When ∫⁄∂¥…Á«¯ launched its ∫⁄∂¥…Á«¯ A Better Brexit campaign at the start of the year, we promised a reader survey to find out what the industry wanted the government to take into its negotiations with the EU. Chlo√´ McCulloch sifts through the results of the more than 2,000 readers who responded

Any doubts about what the construction sector wanted from a Brexit deal can now be put to rest. Having conducted ∫⁄∂¥…Á«¯‚Äôs Brexit survey, completed by more than 2,000 readers, we now have a clear picture of what the industry would like the government to take into its negotiations to exit the EU. The strong message from the survey is that construction wants a Brexit deal based on liberal policies to allow the maximum free movement of construction workers possible as well as protecting the import and export of construction products from tariffs. At first blush, then, you could argue that what construction wants is exactly what it has now. But what, realistically, are construction‚Äôs priorities and how is the government likely to respond?

Survey results

The results of the survey came as the government unveiled its “12 principles” for Brexit in its white paper, including a commitment to gaining control over migration and seeking a new trade agreement with the EU. From these plans it would seem construction is significantly at odds with the current direction of the government. However, the white paper did indicate that the new system to control migration from the EU could be phased to allow businesses time to prepare. It also said the system would set out to help fill skills shortages.

This will be of some comfort to the survey’s respondents, 87% of whom said construction should have similar assurances to those given by ministers to the agriculture sector – namely, that agriculture would “have the right people with the right skills” post Brexit.

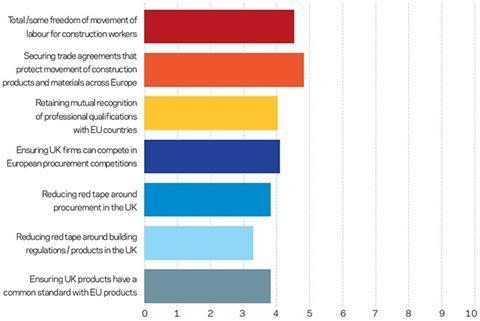

The clear priorities identified by the respondents for the final Brexit deal are free movement of labour for construction workers and securing trade agreements for products – 44% gave these the two highest ratings of importance, on a scale of 1 to 7, above other issues such as retaining recognition of professional qualifications or reducing red tape.

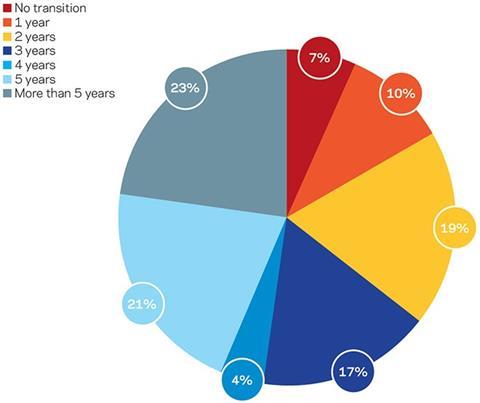

The survey also revealed a desire to phase Brexit in slowly, with 43% saying the transitional period should be five years or over, and 38% saying it should be 2-4 years. Commenting on the survey results, Simon Rawlinson, head of insight at consultant Arcadis, points out that an extended transition period in excess of two years clearly places the industry at odds with indications that the government’s preference is for a clean break. He says: “The implications for the industry of a poorly designed transition could be significant – with scarce labour resources and perhaps higher costs crimping both demand for construction and the ability to deliver.”

Steve Beechey, group strategy director and managing director for government affairs at Wates, also understands respondents’ concerns about the timeframe for Brexit. He says: “We do have concerns that the government will be able to negotiate favourable terms within the two years. This is a complex negotiation in unchartered waters and it introduces significant risks for contractors. This uncertainty is very damaging for businesses in a low margin market like construction where risks need to be very carefully managed with no margin for error.”

Staying green

A more unexpected finding from the survey was the extent to which our readers are concerned about the impact Brexit could have on the green agenda. While the survey did not specifically ask about sustainability, when given the opportunity to suggest other issues facing the industry post the Brexit vote we received a high proportion of pleas to ensure environmental regulations be maintained.

This respondent’s comments are typical: “I am concerned that there will be strong push for a bonfire of regulations which will lead to sustainability being sacrificed, pulling the construction industry into a race to the bottom and the creation of a rash of unsustainable, cheap buildings that we will regret building in years to come.”

A smaller number of responses, however, went the opposite way, favouring reduced regulation around sustainability.

Other suggestions were more unusual, such as the idea of providing university fees dispensations for those going into construction – along the lines of the Teach First programme for training teachers in the public sector. Another respondent put forward the idea of the compulsory purchase of brownfield sites that had not been active for 10 years to be government financed and given over to social housebuilding.

While these ideas are unlikely to gain immediate traction at government level, they point to an industry willing to accept Brexit as a reality and keen to look for opportunities to improve construction’s ability to deliver what the country needs once it has left the EU.

Below ∫⁄∂¥…Á«¯ outlines the headline results and asks industry experts for their views on the findings and their implications.

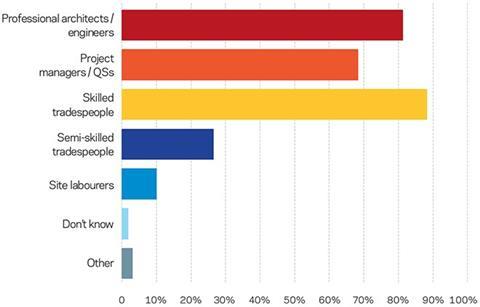

Views on migration

A clear majority of respondents, 84%, said some or all construction workers should have free movement under the final Brexit deal. Architects and consultants were the most positive about migration, 63% of architects wanted free movement for all construction workers (23% wanted it for some workers) while 50% of consultants wanted the full freedom (35% for some workers). Subcontractors were the least keen, with only 40% in favour of free movement for all construction workers, although 36% of them said they favoured free movement for some workers.

Only 13% of all respondents did not favour any movement of workers, with this view held most strongly among respondents working for companies with a turnover under £5m.

The reasons for construction’s broadly pro-migration stance is obvious. According to our survey, 34% of respondents estimated that EU nationals make up 25% or more of their business’ workforce. Moreover, Mark Farmer in his report on the state of the industry predicted a 25% decline in available labour over the next decade due to older workers retiring and the difficulty the industry has in attracting young recruits. The result, inevitably, is rising labour costs.

According to Noble Francis, economics director at the Construction Products Association (CPA), a “hard” Brexit can only make the situation worse. “There are already skills shortages in many parts of the industry and these would be exacerbated considerably by any constraints on labour flows, particularly for skilled workers that take a long time to train – longer than we have to leave the EU,” he says.

“Any obstacles to labour flows would have a financial and admin cost but 80% of construction employment is with small and medium-size firms, who are the least able to deal with these costs.”

However, Ann Bentley, chair of consultant Rider Levett Bucknall (RLB), says the debate about the free movement of all workers within the EU has moved on as far as the government is concerned. “Free movement isn’t going to happen; the industry needs to focus on the skills they definitely need and build up the indigenous workforce. Free movement is like asking for something that’s beyond the pale.”

Suzannah Nichol, chief executive at trade body Build UK, agrees that asking for open migration is not realistic and thinks the key is to be specific and provide the government with detailed information about high-priority skills. “It’s no good just shouting really loudly that we need tradespeople; we need to say which specific skills would grind the industry to a halt if we don’t have access to them,” she says.

Which categories of workers should be allowed freedom of movement in a final Brexit deal?

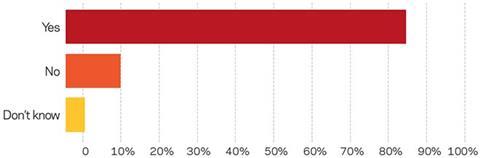

Views on skills agenda

The skills shortage was a clear concern among respondents. When asked: “Does there need to be a clearer plan for tackling skills shortages in the UK construction sector before any visa restrictions are brought in for construction workers?” 84% said yes. This concern was roughly the same across all the professional disciplines and the whole range of company sizes.

We cannot do it all at once [but] we now need to work on a consistent and joined-up training and qualifications structure

Suzannah Nichol, Build UK

Build UK’s Nichol understands why this is such a priority. The trade body’s members have reported difficulties recruiting British employees who have the right attitude and aptitude for labour-intensive occupations. And in a recent survey it carried out, 55% of contractors reported rising labour costs, with a lack of suitably qualified staff being a key factor. One area where she wants more clarity is over how the all sector apprenticeship levy will operate.

Nichol is optimistic, however, that the industry is addressing the issues around training and points to the CITB’s recent reforms to its levy as evidence that change is happening. “We cannot do it all at once, but the industry can take confidence in the changes at the CITB. We now need to work on a consistent and joined-up training and qualifications structure. But the industry can be comfortable that its views are being presented [to government] and there is work being done on the detail to help government to help us.”

Does there need to be a clearer plan for tackling skills shortages in the UK construction sector before any visa restrictions are brought in for construction workers?

Views on trade agreements

While 68% in the survey said the UK should be a full or partial member of the customs union, it seems, according to last week’s white paper, the government will seek a new agreement.

Switching from a customs union to a free trade agreement with the EU would mean no longer being subject to the common external tariffs imposed by the EU. Rebecca Larkin, senior economist at the CPA, points out the UK could, therefore, negotiate more favourable tariff deals with its largest non-EU market, China, for example. The UK would also be able to increase import tariffs to take a more protectionist stance on Chinese steel, for example, currently governed by the EU’s external tariff with China.

At the moment we are encouraged to import from the EU, so under Brexit we must now look to opportunities from other places like China

Ann Bentley, Rider Levett Bucknall

However, Larkin says: “UK products would also be subject to rules of origin checks and documentation, raising administrative costs and burdens for exporters and manufacturers involved in components import/export and assembly.”

When asked to rank priorities for the final Brexit deal, securing trade agreements that protect movement of construction products and materials across Europe came out as the issue of most importance to respondents. Wates’ Beechey says: “The trade agreements on building materials with our European trading partners are crucial in controlling construction cost inflation particularly with more complex projects using proprietary cladding systems and the like.”

RLB’s Bentley is more optimistic. She says: “At the moment we are encouraged to import from the EU, so under Brexit we must now look to opportunities from other places like China.” And while she acknowledges many in the industry are nervous about how favourable individual trade negotiations will be for the UK, she says “the biggest issue [caused by Brexit] is the exchange rate – the threat of tariffs is not so great compared with the exchange rate dropping 20% as it did”.

Rank the following in order of how important they are to you in the UK’s final Brexit deal, with 1 the most and 7 the least

The OJEU question

While only 25% of respondents felt Brexit offered an opportunity to simplify regulations, among those that back regulation reform the most popular target for reform were the OJEU rules governing public procurement.

Al Watson, partner at law firm Taylor Wessing, has some sympathy with this view. He points out that as the government is keen to show it is open for business, simplifying and making procurement easier is one way to make the UK more competitive. He says: “As OJEU is a long process, a series of hurdles designed to create a level playing field across Europe, once we are out [of the EU], we no longer need to use it.”

Watson goes further, suggesting the government should consult the private sector about its bidding processes, taking what works best and adapting it for public procurement. Such a change would mean putting a draft bill through parliament to set out the way public bodies carry out the contractual bidding process in order to make sure everyone was abiding by the same rules.

As OJEU is designed to create a level playing field across europe, once we are out [of the EU], we no longer need to use it

Al Watson, Taylor Wessing

Arcadis’ Rawlinson agrees Brexit could be seen as an opportunity to rethink procurement rules. He says: “Fixing procurement to enable the industry to invest in labour-saving innovation may in the long-run be the industry’s best option.”

Rebecca Rees, partner in Trowers & Hamlins’ projects and construction department, says one implication would be that UK clients “would be able to buy British”. She says that without OJEU “the only constraint would be from other trade deals with other countries and of course a trade deal with the EU”.

However, Rees cautions that the UK should look at the benefits it currently gains from some of the EU principles behind OJEU, such as not discriminating against any bidder on the basis of where they come from. “This principle also protects against regional favouritism, where, say, a public sector client in Scotland only awards contracts to builders from Scotland. Whereas when you look at best value, you would want a wider pool than that.” A return to regional favouritism could hamper competition, says Rees, and undermine the ability of nationwide firms to bid for contracts that they may be best placed to win.

Rees also points out that under any Brexit deal the government is very likely to want public bodies to abide by strict procurement rules, which exist to protect against corruption and collusion. One option, Rees says, if we do pull out of OJEU, would be to adopt the World Trade Organisation’s Government Procurement Agreement, which the UK is currently signed up to through the EU.

If the UK were to have a ‘hard Brexit’, with removal of all freedom of movement of labour, how long would be a sensible period for transitional labour arrangements for construction?

∫⁄∂¥…Á«¯ a Better Brexit ‚Äì What next?

The survey is a key part of this publication‚Äôs ∫⁄∂¥…Á«¯ a Better Brexit campaign, launched at the start of the year to highlight the particular needs of the construction industry, which contributes 6.5% of GDP, rising to 10% when product manufacture and services are included. In running this campaign, ∫⁄∂¥…Á«¯ is working with Lord Andrew Stunell, former minister for building regulations, to inform his review for the House of Lords into the implications of Brexit for construction.

In reaction to the huge response to the survey, Stunell said: ‚ÄúI am delighted so many readers of ∫⁄∂¥…Á«¯ have responded. It is time for the construction industry‚Äôs voice to be heard clearly by those who will be negotiating for us in Brussels, and this survey provides exactly the kind of practical evidence of what needs to be done if the government‚Äôs housing and infrastructure targets are to be met.‚Äù

We are sharing the findings with Lord Stunell,who will consider the results and feed them into his review. The government’s Brexit bill will reach the Lords for its second reading in late February. It would be unusual for there to be a vote at this point, but it will go on to committee stage and report stage in early March, when votes are likely.

Methodology

The survey was hosted on ∫⁄∂¥…Á«¯.co.uk for two weeks, in which time over 2,000 people registered their details. Of the survey respondents, consultants made up the biggest group, accounting for 36%, followed by contractors at 20%, architects 12%, clients 8%, subcontractors 6%, manufacturers 6% and the rest from other backgrounds. In terms of size of company that respondents work for, 35% have a turnover under ¬£5m, 24% have a ¬£5m-¬£49m turnover, 13% ¬£50m-¬£249m, 6% ¬£250m-¬£499m and 21% over ¬£500m. More survey results are online .

No comments yet