The water sector is under increasing pressure to deliver better value. Investing in digital and smart technologies and opening up to innovative delivery and business models will be critical enablers for the water companies to rise to the efficiency challenge and meet customers’ expectations. Elisabeth Selk of Arcadis looks at how they can improve performance during Ofwat’s next price review period, PR19

01 / Introduction

Water companies in England and Wales will invest more than £8bn in 2018/19. The investment comes in the fourth year of a £44bn five-year spending commitment up to 2020, aimed to boost customer satisfaction and improve resilience.

Water companies are at present actively working on their business plans to be submitted to the economic regulator, Ofwat, for the next price review period (PR19), 2020-2025. PR19 brings new approaches and mechanisms that impact cost recovery and performance and will steer the companies’ asset management and capital delivery programmes.

Under PR19 companies will need to demonstrate more than ever before that water bills are underpinned by a good understanding of costs and that they are able to deliver value for money to their customers. They will not only need to do much more to understand their customers’ needs but will also want to obtain a strong mandate for expenditure from their customers.

This will be no easy feat. PR19 requires a step-change in efficiency bringing in more competition and lowering returns. Achieving efficiency, productivity and customer service targets has become ever more demanding. Population growth and concentration and climate change-driven weather patterns are putting pressure on an ageing asset base.

As the regulator is playing tough, or so it seems, political capital has been waning for the UK water industry. Concerns about water bills, transparency and the corporate behaviour of water companies have been voiced more widely and loudly, including recently by the environment secretary, Michael Gove. The idea of renationalisation of the water sector appears to have been gaining ground recently, and not only in the ranks of the Labour Party.

While customer satisfaction, willingness to pay and political acceptability are increasingly driving the new agenda. Opportunities are presenting themselves for the UK water industry.

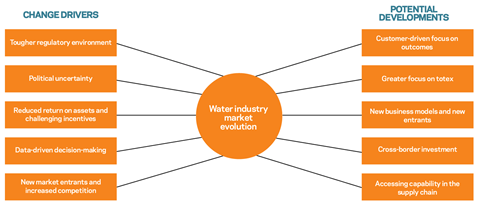

Innovation will be a critical enabler for companies to deliver value for money to their customers, satisfy the regulator and overcome environmental challenges. Digital and smart technologies as well as new delivery and business models are opening up new avenues for water companies to rise to the efficiency challenge and put customers at the centre of their operations while boosting returns on investment. Innovation is about how, with developments such as the “internet of things” and smart appliances, companies relate to their customers as much as about how they relate to their operations.

02 / PR19 themes

The price control mechanism allows a regulated company to recover the revenues it needs to provide its regulated services efficiently from its customers. Incentive regulation is intended to be challenging and to replicate the forces that are present in a competitive market. The UK water five-yearly price reviews aim not only to set cost-reflective and fair tariffs for customers, but also to incentivise productive efficiency and permit water companies to make an adequate return on capital.

In setting price limits, the regulator needs to assess what the efficient costs of providing those services will be, including the cost of capital.

The return allowed then seeks to balance the need to incentivise companies to invest in the long-term delivery of reliable and safe water services and at the same time to encourage efficiency savings. Other aspects of performance tend to be dealt with by different penalties and incentives.

In its upcoming price review, PR19, Ofwat has strongly reasserted its view that customers are at the centre of the water value chain. The regulator requires water companies to step up their efficiency in order to deliver fair water bills for their customers. New cost baselines and a significant pressure on returns aim to drive companies to outperform if they want to achieve the recovery of incentives and avoid penalties.

PR19 is centred on four themes:

- A focus on resilience for the long term: Companies will have to demonstrate the ability to navigate operational, financial and corporate challenges beyond the five-year period, and develop smarter solutions for resilience.

- A real push forward in customer service: Reacting to customers will not be enough and companies will be expected to encourage active customer engagement and foster water efficiency. The industry needs to make greater use of available technologies to further resilience and affordability and better communication.

- Finding new and innovative ways to deliver more for less: Companies will be rewarded for innovating to achieve efficiency savings and reducing costs will not be sufficient. Innovation in smart technology, customer service and the effective use of customer data are all areas for improvement.

- Affordable bills over the long term for all, including those customers who are less able to pay or who are in vulnerable situations. Companies will need to demonstrate improvements in efficiency that lower bills and will be expected to consider innovative approaches other than social tariffs in order to reach a wider vulnerable customer base. They are also encouraged to tackle bad debt.

For Ofwat, innovation is a critical enabler to the other themes. It includes technological developments as well as cultural changes and collaborative practices. It extends to the relationships companies build with customers, their supply chain, other companies, and partners in related sectors.

03 / New approaches to incentivise efficiency

PR19 new approaches are significantly altering the balance of risk and return and the overall package of incentives for capital programme delivery in the water industry:

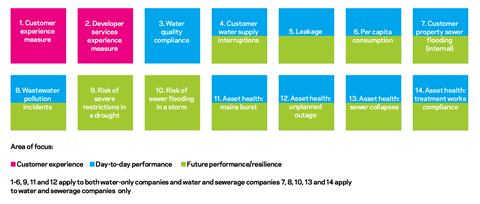

- Performance commitments. Companies make performance commitments to their customers on the quality of the services they will deliver for them. Companies must have 14 common performance commitments, covering customer service, asset health and resilience. In addition to the common performance commitments, companies will need to propose bespoke performance commitments, reflecting their customers’ preferences.

- Transparency. Companies will need to demonstrate to their customers as well as to the regulator that bills are underpinned by a strong understanding of cost as well as generating value for money. Companies will be expected to make their business plans accessible to all. A new IAP (initial assessment of business plans) test requires board assurance that their plan enables customers’ trust and confidence through transparency and engagement on issues such as its corporate and financial structure.

- New cost efficiency baseline. Average historical performance is deemed not good enough. The water companies are expected to deliver a step change in efficiency. For example, they are expected to reduce their leakage by 15% over five years. Performance levels for supply interruptions, internal sewer flooding and pollution incidents need to reach at least the forecast upper-quartile performance level for each year. The efficiency benchmark is being strengthened and will rely on forward-looking as well as historical efficiency projections.

- Asymmetric rewards and penalties. Outperformance will be rewarded, and penalties incurred by underperformers, by adding or deducting from the return on regulated equity (RoRE). An efficient company would be in neither reward nor penalty on total expenditure (known as totex). A company whose future performance remains at the current average should expect to incur underperformance penalties on its totex. Companies will need to deliver beyond stretching service levels to earn outperformance payments. Rising expectations should lift all ships, as companies will not want to risk not delivering on performance.

- Cost-sharing incentives. For the network plus and water resources activities, the costs of out- and underperformance are shared between companies and customers based on cost sharing rates. PR19 provides stronger incentives for companies to submit and deliver efficient business plans and outperform their cost allowance while protecting the consumer from either over-recovery or underperformance. This is because efficient business plans will be able to retain a larger proportion of any outperformance on costs, while inefficient business plans will retain a higher proportion of underperformance.

- The allowed cost of capital will fall by 1.34%. The cost of capital assumption within the price controls – possibly the most important and controversial element – underpins the allowed return on capital (regulatory capital value). The weighted average cost of capital (WACC) is the allowance that Ofwat makes for the costs of raising debt or equity in order to fund improvements. Ofwat mentioned a 2.4% WACC – compared with the current 3.74% allowed in AMP6 – driven by lower expectations of the market cost of debt and equity. With this cut in the share of financing costs that can be recovered from customers – which will bring an estimated impact on customer bills of a £15-£25 reduction per year during 2020-25 – the water companies will need to be more efficient and innovative than ever before.

- New measure of customer experience. The regulator expects companies to raise the bar using active customer participation and demand management. C-MeX is the new mechanism replacing SIM (Service Incentive Mechanism) to incentivise companies to provide a better customer experience for residential customers. C-MeX will be based on both a customer service and a customer experience survey and will include a reward for outperformance.

- CIPH to replace RPI indexation. The price control is to be linked not to RPI but to CPIH, a measure of consumer price inflation that includes an additional factor of owner-occupier housing costs. The regulator views this measure as a better reflection of customer expectations. However, over the next five years water industry costs are forecast to rise by 5% annually. This cost-price gap means that water companies will need to be even more innovative, particularly in their procurement planning and delivery, to raise efficiency over the lifetime of the price review period.

04 / Investing in long-term resilience

Resilience is the ability of the assets, networks and systems to anticipate, absorb, adapt to and/or rapidly recover from a disruptive event. Customers expect reliable water and wastewater services supplied by infrastructure that can avoid, cope with and recover from, disruption. Resources are finite, however, and customer willingness to pay for resilience is limited.

For Ofwat, a resilient sector is one that can navigate its way through operational, financial and corporate challenges in a smooth, predictable way. To deliver these critical services, companies need to make the best long-term decisions about operations, maintenance and investment.

In their asset management plans for 2020-25 (AMP7), water companies are requested to include a set of performance commitments relating specifically to resilience for the next 10 to 15 years, as well as a new asset health performance commitment. Ofwat stresses that companies need to think smarter about resilience and focus on the long term.

The regulator has been supportive of several recent initiatives such as:

- Development of resilience metrics

- Robust decision models to help make long-term best-value decisions under the uncertainties of climate change and population growth

- Collaboration in planning to enable better value options across company boundaries. For example, the alliance Water Resources in the South East Group developed a 25-year over-arching strategy for five water companies in the region. Water-sharing schemes were identified in the Medway region in Kent and in South Hampshire. The strategy has also been looking at shared opportunities for managing water demand.

The regulator, however, wants engagement to widen further, and see more integrated thinking about the management of resources. Specifically, it recommends that companies consider explicitly cross-boundary resilience solutions such as water transfers and catchment area management.

Finding the right way of meeting the expected demand with available resources requires a range of approaches:

- Demand management – decreasing customer demand by introducing more water-efficient household devices, and metering

- Reducing leakage – 25% of all water (treated water) is lost through leakage

- Mechanisms for coping with more extreme rainfall patterns – flood defences, better planning of housing developments, new wastewater treatment plants

- Better use of available resources. With water resources concentrated in areas where they are not necessarily the most needed (such as Wales versus the South-east), trading between water companies could form part of the solution.

05 / Improving outcomes through collaboration and competitive procurement

Collaborative delivery

Both Ofwat and the water companies are looking at opportunities to deliver outcomes in different, more efficient ways. More innovative approaches to deliver work beyond the tried and trusted traditional procurement and commercial models are changing the ways in which water companies deliver their enhancement programmes. Opportunities to improve performance include greater reliance on collaboration with the supply chain and the introduction of new players into the sector through direct procurement.

To encourage efficiencies and find the best solutions for outcomes there has been greater collaboration between water companies and their tier one contractors and equipment suppliers, with the latter two involved at an increasingly early stage, sometimes through an alliance. Anglian Water, for example, uses a well-established alliance with an incentivised commercial model to drive outperformance across its capital programme. This helped the company consistently exceed the efficiency targets set by Ofwat for successive investment periods. In another example, Thames Water’s eight2O alliance has brought together expertise from multiple sectors to deliver a common set of outcomes.

Collaborative delivery relies on aligning the activities, behaviours and interests of owners and suppliers:

- Integration – encouraging collaboration and an exchange of capabilities to drive improvement and innovation

- Aligned commercial arrangements – based on clear definitions of value and desired outcomes

- Sustainable alignments of interests – that extend beyond a single project.

Procurement initiatives

As part of the 2019 process, Ofwat requires water companies to participate in a new model of procurement in respect of certain large and discrete infrastructure projects. Under this new model of procurement, called direct procurement for customers (DPC), a licensed water company procures services on behalf of its customers.

Companies are expected to conduct a competitive tender for and appoint an entity to design, build, operate, maintain and finance a service. As well as attracting new entrants, water companies can compete for the DPC projects of other water companies as part of their unregulated business. By introducing competition with the market, the regulator aims to allow lower costs of financing and improved outcomes for customers. DPC has the potential to reduce totex costs and deliver savings for customers – the challenge is how best to deliver it.

As the aim of DPC is to provide services to the consumer at lower cost, making sure these programmes are investable is a real challenge for the regulator. Ofwat can point to successful examples in connection with transmission assets for Offshore and Onshore Wind, as well as the Thames Tideway Tunnel, but the National Grid has recently indicated that the potential returns on the Hinckley Point programme are insufficient to attract investment. At the heart of the challenge is getting the right programme structure to attract investment. Tideway, for example, has a particularly attractive risk profile underwritten by a government contingency guarantee and early income stream that made it possible to attract low-cost pension fund capital at an early stage. Given the risk profile of the smaller programmes proposed under DPC, it may be less easy to attract competitors into this market segment.

06 / Step up efficiency with smart and digital technologies

The intelligence embedded within everyday devices and assets, combined with connectivity through the internet, is driving a revolution in business models, service opportunities and asset management approaches across industries. The “internet of things” is about how water companies relate to their customers as much as about how they relate to their operations.

These technologies support the data value chain, from data capture, establishing asset knowledge and insight through to making optimal decisions from the operational through to strategic level.

They also allow the sharing of this knowledge to influence behaviours in the supply chain and the customer base.

Armed with better cost assessment tools and additional insight around which to make informed decisions, companies can build innovation into their plans for PR19 that meet customer demands, overcome environmental challenges and satisfy regulators.

The top disruptive trends setting the stage for innovation in the water industry include:

- Communication technologies. Social media offers communication channels through which to reach customers in the case of outages. Cloud infrastructure provides new opportunities for digitalisation and decentralisation, allowing the water value chain in a collaborative delivery model to achieve greater efficiency. The distributed nature of assets, combined with the need for more efficient asset management and labour use, makes mobility and supporting communication technologies high investment priority areas for water companies. For example, Thames Water automates the despatching of responsive maintenance crews using location and progress on their current job.

- Control and automation. Not only do new products and processes allow companies to optimise their asset performance, but they also provide much better access to the customer and their water usage. This is valuable knowledge that can be used to design new services such as demand-side management programmes:

- 1: Sensors can be applied extensively throughout the network to support the optimisation of network performance, aid in leakage detection and enable the adoption of condition-based maintenance.

- 2: Smart meters have the scope to disrupt the supplier-customer relationship with demand-management programmes, as well as enable smarter network operations.

- Data analytics. More information than ever before flows from smart meters and other sensors alongside traditional sources of data about their operations. By 2025 Thames Water will be dealing with 35 billion hourly meter reads every year. Future trading schemes will further increase data volumes. This creates immense potential to mine data for invaluable insights. One system, the European Commission-sponsored iWIDGET, aims to analyse usage patterns and offer highly customised suggestions on how to reduce use and get better value for money.

- Predictive analytics. Common applications include understanding the future failure patterns of equipment, or the likely load from certain customer groups or regions. By understanding likely future circumstances, organisations are better able to respond when they arise. For example, RAPIDS (Radar Pluvial flooding Identification for Drainage System) predicts flooding in sewer systems. It uses computer models to assess very large networks in real time and raise alarm of sewer flooding with much greater accuracy. Arcadis’ SEAMS forward-planning software focuses on descriptive, predictive and prescriptive analysis – all designed to help clients better allocate investments to maximise returns.

- Robust decision support.Ofwat requires the use of tools that allow the long-term best-value decision under the uncertainties of climate change and population growth. Arcadis SEAMS’ forward-planning software focuses on prescriptive analysis around uncertain decisions. This scenario modelling capability is designed to help clients make the right decisions on their assets, informing customers and their stakeholders of why the decision is optimal given the operational environment.

- Artificial intelligence. As assets become more intelligent and connected, there is scope to overlay AI-enabled control systems that support machine learning and autonomous network optimisation. Recently, United Utilities revealed that it plans to employ “software robots” that use AI to help anticipate disruptions to supply. As part of customer-facing operations, chatbots have the potential to boost customer engagement through a new channel. Other applications of AI include the provision of digital training and support services to staff in the office and on site.

- Blockchain is a distributed ledger technology that allows for fast and super-secure transactions between multiple parties in a network. UK blockchain leader Electron has developed a blockchain-enabled switching service, for example, which could allow consumers to flip their supplier in a matter of seconds. There is also the potential for blockchain to help tackle rising problems around the fair treatment of vulnerable customers.

- Renewables provide a source of unregulated revenues. Water companies have been investing in renewables, especially solar farms, enabling them to reduce the very high energy costs associated with their operations. Many water companies now have ambitious targets for energy self-sufficiency. As their renewable investments grow, they are also realising opportunities to benefit from revenue streams associated with the provision of balancing services to the grid. This provides a welcome source of unregulated revenues. Anaerobic digestion, a technology that transforms sewage sludge into energy and fertilisers, offers another sustainable option for water treatment.

- Water reuse technologies. With growing water scarcity, water reuse can boost water resilience at a local level and ease pressure on resources, while also helping to reduce the burden on urban sewerage systems. Recognising the potential sustainability benefits, some water companies have used the changes in connection charging regime to incentivise the installation of rainwater harvesting and grey-water use in new housing developments.

07 / Conclusion: smart water companies rethink delivery to outperform

With PR19, the regulator is upping the ante to stimulate greater competitiveness in the water sector. Providing an essential service, water companies are facing increasing pressures to deliver more value for money to customers. Companies will want to obtain a strong mandate for expenditure from their customers to deliver the efficiency, environmental and social outcomes required.

The future for AMP7 will be one of innovation as companies strive to achieve the reset incentives and avoid penalties. Against a backdrop of ageing assets, the delivery of capital programme and asset management will be increasingly constrained by the public’s poor perception of the sector, willingness-to-pay constraints and the lower returns allowed by Ofwat. Investing in new technologies and embracing disruption will be key factors driving companies’ business plans for AMP7.

The UK water companies and their industry partners will want to pay particular attention to the following issues:

- Ramping up technology to engage effectively with customers. Companies will be looking at enhancing their communication strategy and tools directed at customers as well as making use of smart technology to engage directly with customers and incentivise demand management.

- Generating savings from innovation while maintaining quality of service. The key challenge here is all about balancing asset and network optimisation while at the same time maintaining excellent drinking water quality in the short, medium and long term.

- Increasing resilience. Water companies will have to find innovative ways in which to deliver more cost-effective leakage reduction programmes – and, in the longer term, the most resource-efficient options enabling them to balance water availability and consumption across the UK.

- Addressing longer timescales for planning and decision-making. With totex and sustainability driving the efficiency agenda, companies are having to plan beyond the single AMP, looking to AMP 8 and beyond to plan large-scale investment in asset data, analytics and interconnection.

- Assuring investability. With the lower guaranteed returns from assets, the regulator aims to transfer more performance risk onto shareholders. This will require water companies to work across their full portfolio of regulated and non-regulated activities to prioritise activities that will deliver the best performance improvement, or that minimise risk. The supply chain will play a significant role in supporting this investment optimisation.

- Managing the supply chain efficiently. The next generation of alliances will access specialist skills within the supply chain as well as the management capability of the integrator/contractor. Given the need to balance cost reduction for customers against sustainable profits, getting the right balance of risk and reward is crucial. Costs and incentives must be aligned in order to eliminate waste and duplication and to incentivise innovation.

- �ڶ����� business capabilities. Several water companies are building in-house capability around business areas that have great potential for future out-performance. Smart sensors, artificial intelligence, big data analytics and cloud computing will become increasingly important as a means of delivering customer satisfaction at an affordable price. The implications for procurement are that clients are likely to have a more direct role in programme delivery – using their network insights to direct the team to deliver the most impactful and best-value investments.

No comments yet