Construction companies are going bust at the rate of about one every 36 hours and regional contractors are under particular strain. Dave Rogers reports on the reasons for their demise ŌĆō and what others are doing to buck the trend

David Chambers has a story for our times.

The 63-year-old chair of Lindum, the ┬Ż164m turnover Lincoln contractor set up by his father John more than 60 years ago, is talking about the spate of high-profile collapses which have bedevilled the sector over the past year.

He stops and recalls his own firmŌĆÖs apparent brush with the grim reaper. The manager in charge of its office in Peterborough had shut early one Friday afternoon last August. Suddenly, the firmŌĆÖs head office was getting calls from panicked suppliers. ŌĆ£They thought weŌĆÖd gone bust.ŌĆØ

Glyn Mummery is a partner at FRP Advisory, the firm handling the administrations of two of those casualties to hit the headlines in 2019 ŌĆō Simons Group and Shaylor, which between them had accumulated 125 years of trading.

Mummery, who began his career 30 years ago in the teeth of the recession of the early 1990s, says modern-day collapses are almost always aided and abetted by the rumour mill. ŌĆ£The speed of the rumour mill can be ferocious,ŌĆØ he says. ŌĆ£If there is a cash pinch and creditors go unpaid, people can start sharing information [on their mobile phones] and the speed at which a business can decline is frightening.ŌĆØ

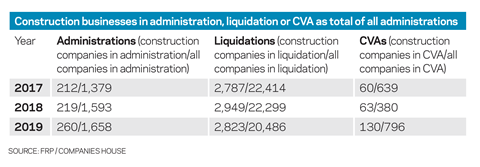

Data produced by FRP shows just how precarious being in the construction industry really is. Using Companies House records, the firm claims that last year the industry was responsible for the second-highest number of administrations across 20 sectors analysed ŌĆō only manufacturing fared worse. In the past three years, construction has remained in the top three of worst-performing sectors for administrations, along with manufacturing and retail.

In the last quarter of last year, 57 construction firms went under ŌĆō a rate of roughly one every 36 hours

Insolvency specialist Begbies Traynor said last week that construction and property accounted for the steepest rise in financially distressed firms ŌĆō those companies that have county court judgments against them ŌĆō for the last quarter of 2019. And KPMG says that in the last quarter of last year, 57 construction firms went under ŌĆō a rate of roughly one every 36 hours.

Steve Absolom, a partner at KPMGŌĆÖs restructuring practice, says: ŌĆ£We saw decisions on investment and capital projects delayed in the run-up to the general election. That, coupled with a question mark around the UKŌĆÖs position on Brexit, prompted a number of businesses that had already been teetering on the edge of insolvency to run out of cash to keep afloat.ŌĆØ

ŌĆ£Brexit is a factor but there are others as well,ŌĆØ says FRPŌĆÖs Mummery. ŌĆ£Weak management, weak management information and [lack of] cash in the business.ŌĆØ He says firms have been trying to find work in non-core areas when work in their traditional markets has become harder to win. ŌĆ£They find the skillset isnŌĆÖt there.ŌĆØ

Sticking to your knitting

One firm which knows all about this is Interserve, which did exactly that with its foray into the world of energy-from-waste (EfW) ŌĆō a sector in which Clugston, another firm that collapsed last year, was also heavily involved. Saddled with a huge debt and losses of more than ┬Ż200m on the EfW schemes, Interserve collapsed into a pre-pack administration last March. It restructured and split into three businesses with one, its construction business, headed by Paul Gandy who was appointed last September.

[Regional firms] have brought in external leadership rather than family and overreached on competency and geography

Paul Gandy, Interserve

Gandy says his ┬Ż450m turnover business is a regional contractor and has a view on why some regional firms have hit the buffers. ŌĆ£I think theyŌĆÖve overreached themselves, theyŌĆÖre a certain size, want to be bigger and for various reasons have brought in external leadership rather than family and overreached on competency and geography.ŌĆØ

Gandy, whose CV includes spells working at Multiplex, Balfour Beatty, Carillion and Lendlease, adds that managers brought in from tier-one contractors can often send a smaller firm down the road to oblivion. ŌĆ£They might have been in charge of a ┬Ż300m construction business and now theyŌĆÖre in charge of a ┬Ż50m one. They might think ŌĆśthis needs to growŌĆÖ.ŌĆØ He adds: ŌĆ£If they stuck to their knitting, they might still be here.ŌĆØ

Bringing in outsiders to run a business can mean relationships with clients become irreparably damaged, LindumŌĆÖs Chambers says. ŌĆ£A lot of firms [which have gone under] have chief executives from outside the family and, when I say ŌĆśfamilyŌĆÖ, I mean the company family,ŌĆØ he adds. ŌĆ£National contractors who are involved in those companies are not understanding what a regional player has to have ŌĆō which is, if they take on work, they need to know their client.

ŌĆ£Almost all jobs, in some way, do go wrong and you need to be able to get on the phone to your client and have a proper discussion.ŌĆØ

Financing

Looming over all of this, though, is the waning appetite of banks to keep bankrolling contractors. Laing OŌĆÖRourkeŌĆÖs group finance director Stewart McIntyre spoke to ║┌Č┤╔ńŪ° last week about just how difficult it was getting the firmŌĆÖs banks to agree to a refinancing. ŌĆ£Banks are trying to reduce their exposure to construction,ŌĆØ says Cenkos analyst Kevin Cammack. ŌĆ£ItŌĆÖs not easy [for a firm] convincing the local bank manager, whoŌĆÖs been given instructions by head office to reduce the construction book, to stick with them.ŌĆØ

Cammack says regional firms, like their larger peers, have been hit by the structural changes going on in the sector. ŌĆ£ItŌĆÖs much harder to get pre-payment and upfront payments than in the past.ŌĆØ All this means less money coming in and, for firms with fixed overheads, more money going out. ŌĆ£What brings a business down is cash flow.ŌĆØ

Ian Marson, UK head of construction at accounting giant EY, says: ŌĆ£The regional construction firms are just as exposed to the challenges in the sector as the big tier ones ŌĆō with working capital shortfalls and financing constraints increasingly coming to a head.ŌĆØ

He says initiatives such as the prompt payment code (PPC) ŌĆō nominally a good thing as it compels tier-one contractors to pay up more quickly ŌĆō have caused some headaches for regional firms. ŌĆ£PPC suspensions arenŌĆÖt typically an issue for most regional firms, and the changes should eventually be of benefit to subcontractors when they have worked through,ŌĆØ he says. ŌĆ£[But] the adjustment dynamics themselves are causing tightening against available financing, which is still very tight.ŌĆØ

Marson says that those firms which work for the bigger contractors are also feeling the pinch from the efficiency initiatives being rolled out higher up the supply chain. ŌĆ£Many regional firms that take on subcontract work are also now being actively impacted by the cost reduction programmes that are well under way in the main contractors, which have moved beyond the lower hanging fruits of internal headcount removal, into a wider supply chain focus to control costs and challenge invoices ŌĆō potentially further increasing payment days.ŌĆØ

Mark Beard is the chairman of Beard, another well-known regional firm, which was set up in 1892 by his great grandfather Edward, who was just 14 at the time. The firm now employs 320 people from four offices in southern England and has a turnover of ┬Ż160m. Beard, who is due to become the president of the CIOB this summer, says regional firms need to keep things simple. ŌĆ£You need loyal staff, a loyal supply chain. These are the basics you have to get right. Paying the supply chain on time gets their goodwill.ŌĆØ

We like to churn out 2% year-on-year and reinvest the profit rather than take it out

Mark Beard, Beard

He also says that some firms can become too obsessed with trying to improve margins to unobtainable levels. ŌĆ£Our ambition is to make 2%-plus margins year-on-year and weŌĆÖve done that for the last 10 years.

ŌĆ£We like to churn out 2% year-on-year and reinvest the profit rather than take it out. People who go on about 3%, 4% or 5% are sowing the seeds of their own demise.ŌĆØ

KPMGŌĆÖs Absolom says the pursuit of turnover to cover overheads means margins feel the pinch and the number of problem contracts for regional firms pile up as a consequence. ŌĆ£This has exposed them to disputes that negatively impact their top and bottom lines.ŌĆØ

After it was appointed to handle SimonsŌĆÖ collapse at the end of October last year, FRPŌĆÖs joint administrator Nathan Jones mentioned ŌĆ£contract delays result[ing] in unsustainable cash flow difficultiesŌĆØ.

Just before Christmas, when Manchester firm Bardsley slipped into administration with the loss of 200 jobs, the joint administrators at Duff & Phelps also made reference to the firmŌĆÖs disputes with clients as a reason for its demise.

And, announcing a rejig last month, Rugby-based Stepnell, whose construction business posted a pre-tax profit of just ┬Ż50,000 on turnover of ┬Ż164m, said it had been hit by ŌĆ£difficulties experienced in closing certain larger contracts, where there had been significant client variations resulting in substantial additional works and consequential delaysŌĆØ. StepnellŌĆÖs joint managing director Tom Wakeford promised: ŌĆ£We will be more selective about the projects that we bid for.ŌĆØ

The perils of uncertainty

Most agree that political uncertainty caused by Brexit has not helped. EYŌĆÖs Marson says: ŌĆ£The uncertainty of the past couple of years has meant many clients have cut down or delayed plans, which has resulted in a prolonged stagnation. This has been exceptionally challenging for many smaller firms to try and trade through, especially given the ongoing rise in input costs both labour and materials.ŌĆØ

Laing OŌĆÖRourkeŌĆÖs McIntyre adds: ŌĆ£Uncertainty is a really dangerous thing. When was the last new hospital project awarded?ŌĆØ

The result of the general election, though, is encouraging some to think that some sort of normality is returning. Beard reckons it will take another year for firms to feel more comfortable, a sentiment echoed by FRPŌĆÖs Mummery. ŌĆ£The election has given certainty, people can make decisions knowing Brexit is happening. Indecision is the biggest crime of all. Firms plan start dates and staged payments. Delays make a mockery of that.ŌĆØ

Management teams at struggling firms need to make their lenders aware of the problems as soon as they surface

Still, an 80-seat majority for Boris Johnson will not suddenly wipe out the threats facing firms overnight. ŌĆ£Well respected contractors can fall over,ŌĆØ Mummery warns.

So what to do? He says management teams at struggling firms need to make their lenders aware of the problems as soon as they surface. ŌĆ£As long as they have good management information that they can rely on, [a firm] can put forward a case to protect the business and turn it around.

ŌĆ£More sophisticated management teams will get in early with the banks.ŌĆØ

Mummery says that banks ŌĆ£are more supportive than they used to be, so long as you go to them and demonstrate where you are and keep them in the loop. Do not feel embarrassed about getting advice [from specialist restructuring firms] early.

ŌĆ£Doing so means there is a far greater chance of turning the business around and avoiding problems.ŌĆØ

Staying in business ŌĆō how not to blow it

Lindum will record its 12th straight year of profit when it publishes its annual results later this spring. Turnover was ┬Ż86m in 2008, growing to ┬Ż164m by the time it filed its lastest set of results for the year to November 2018. Growth, in other words, has been steady rather than spectacular. Typical jobs average around ┬Ż5m.

The firmŌĆÖs chairman, David Chambers, has been in the post since 1991 and is happy to eschew big schemes, saying: ŌĆ£If we had five ┬Ż20m jobs, it probably means we donŌĆÖt know the clients because theyŌĆÖre choosing anybody. ItŌĆÖs not a good way, it wants to be on the basis of relationships really.ŌĆØ

He says firms can too easily fall into a trap of taking on too much work if things are going well. ŌĆ£Often there is too much work out there and thatŌĆÖs the problem, of course, because if youŌĆÖre doing well, people start to think youŌĆÖre quite good and like anything they start to give you more work and suddenly you end up too busy and of course then you blow it.ŌĆØ

The firm has around 680 staff, with its contracting business its biggest division ŌĆō accounting for ┬Ż133m of revenue. It also has a land and development business, waste recycling arm, owns its own plant and carries out vehicle servicing for, among others, Lincolnshire Fire and Rescue.

Chambers sees CVs from potential employees asking for more money than he earns. ŌĆ£I think company directors are really bad sometimes in that they take too much and theyŌĆÖre greedy. IŌĆÖm not quite sure what they spend it on. If you make any money, you need to leave some in the company to make sure that you carry on.ŌĆØ

How does he deal with those who ask for eye-watering salaries, then? ŌĆ£You have to be polite,ŌĆØ he says. ŌĆ£I just donŌĆÖt want to see them. They donŌĆÖt see the need to be involved closely.ŌĆØ

By contrast, even though his two sons hold senior positions there, he remains very much involved. ŌĆ£I do it deliberately because I want people to feel like weŌĆÖre not just one of these companies thatŌĆÖs working for a chairman who doesnŌĆÖt know what heŌĆÖs doing.ŌĆØ

No comments yet