Our regular market forecasts on output, activity, costs and tender prices include an analysis of three different scenarios for recovery from the pandemicŌĆÖs economic impact. Michael Hubbard of Aecom reports

01 / Summary

Tender price index Ō¢▓

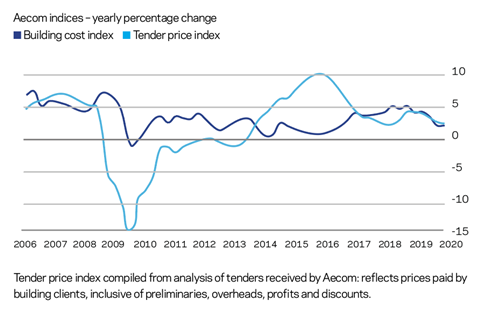

Tender prices increased by 2.3% over the year at Q4 2019. Although still positive on a yearly basis, it is the fourth consecutive quarter where the rate of change slowed.

║┌Č┤╔ńŪ° cost index Ō¢▓

A composite measure of building input costs recorded a 3.4% yearly rate of change in Q4 2019. Materials prices mostly fell from Q3 to Q4 but labour rates stayed elevated in the main.

Consumer prices index Ō¢▓

The annual rate of change slipped to 1.3% in December 2019 from 1.5% a month before. This is significantly below its target rate of 2% but will help real-terms wage increases.

02 / Output

UK construction output

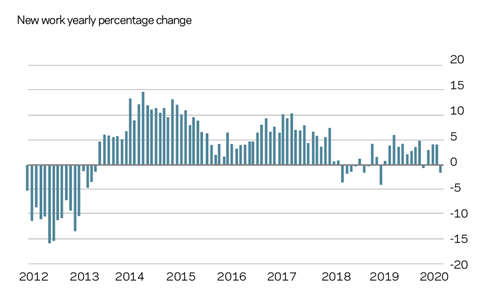

Construction data released by the ONS on 9 April covering the period up to 29 February largely excludes any coronavirus impacts. The all work construction output series fell 1.7% between January and February, with extremely adverse weather playing a part in this decline. The other notable change within this data point was the 7.7% monthŌĆæonŌĆæmonth fall in private housing output. Housing activity almost always reflects or signals fundamental trend changes in UK construction activity. Yearly change metrics offered better news up until this point: new work across all sectors increased by 2.1% on a three-month rolling average basis.

But the coronavirus pandemic has created extraordinary times, upending economies across the world; the outbreak created rapid changes to societal interaction once mitigation and lockdown measures were implemented by national governments. Large impacts are inevitable to national economies and domestic industry sectors. Compounding these dynamics is the synchronisation of the impacts across the world. Construction sectors in the UK and Ireland will of course not escape this disruption.

03 / Activity indicators

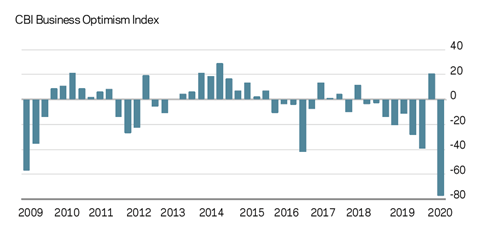

Business sentiment

UK business sentiment indicators in Q1 2020 were holding up, broadly speaking, against a backdrop of general uncertainty. In fact, measures of business confidence moved somewhat higher over the first quarter of 2020. However, the pandemicŌĆÖs impacts on economic and business activity are beginning to filter through into newly published sentiment surveys ŌĆō and they make for troubling reading. The CBIŌĆÖs business confidence index hit its lowest ever level at -87 in Q2 2020.

The UKŌĆÖs GDP annual growth rate to Q4 2019 was just over 1%, confirming an otherwise benign trend seen throughout 2019. Brexit was a constant theme within supporting commentary to the multiple data releases. Nevertheless, corresponding mitigation activities ŌĆō stockpiling, for example ŌĆō helped to keep economic activity from declining further.

The coronavirus pandemic is resulting in unique and extraordinary impacts on many industry sectors. Expansive and immediate disruption to populations, economies and businesses was quickly introduced by the public health crisis, as governments across the world implemented measures to contain the coronavirus outbreak. These mitigation measures directly address public health risks and implications from covid-19, but an economic demand and supply shock is also a consequence of these actions. Without question, UK construction supply chain firms face an array of risks during 2020, as fallout from the crisis evolves.

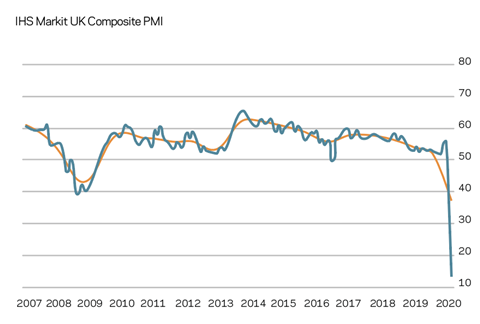

MarkitŌĆÖs composite PMI ŌĆō a measure of manufacturing and service sector activity ŌĆō plummeted to the lowest level in its 20-year history in April. It is the simultaneous hit to demand and supply that differentiates this current period of disruption from the global financial crisis of 2008. The events of 2008-09 were largely demand-side in origin, with a collapse of general demand initially and minimal supply-side aspects for the most part. Now supply-side components are affected too, as economic stoppages and restrictions on movement of goods and people add to the extreme dislocations. Speed of impacts is the other significant difference this time.

04 / ║┌Č┤╔ńŪ° costs

Exchange rates

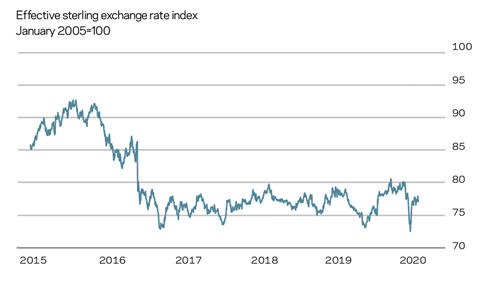

Before the coronavirus outbreak began, inflationary pressures were set to remain as a result of sterlingŌĆÖs value against two of its major currency pairs: the US dollar and the euro. SterlingŌĆÖs range-bound path from 2016 until Q1 2020 was starting to be considered a new benchmark range. Anchored at these levels, it is very likely that the construction supply chain would experience further commercial pressure from its input costs, specifically where imported materials and components play a part in project delivery.

Sterling exchange rates will continue to experience volatility as the UK manages extensive fallout from the lockdown and impacts on economic activity. However, the relative lockdown impacts to other countries will also feed into the movement of exchange rate pairings. Further turbulence is expected as the UK approaches its self-imposed end-of-June deadline for Brexit negotiations. These factors combined are likely to sustain downside pressure on sterling. Ultimately, sterling locked to a lower range maintains upward pressure on costs for imported goods and materials.

Inputs

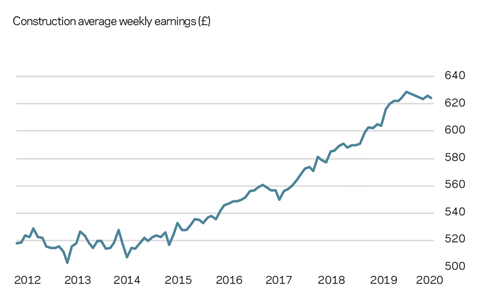

AecomŌĆÖs composite index for building costs ŌĆō comprised of materials and labour inputs ŌĆō rose by 1.1% over the year to Q1 2020. There was an average fall of 0.6% across all inputs between Q4 2019 and Q1 2020. The largest increases were in plastic pipes (4%), steel pipes (2.8%) and cast-iron pipes (3%). New statistics published in April by the Office for National Statistics for UK average weekly earnings recorded an increase of 2.8% in the three months to February compared with the same period a year earlier. Weekly earnings for construction grew by 2.7% over the same period.

If site activity picks up, as a lockdown exit path in Q2 and Q3 2020 takes hold, a combination of restart demand, some enduring lockdown constraints and low supply inventories is expected to create above-average cost inflation. Distribution and logistics chains will be fragmented or disordered, though, after the rapid lockdowns across the world. Until these channels return to some form of normal sequencing, supply constraints will endure with subsequent effects on the procurement of both domestically sourced and imported construction materials. Consequently, elevated input cost inflation is likely to remain until supplier and distribution channels return to more typical output and operating levels.

05 / Tender prices

Resources

Tender prices increased by just over 2% in the 12 months to Q1 2020. Keener pricing was evident, but UK regions showed variation in the rate of change. Labour rates remained one of the key drivers of tender price inflation. An aggregate measure of labour-only wage rates increased by approximately 2.5% annually in Q1 2020. This was a slight pick-up in the yearly rate of change, correlating with the output and sentiment rises recorded over the same period and the end of 2019.

The labour force is at the centre of the debate on how sites can stay open safely in the pandemic or whether they should close. Labour supply constraints are likely to continue, either because of higher short-term demand as sites reopen, or due to restrictions in labour availability as a result of enduring coronavirus mitigations. The combination of these factors will probably see labour-only rates experience short-term above-average increases once any restart demand spike takes hold.

Capacity within contractors and supply chains to respond to tender enquiries and produce commercial submissions also poses a risk to projects and programmes over 2020. Tendering backlog, estimating capacity and enduring coronavirus mitigations are likely to hinder normal bidding operations for an extended period.

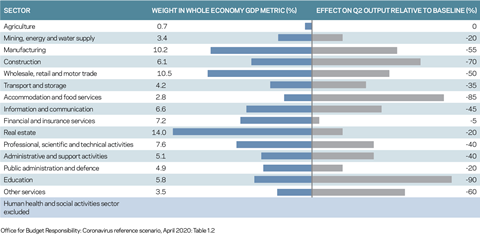

05 / Outlook

The Office for Budget Responsibility (OBR) recently published its forecast of economic sector impacts to UK gross domestic product (GDP) for Q2 2020 (see chart below). Construction ŌĆō which accounts for 6.1% of GDP value added ŌĆō is set to experience a heavy hit, declining by 70% in the quarter, according to the OBR. Restrictions on the movement of people, goods and materials, along with site shutdowns, have brought many parts of the construction sector to a standstill. The extent to which all this continues will be determined by the progression of the coronavirus outbreak, despite a number of sites reopening and firms stating they are soon to restart site operations.

Output loss forecast

Estimated output losses by sector in the second quarter of 2020

The financial effects on the supply chain will become evident in the upcoming months. Nevertheless, supply chain firms responded immediately to the severity of the situation through a mix of operational and financial mitigations. Many trading and operational updates released since the start of the pandemic have detailed temporary suspension of activities, cost containment, and deferral of non-essential capital expenditure, among other things. Banking facilities have been renegotiated or extended. Tellingly, and with candour, assessments of trading for the year ahead are not provided, stated as not possible and, in some cases, previously stated market guidance is explicitly withdrawn.

Significant swathes of the construction supply chain are expected to endure increased financial stress during 2020. Delayed or deferred projects will reduce cash flow. The adage of cash is king resonates loudly now. A weak margin story for sections of the industry adds to the financial complications. Balance sheet strength will be a determining factor in the survival of supply chain firms through this period of economic and industry dislocation. Thin capitalisation of many supply chain firms offers minimal financial buffer through this turbulence. A short period of lockdown will inevitably test the financial resilience of many firms. A protracted period of lockdown and disruption will produce financial disruption horizontally and vertically throughout the industry, such is the structural impact of this pandemic. Insolvencies are expected to be an inevitable consequence of this financial strain.

When the official pandemic lockdown is lifted, a different ŌĆ£normalŌĆØ from previously is likely to be evident for a significant period. Social, economic and public health strands of the pandemic, entirely understandably, have been the focus of attention. But social psychology will become an equally significant component of the mix, with direct and indirect implications for business operations and methods of revenue generation.

Data will inform the speed at which lockdown measures are eased, lifted or changed. Restrictions such as social distancing, testing and quarantines will affect operations, at least until a vaccine becomes available. One thing is certain for the supply chain: productivity will suffer materially.

Aecom has developed three scenarios for the construction sector covering the short and medium term by which to analyse and plot possible routes out of this crisis; these are detailed below and right. It should be stressed that Brexit is an added complication to these scenarios and its specific impacts are excluded for the time being. Nonetheless, a spectrum of disarrangement will occur, with no-deal Brexit bringing the largest amount of disruption to trading conditions and supply chains later this year.

Scenario 1: quick rebound

Outline:

- A short-term pause, albeit significant, is suffered in existing construction activity.

- Activity and output return to near previous levels by Q4 2020, settling at an industry long-run average.

- No further lockdowns are implemented.

- The current crisis does not develop into a deeper financial crisis through a negative feedback loop.

- Post-lockdown construction demand remains broadly in place.

Effects and outcomes:

- Lower site productivity is experienced due to social distancing measures on sites.

- Some reduced supply chain capacity, either because of insolvencies or restrictions on delivery capability, is likely to be an offsetting factor that applies upward pressure to tender prices.

- Tender pricing sees softer trends over the rest of 2020 but the yearly run rate is still positive. As construction activity picks up, tender price levels begin to head towards longer-run averages and with the potential for short-term tender price spikes where supply and demand converge quickly to influence tender price inflation.

TPI forecasts:

2020 0% to 1%

2021 2% to 3%

2022 3% to 5%

Scenario 2: slower rebound

Outline:

- Existing country-wide lockdown remains on a rolling basis but with specific exemptions added to the policy mix at appropriate times.

- Monitoring and suppression is the overarching approach as lockdown severity eases, but the potential remains for further country-wide or localised lockdowns where necessary.

- Construction output does not return to levels similar to those immediately prior to the coronavirus outbreak until 2021 at the earliest.

- Broader economic disruption is sufficiently large that related construction demand, either directly or indirectly, is notably impacted.

- Operational and productivity impacts continue from social distancing, monitoring and suppression mitigations.

Effects and outcomes:

- Input costs maintain long-run average or above-average yearly rates of change, because of global and domestic supplier and distribution problems.

- Reduced supply chain capacity, either through insolvencies or restrictions on delivery capability, is a significant offsetting factor that applies upside risk to tender prices.

- Tender prices experience downside pressure over the short term due to restrictions on activity, lower output and some knock-on effects to overall demand. For similar reasons, supply-side effects produce some upside risk, but overall pressure for the supply chain to win work and secure cash leads to competitive tendering ŌĆō and possibly even sub-economic pricing in some instances.

TPI forecasts:

2020 -1% to 1%

2021 1% to 2%

2022 2% to 3%

Scenario 3: significant downturn followed by slow recovery

Outline:

- Without a vaccine, coronavirus continues its presence in society, the risk of infection transfer remains, and further waves of infection occur in response to attempts at easing social distancing measures.

- Any discernible rebound in construction activity, let alone a recovery, does not occur until late 2021. Similarly, UK GDP remains well below par and recessionary for an extended period.

- A negative feedback loop develops where the effects of the lockdown restrictions begin to cut across economic sectors, adding to overall downside risks. In turn, aggregate construction demand falls materially.

Effects and outcomes

- Tender prices enter a deflationary trend over the short and medium term. Pressure to secure workload and cash flow outweighs the often-stated objectives of always securing higher-margin work. Sub-economic pricing therefore becomes more prevalent.

- Input cost trends remain higher than prevailing rates of tender prices largely due to weaker sterling, further complicating the commercial dynamic.

- Some upside price pressure is applied to tender pricing from tighter supply chain capacity, but not to a greater extent than competitive pressure to secure workload in a declining market. Changes to sourcing and buying are necessary ŌĆō locations and frequency for example ŌĆō because of global supply chain problems and on-going dislocations.

TPI forecasts:

2020 less than -3%

2021 less than 0%

2022 0%-2%

No comments yet