses of all sizes remain at elevated or maximum capacity levels. Many firms have struggled to recruit to meet increased demand in the last 18 months. Higher-than-expected price returns in the pre-contract stage and post-contract design issues are different in nature but both have similar capacity-related causes. Requests for extended tendering periods are not uncommon. Full order books among contractors have led to changes in bargaining. Contractors have sought early commercial positions where negotiation is the only procurement route that would be countenanced. Supply chain pressures are likely to continue into the next quarter, before the effects of sector changes become apparent on workloads, perception and sentiment.

Across the UK, preliminaries costs are higher as a result of staff recruitment and retention pressures experienced throughout the industry. Similarly, overheads and profits levels are higher overall as a result of stronger sentiment. The spread of overheads and profit levels narrowed during this period of better growth. During the gloomier days of 2011, 2012 and 2013 the range of overheads and profit levels was much wider. Stronger market conditions therefore enable firmer views of prevailing on-costs, with outlying positions for overheads and profit levels now moved into line with market sentiment.

Achieving more with the same resources will be necessary in the near term in order to meet sustained output requirements. Should the industry’s output and new orders take off again, then price growth will continue and firms will continue to feel stretched. What will now feature is the effect of the remaining 50% of deficit-related public sector spending cuts planned for 2015-2018 and the consequent dent to economic confidence.

03 / Focus: Coalition review

The coalition can claim to have got Britain building again. The last two years have posted significant improvements in total construction output.

A corresponding feel good factor has spread through the industry, with rises in wide-ranging metrics from tender prices to employee salary increases and bonuses. In November 2011 the prime minister declared that [the government] would “restart the housing market”. Although it was not until mid-2013 when the sector began to take off, the forecast was borne out. Output is currently above its long-run average level. Analysis taken solely at this shorter time-frame ignores the preceding period though. Output data over the course of the last five years tells a different story.

Winding the clock back to 2010, Britain was still building as the financial crash cast a long shadow over the UK economy and its construction industry. Construction was posting greater volumes than anything experienced each year through 2012 to 2015. This is partly explained by the last government moving forward fiscal expenditure, possibly to offset the post-boom recession that followed 2008. Other major projects and infrastructure were also under construction at the time.

Many stated objectives in the early years of the coalition were to rebalance the economy, not only in a geographic sense but economically. Exports would grow as a share of GDP, reducing the burden of the service sector that dominates UK plc. Regions would flourish, reducing reliance on London and the South-east.

Of the four areas that can propel economic growth - investment, consumption, trade, government spending - construction sits squarely behind and supports each of them.

Extending the logic, UK construction would benefit from these aims and objectives. In 2011, the prime minister promised an “all-out mission” to start infrastructure projects in support of these goals. Infrastructure would be built to support regional growth, enabling nationwide productivity improvements; private investment moves in to take the place of public sector expenditure, which purportedly crowds out other investment.

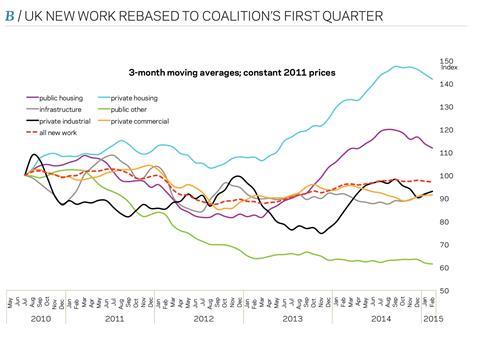

The evidence suggests a less straightforward narrative, according to a National Audit Office report published in March 2015 (The choice of finance for capital investment). The report states that “the government’s annual capital spending has reduced by around one-third” in real terms. The report acknowledges the capital spending moved forward by the last government but this does not explain all of the decrease. A broader appraisal of construction volumes during the last five years highlights the mixed nature of sector activity. Excluding housing, August 2014 saw the lowest month during the last five years for new work output (in constant prices) across the ONS’ sector classifications. Clearly, without the housing sector’s contribution, UK construction then looks very different over the coalition’s tenure. Chart B (overleaf) tells the story in respect of volumes - output by sector is shown in constant price terms. Total new work output remains 3% below the start of the coalition’s time in office.

Housebuilding was a short-cycle sector that picked up quickly, particularly when policy stimulus provides a catalyst for activity. There is likely to be a political link for the housing policy interventions, and they were timed very well for maximum political effect approaching an election and when the construction industry was flagging during 2012 and early 2013.

Other sectors and those of a longer cycle though are still afflicted by political inertia and the economic backdrop. One of the reasons for this is an inability to remove decision-making from the political cycle. There are signs of improvement in this arena: a published plan of national infrastructure; a construction strategy through to 2025; a chief construction advisor; reheated talk of removing decision making on critical national infrastructure from the political cycle. The Cabinet Office has also published analysis into cost reductions achieved during the coalition through measures to match private sector project delivery.

In 2013 Nick Clegg described the relationship between government policies and construction activity, when he said “the gap between intention, announcement and delivery is quite significant”. Any government must see the need to remove dialogue and decision making regarding critical infrastructure from the political arena.

Construction skills at all levels and of all disciplines were lost in this and earlier recessions. Large numbers have not returned to the industry, often through choice. It is likely that the industry did not truly recover its skills base from the recession of the 1990s. Is it the requirement of any government to make industries attractive to potential recruits? Government policies of the day should facilitate the entry of younger recruits, and construction would certainly benefit from raising its profile amongst those considering career options. Apprenticeships generally under the coalition have become an area of focus, particularly through liaison with professional services firms and industries on potential solutions. But the outcomes and results, particularly for the construction industry, are mixed. According to the Federation of Master Builders, those completing a construction apprenticeship in 2013 fell to half the levels seen in 2009. Apprenticeship funding reform is also a source of frustration. Ultimately, reduced investment in the means of producing buildings and infrastructure affects future capacity, both in respect of quantity and quality.

A balanced economy undoubtedly provides the means for a balanced construction industry - possibly even minimising the impacts of cyclical downturns. Current trends in construction output data merely reflect those imbalances in the wider economy. A long-term economic plan suggests that infrastructure and construction play a key role in making this happen. When the UK economy improves, construction’s fortunes improve. Clearly, each support and enable the other to flourish. The coalition can leave office with a bittersweet feeling in respect of its approach to construction.

04 / Activity indicators

The volume of new orders for main contractors turned negative in Q4 2014 (constant 2005 prices). Overall, new orders were down 2.3% at Q4 2014 on the year earlier. Infrastructure (+1.9%), private commercial (+22.4%) and other work (+5.8%) were the only sectors to post positive values at Q4 2014 when compared to Q4 2013. Notably, public and private housing combined to record a 17.9% fall in new orders.

Maybe too much shouldn’t be read into the headline figure because of the base effects of 2013 in the calculation. Housing new orders leapt up through 2013, bringing life to an otherwise inert UK construction industry. There is now an element of offsetting too, as other non-housing sectors have taken up the slack that the housing sector drop-off has created. While there will not be immediate effects on industry activity, in the absence of material revisions to the data in future months, a correction in new orders will have tangible effects within the next year. Additionally, the ONS data covers main contractors so a time lag may be also be a factor in determining the recorded effects on output, other new orders data releases and industry surveys.

B / UK New Work rebased to coalition’s first quarter

Unquestionably, the UK construction industry is busy. But some differences have begun to emerge between output data and industry surveys. Contrasting new orders data releases also adds to the complex picture. Regional variations are also evident. While almost all regions over the last 18 months experienced increased demand and output, some regions have levelled or fallen towards the end of 2014 (output at current prices). Scotland was the strongest growth region and London continues to be provide different market dynamics to the rest of England, with output (at current prices) continuing to rise by 17% annually at Q4 2014.

The main driver of new work output growth over the last 18 months is slowing. Both the public and private housing sectors are quickly reversing all of their recent upward trends when looked at on a yearly growth basis. The counterpoint to this is that the yearly growth figures are still positive, meaning that new work continues to flow. The steepness of the drop-off in Q4 2014 and into 2015 should though raise an eyebrow, particularly when assessing near and medium-term industry conditions.

After posting better growth rates in 2013 and 2014, estimated business investment was revised upwards in Q4 2014. However, this good news was tempered by the fact that nominal levels of business investment began to fall away from the recent highs recorded in the middle of 2014. The correlation between business investment and its corresponding construction sector output classification was evident last year. Changes to construction-related activity will be closely watched on the back of these changes to business investment levels.

05 / �ڶ����� cost index

Strong wage increases propelled AECOM’s building cost index to a 1.9 percent year-on-year rise at Q1 2015. Average annual rates of change across most construction trades saw 6 percent increases on the same time last year. Some trades continue to outperform this average rate of change, namely bricklaying, joinery, electrical and roofing trades. But plasterers, steel erectors and insulation trades experienced a plateauing in wage growth towards the back-end of 2014 and into 2015.

AECOM’s building cost index for materials and labour is forecast to increase by just over 2 percent in the year to Q1 2016, and by a similar rate to Q1 2017. Both international and domestic issues are likely to contribute to the pace of change in these input costs. Labour cost inflation though will be driven by domestic supply and demand factors. Nationwide demand for housing-related trades brought strong wage growth. Changing activity levels in the housing sector should bring consequent changes to wage inflation for the trades that have been influenced by housebuilding.

Price levels for key commodities are correlated to global economic factors and demand. Disinflationary or deflationary trends continue across many commodity prices. The Bloomberg Commodity Index shows no sign of moving from its record lows. Similarly to oil, commodities oversupply, demand deficiency and US dollar strength all contributed towards price weakness. Further, the correlation between US dollar strength and commodity prices remains high.

Steel billet prices fell significantly in March, after recovering during the second half of 2014. Not for the first time, iron ore - a key input into steelmaking - was at the front of price fallers in the quarter. Having posted an average price through March below $60/tonne, the commodity’s price level is below any equivalent average monthly price in 2009, and now its lowest for a decade. Demand is forecast to contract further still in the year ahead, at the same time as output by the big producers continues unabated. The fourth largest iron ore producer in Australia (Atlas Iron) recently announced the suspension of all operations in response to these price falls. Iron ore futures prices have recently traded at below $47/tonne.

Oil benchmark prices settled around the $50/barrel mark in Q4 2014 and Q1 2015. Numerous issues relate to and influence the oil price narrative, and geopolitical issues again caused short-term price movements in recent months. These supply factors continue to generate many of the explanations for current price levels, despite global demand deficiency. Oil storage issues are now discussed as a reason why prices could be pushed down further. Inventory levels at major oil storage facilities are at record highs and as oil supply continues to the market, storage options are rapidly diminishing. A lack of storage options amplifies a supply glut and does not support price levels. A counterpoint to this suggests that refiner demand will remove some excess supply volumes.

No comments yet