Half a decade since the start of the economic crisis, output is still falling and tender prices continue to head south. Peter Fordham of Davis Langdon, an Aecom company, reports

01 / EXECUTIVE SUMMARY

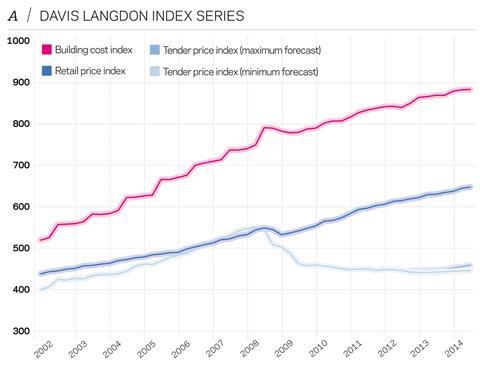

Tender price index

Softening materials prices and intensifying competition push prices down further. The short-term outlook remains negative.

║┌Č┤╔ńŪ° cost index

The index falls for the first time in 13 quarters as materials prices move into reverse. Labour costs will push the index up over next two quarters.

Retail prices index

Retail prices rose at a lower rate of 0.4% over the second quarter but the index for September still shows prices 2.6% higher than the year before.

02 / TRENDS AND FORECAST

Last week was the 25th anniversary of Black Monday, when share prices in the UK fell by 26%. Within two years, share prices had recovered and had normality resumed. We recently passed the fifth anniversary of the start of the current recession: over the following 18 months share prices dropped by nearly 50%. Recovery was strong over the next two years, but then the euro crisis struck and prices have staggered drunkenly ever since. Two weeks ago, the IMF downgraded (again) its forecast for 2012ŌĆÖs GDP in the UK to -0.4%.

Construction prices dropped by 17% over an 18-month period from the first half of 2008, but then failed to recover any ground, slipped a little further and is still bumping along what is hoped to be the bottom. But in the latest quarter, prices overall fell by a further 0.5% as workload continued to disappear and materials prices softened.

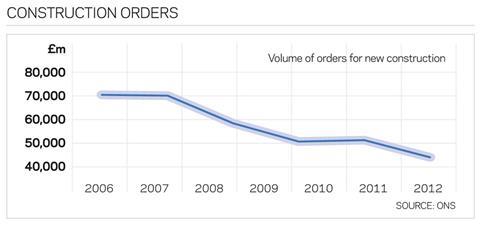

Construction output has been falling throughout the year and is forecast to fall further next year as the latest set of new orders figures reveal the lowest level of new activity since 1980. Separately, recent official figures showed that people employed in construction fell below 2 million for the first time since 2001. In those circumstances it is unsurprising that many contractors have weak forward-order books and continue to look for an ever more competitive edge.

Preliminaries are frequently priced at less than 10%, although there is some evidence that the cost of performance bonds has risen. The latest insolvency figures are actually the lowest for a couple of years but construction remains at the head of the list of industries suffering failures, not helped by companies extending payment terms to their suppliers.

Contractors continue to be tempted to trim their overheads and profit provision, and to consolidate in an attempt to save costs - Morgan Sindall recently closed its North-east office and Lovell announced the merger of some of its regional operations.

M&E contractors have come under pressure this year and a number of major companies have gone to the wall, including Airedale M&E in July and Rotary UK in August. With both companies based in northern England, future competition for M&E works in that region will be less competitive.

Despite the drop in workload, some contractors have actually become more selective in the projects they are willing to bid for. This is often simply the result of estimating teams having been reduced.

Competitive design and build remains the most popular procurement route but one that is heavy on estimating resources. Claims, inevitably, are now more prevalent.

With the easing of steel prices, rebar costs have responded by dropping from ┬Ż1,100 per tonne in Q2 to ┬Ż1,000-┬Ż1,050 per tonne. Finishings rates appear to have softened as the fit-out market becomes tougher - raised access floors can be bought for under ┬Ż30 per m2. The drop in metals prices and the strength of the pound against the euro has helped to secure lower prices for M&E components. In the other direction, rates for disposal of waste material are higher.

As the number of contractors and subcontractors dwindles, there will eventually be less fierce competition and those that remain will price more sensibly, but the industry is still some way from that position. The outlook for 2013 is worse than for 2012 - Experian and the Construction Products Association (CPA) expect new work output next year to drop further, the CPA by 2.4% after a 9.5% fall this year; Experian, a 3.8% drop after a 10.9% fall this year. The private commercial sector on which the industry must now depend is not expected to show any sort of growth nationally until 2014 at the earliest.

The outlook for London is better than for the rest of the country. London is bolstered by Crossrail, and has probably the only other booming sub-sector, the luxury residential market. There is also a large pipeline of office projects, though many programmes keep slipping as funding remains difficult.

The outlook for prices is muted. Competition will remain or even increase for the dwindling volume of work that is expected to be let over the next year or so. The eurozone crisis and a weak global economy are likely to keep a lid on commodity prices. Construction prices in London may harden if more of the office and residential pipeline comes through but are expected to move only in the range of -1% to +0.5% over the following 12 months.

Outside London, conditions look set to stay tougher for longer. Prices over the next 12 months may move by -1.5% to zero and, in the second year, are unlikely to rise by more than 1% in most locations.

03 / HOT TOPIC: IS HOUSING THE ANSWER?

Housing has long been the engine of the construction industry - it can turn on and off relatively quickly and uses a significant proportion of the construction workforce.

All of the major political parties have called for more housebuilding to drive the economy forward. In November 2011 the government published a ŌĆ£comprehensive housing strategyŌĆØ. This was followed by the launch of the NewBuy scheme in March, allowing access to mortgages with only a 5% deposit, and the Get Britain ║┌Č┤╔ńŪ° fund, providing financial support to housebuilders to get stalled developments back on track.

In September the government unveiled a further series of measures. These included:

- Removing affordable housing requirements on housebuilders to unlock currently unviable sites

- The Infrastructure (Financial Assistance) Bill, which will include guarantees of up to ┬Ż10bn of the debt of Housing Associations and private sector developers

- New capital funding of ┬Ż300m for affordable housing to deliver up to 15,000 affordable homes and bring 5,000 empty homes back into use

- An additional 5,000 homes built for rent at market rates including an investment of ┬Ż200m in sites to ensure land is available to institutional investors quickly

- Fast tracking of large residential applications through planning

- A ┬Ż280m extension of the FirstBuy scheme to March 2014.

All worthwhile measures, but will they succeed in significantly improving supply? Latest statistics on housebuilding emphasise the need for such measures. In England, housebuilding starts in the quarter to June 2012 were 10% lower than in the previous quarter. Starts by housing associations were 23% down. In Scotland statistics show that construction of new homes is at its lowest ebb since records began 16 years ago.

In truth, the various measures will help at the edges but will probably not significantly boost numbers. The large housebuilders have marginally increased production, but sit on large landbanks, which they do not intend to bring into use until demand requires. All have significantly increased profit margins over the past two years and are focusing on their margins and returns to shareholders rather than building into a market where demand is weak (because of the underlying economic conditions, job instability, low wage growth and lack of mortgage availability).

The biggest rise in housing output last year came from small housebuilders, rather than the big companies, but they struggle to get credit (which may be helped by the Get Britain ║┌Č┤╔ńŪ° fund for which most recent bids are from SMEs).

At the beginning of the year, there was an upturn in lending. But then came the double-dip recession and the trend was reversed. Latest figures for September show that the number of loans for house purchase was the lowest September figure since records began in 1993. Loans in the third quarter overall were 7% lower than in the same period of 2011.

The latest attempt to improve this issue is the Bank of EnglandŌĆÖs Funding for Lending scheme which provides cheap loans to banks who lend to SMEs and mortgage applicants. Mortgage rates have recently fallen, which suggests the scheme is having some success. This and other measures may well improve liquidity of the market in time, which will encourage housebuilders to increase their output. The process is likely to be slow but this yearŌĆÖs expected drop in output may be balanced by a 2-3% rise in activity in 2013.

04 / ACTIVITY INDICATORS

The latest data released by the Office for National Statistics show that total construction output in the first eight months of 2012 fell by 8% compared with the same period of 2011 in constant price terms. New work output was 12% lower. That is an average reduction of ┬Ż559m of work per month. This disastrous figure cannot be blamed on the extra bank holiday for the QueenŌĆÖs Diamond Jubilee. Spending in the public sector was down by 21%, a drop-off of ┬Ż304m per month.

Last month the ONS was forced into another apology after admitting an error in its new orders figures that it had released three weeks earlier. Initially the data had suggested a 0.2% increase in the volume of new orders in the second quarter of 2012 compared with the first quarter and a rise of 11.1% compared to the first quarter 2011, numbers which were greeted with much delight in the corridors of power.

The revised figures paint a very different picture. The total volume of all new orders in the second quarter is now estimated to have fallen by 8.5% compared with the first quarter and was 0.3% lower than the second quarter of 2011. The revised figure represents the lowest level of new orders since 1980.

In constant price terms, the volume of new orders in the first half of 2012 was 4% lower than in the same period of 2011, 20% lower than the same period of 2010 and 43% down on the same period of 2007, graphically illustrating the dramatic fall in industry workload, which will continue to feed into work on site figures over the next year.

The decline is most evident in public sector non-housing work where orders were 26% lower than in the first half of 2011 or reduced by an annualised ┬Ż2.5bn.

MarkitŌĆÖs Purchasing ManagersŌĆÖ Index for September confirms the grim ONS data. The survey found both output and new business levels declining and confidence in the business outlook much lower than at any time since mid-2008. Worryingly, commercial sector building activity dropped in September at its fastest rate for two-and-a-half years.

05 / BUILDING COST INDEX

Provisional figures for the third quarter 2012 show that the ║┌Č┤╔ńŪ° Cost Index fell by 0.4% compared with the second quarter. Over the year to the third quarter, the index shows a rise of 0.7%, its lowest figure since the end of 2009. Materials prices fell for four consecutive months between May and August and labour rates remain at their September 2011 fixed level.

The index is forecast to rise by 3.5% over the year ahead as materials manufacturers struggle to secure price rises and a small labour increase comes into effect in January. But employers will be hit harder by a change in National Insurance that starts next month (see below).

| Actual | Forecast | |

| 3Q11-3Q12 | 3Q12-3Q13 | |

| Labour | +1.0% | +4.5% |

| Materials | +0.3% | +1.7% |

Labour

║┌Č┤╔ńŪ° operatives secured a 1.5% wage increase in September 2011 that provided their first increase in pay since June 2008. Negotiations for a further pay deal in 2012 came to nought but a deal was eventually struck that will see basic wage rates rise by 2% from 7 January 2013. The agreement provides for no further revisions to pay before January 2014.

However, before that, employers will be faced with a further increase in their wages bill when the National Insurance concession on holiday pay schemes is withdrawn on 1 November. The removal of this concession will increase wage bills by at least 1% (for general operatives on the minimum agreed wage) but is more likely by up to 3% or more for more highly paid operatives.

The only industry operatives to gain a wage increase this year are plumbers (a 3% increase from the beginning of January) and demolition workers (2.5% from 20 July) though heating and ventilating operatives, whose pay last increased in October 2010, are still in negotiation.

Materials

Construction materials prices rose in the early months of the year but have since fallen back. Over the 12 months to August, the index shows an overall rise of just 0.1%.

Insulation is one of the few materials to have registered a significant price increase over the last year, with prices rising by about 6% as sales have risen strongly in response to the green agenda. However, the Insulation Industry Forum recently warned that the good times are over

(for now) as subsidies are withdrawn before Green Deal Finance and Energy Company Obligations become fully operational, leading to the closure of manufacturing plants, job losses and insolvencies. Prices in 2013 may not be as strong.

Sand and gravel prices have recently suffered a price fall and show a drop of 11% over the last year. Sales of sand and gravel remain 25% below sales levels in 2008.

In line with most commodities, steel have been falling since the spring. The price of reinforcing bars is 7% down over the year and fabricated steel is down 5%. Prices continue to drift downwards as supply outstrips demand. Total steel demand in Europe in 2012 is forecast to be 6% lower than last year. Steel capacity continues to be cut in many parts of the world. Prices for steel-making raw materials - iron ore, coking coal, scrap - which have been behind many of the price rises of recent years, have plunged this year due to ChinaŌĆÖs slowdown.

The decline has seen the LMEŌĆÖs steel billet contract price drop from $690 per tonne in August 2011 to $315 per tonne in mid October 2012, though this is not reckoned to be a true representation of the real market, where the price is considerably higher. However the 15-month contract price is up to $385 a tonne, a 22% increase from now. Most analysts expect steel prices to rise mildly at the beginning of 2013 but then to dip again while the world economy remains in turmoil.

Metal prices dropped around 20% in the second quarter. This was largely attributed to the slowdown in China which now accounts for more than 40% of global metals consumption. However September saw a quick rebound in prices for all the base metals which appeared to be in response to anticipated stimulus measures in China. Most metals prices are expected to be higher in 2013, but some expect the price of copper to crash as it is currently viewed as fundamentally overpriced.

The pound buys 7% more euro-denominated goods now than this time last year, which is good news for building clients whose projects use a high proportion of imported components such as top-end curtain walling and M&E goods.

No comments yet