Bovis Homes recently set aside ┬Ż7m to deal with its torrent of snagging complaints from buyers of its properties - and itŌĆÖs not the only housebuilder criticised for selling unfinished and faulty homes. Are these firms being effectively held to account? Joey Gardiner reports

When Stephen Lupton bought a ┬Ż250,000 home at Little Stanion Farm, the developer Bovis claimed in its marketing ŌĆ£an enviable reputation for the quality of its buildŌĆØ, promising he would feel ŌĆ£the Bovis Homes differenceŌĆØ. But when he completed the purchase in December 2014, it turned out to be not the kind of difference he was looking for.

Needing boots to make his way through the mud-soaked site, he entered his home to find the wrong kitchen installed and bannisters not affixed properly. While Bovis initially worked hard and resolved these problems, those turned out to be simply the most obvious difficulties. After living in the house, Lupton, a QS himself, realised there were missing padstones in the kitchen and hall lintels when cracks started appearing in the walls; incorrectly installed air bricks, which stopped ventilation under the floor from working; and areas of missing insulation leading to cold spots.

Dealing with these problems, which have yet to be resolved, among many other more minor ones has, he says, turned into virtually another job. ŌĆ£ItŌĆÖs shockingly bad. It takes 10 hours a week of my time just to deal with. And you feel you donŌĆÖt live in your own house, because youŌĆÖre constantly waiting for works to happen, so you canŌĆÖt paint it,ŌĆØ he says.

Lupton, who has contracted shingles in recent months, puts part of the blame for his poor health on the increased stress he has suffered. ŌĆ£It affects your relationship, everything. WeŌĆÖre now locked in to living here ŌĆō we couldnŌĆÖt sell without these things sorted out without losing a huge amount. If I wasnŌĆÖt in the industry and able to understand it, I think IŌĆÖd have had a nervous breakdown.ŌĆØ

Unfortunately, LuptonŌĆÖs experience of buying a Bovis Home has become an increasingly familiar tale in recent months, a situation which ultimately cost former chief executive David Ritchie his job, as the builder tried and failed to rush through completion of 180 homes before the 2016 Christmas year end. But while tales of woe at the company have since abounded in the national press, there are many that maintain that this problem of housing construction quality runs deeper than one troubled major builder.

Last year an all-party parliamentary group led by Tory MP Oliver Colvile branded quality across the industry as ŌĆ£unacceptableŌĆØ and called for action from industry and government. But last month the latest survey of home purchasers, produced by the Home Builders Federation (HBF), found construction quality continuing to head downhill ŌĆō for the third year in a row. It found 98% of buyers now report snags and defects with their home, with a quarter of buyers reporting more than 16 problems to their builder.

However, some are now saying that the experience of Bovis ŌĆō one of the UKŌĆÖs biggest housebuilders ŌĆō and the rise of social media may have delivered a wake-up call to an industry that has neglected its core business. So, how big is the problem, and will the industry raise its game?

A wider problem

Three years ago, David Frise, chief executive of industry trade body the Finishes and Interiors Sector, wrote a series of columns for ║┌Č┤╔ńŪ° in a personal capacity about his experience of buying a new home from a major UK housebuilder. Today he is still battling the builder ŌĆō which is not Bovis Homes ŌĆō to get issues at the scheme rectified. He says these problems include a potentially dangerously mis-installed boiler and ill-fitting doors. He says his experience, like LuptonŌĆÖs with Bovis, is of dealing with a business that is completely deaf to all his pleas to resolve problems. ŌĆ£They have ignored everything IŌĆÖve raised,ŌĆØ he says. ŌĆ£Because IŌĆÖm in the construction industry I know IŌĆÖm right about these issues, but I donŌĆÖt recognise the complete lack of regard for customers from the industry I know.ŌĆØ

WhatŌĆÖs been allowed to happen is that lots of defects and incomplete works now get dressed up as a snagging list

Mark Farmer, Cast

The top line from the HBF home purchasers survey, which is actually conducted by the industryŌĆÖs warranty provider, the NHBC, is that 84% of consumers are, overall, happy with their purchase, which the HBF says puts housebuilding in line with other comparable industries. Following publication of the all-party parliamentary group report last year, the HBF set up a quality task force under Crest Nicholson chief executive Stephen Stone to drive industry improvement. And Bovis itself, which received a two-star rating (out of five) in the HBF survey following its performance last year, says it has now set aside ┬Ż7m for its own customer task force to deal with outstanding customer complaints, and initiated an ŌĆ£overhaulŌĆØ of its customer service function. Steve Turner, communications director at the HBF, denied quality in the industry was at an unacceptable level. ŌĆ£The overwhelming majority of new home buyers are happy with their new home. The percentage of cases where there are serious issues with new-build homes is very small.ŌĆØ

However, the detail of the HBF survey reveals a less rosy picture getting steadily worse. It shows 38% of people encountering more problems than they expected, and 41% experiencing more than 10 defects or snags, up from 28% in 2014. Even the top line figure of 84% satisfied, which is down from 90% three years ago, implies 15,500 unsatisfied customers each year, in an industry where the consequences of major problems on peopleŌĆÖs lives, according to the all-party parliamentary groupŌĆÖs Colvile, ŌĆ£can be devastatingŌĆØ.

Quantity vs quality

Neil Jefferson, managing director of the NHBC, says the worsening figures are down to rising output. ŌĆ£Volumes have doubled. The industry resourcing itself to do that has been a major part of this and itŌĆÖs where the stretch has been created.ŌĆØ Mark Farmer, founder of consultant Cast and author of the government-commissioned report on the future of construction, Modernise or Die, agrees there is an industry-wide correlation between increasing housing output and falling quality. ŌĆ£ItŌĆÖs a much-wider issue than Bovis,ŌĆØ he says. ŌĆ£The industry has got used to delivering at a quality that doesnŌĆÖt bear comparison to sectors like automotive or hospitality.ŌĆØ

Farmer puts this down in part to the quality of staff being diluted as output has risen, but also a failure of the system of site supervision of construction, and a gradual erosion of what is meant in the industry by the term practical completion. ŌĆ£ThereŌĆÖs been a corruption over time. WhatŌĆÖs been allowed to happen is that lots of defects and incomplete works now get dressed up as a snagging list,ŌĆØ he says.

Until Bovis received a two-star rating this year, the company ratings in the HBF customer survey have generally shown little differentiation between those firms that have a reputation within the industy for focusing on build quality and others that donŌĆÖt, giving little incentive for housebuilders to invest in this area. At the same time both the government and shareholders have put builders under pressure to expand quickly and bring in more money. David Birkbeck, chief executive of Design for Homes, says: ŌĆ£Unfortunately, the City undermines quality. Analysts promote companies that squeeze build costs and pay suppliers slowly. They challenge those trying to develop a brand based on better quality of build and design, like Barratt, which has to defend its model of trying to sell a home with fewer defects and better street scenes for a premium.ŌĆØ

Hence, he claims ŌĆ£industry insiders would never allow their friends and family to buy from most builders top rated by the CityŌĆØ.

Complaints

But it is not just the volume of defects and problems, but buildersŌĆÖ response when problems are unearthed, and the means of redress for the consumer which is now under scrutiny. Evidence submitted to the all-party parliamentary group by one consumer who claimed to have been fighting a legal battle over defects in his new home for 17 years, described his threefold realisation once his complaint had been tabled. Stephen Watkins said: ŌĆ£The first [realisation] is that the builder intends to deny the defect and negotiate about it instead of putting it right,ŌĆØ he said. ŌĆ£The second is that the builder is practised and skilled in such negotiation. The third is that a whole host of technicalities surround that negotiation and that the builder and his experts fully understand those technicalities whilst consumers do not.ŌĆØ

ItŌĆÖs shockingly bad. It takes 10 hours a week of my time just to deal with

Stephen Lupton, Bovis home owner

The HBFŌĆÖs Turner completely denies this characterisation, saying: ŌĆ£In all the cases we see, housebuilders or the warranty provider are looking to work with the homeowner to resolve issues, as is their responsibility.ŌĆØ Nevertheless, Paula Higgins, chief executive of pressure group the HomeOwners Alliance, says: ŌĆ£What is shocking is the real lack of consumer protection and real lack of checks and balances in the system.ŌĆØ

This consumer fear about the odds being stacked in favour of the builder, has driven growing concern over the effectiveness of the main 10-year warranty provision for new homes, undertaken by the NHBC. The NHBC, which was born out of the major housebuilders but now claims to be independent from them, steps in if housebuyers and housebuilders canŌĆÖt resolve issues raised in the first two years after purchase, and thereafter acts as insurer for major structural problems. Many see the NHBCŌĆÖs relationship with the housebuilders as a conflict of interest, and both Frise and Lupton claim it has done little to help in their cases ŌĆō to which the NHBC responded by saying the organisation was sorry when new home owners experienced problems. A spokesperson said: ŌĆ£In both of these cases we are working to help resolve the issues as swiftly as possible and make sure that any necessary remedial works are carried out.ŌĆØ

The all-party parliamentary group report called for a full review of both consumer rights when buying new homes and of existing warranties, which it said ŌĆ£did not match the expectations of the consumerŌĆØ. It also called for the setting up of an independent new housing ombudsman to put pressure on both housebuilders and warranty providers, replacing the dispute resolution service offered under the industry-devised Consumer Code for Home Builders.

However, while the NHBCŌĆÖs Jefferson admits there may be a perception problem, he denies any real conflict of interest, pointing to the fact the NHBC finds in favour of the homebuyer in 70% of disputes taken to it. ŌĆ£WeŌĆÖre independent of the government and industry. ItŌĆÖs in our interest that builders build better, and I regularly have difficult conversations with senior people at builders to get them to sort things out.ŌĆØ The HBFŌĆÖs Turner says an ombudsman is not needed, because its function is already covered by the consumer code, with the majority of disputes already resolved in favour of the homeowner. However, Jefferson says NHBC would be ŌĆ£interested to work with specific proposalsŌĆØ for a new housing ombudsman, though he maintains the industry is already starting to improve of its own accord.

Bad publicity

If the sector is now focused on self-improvement, then the experience of Bovis is driving it, at least in part. Cenkos analyst Kevin Cammack says the volume of negative coverage of the firm is almost akin to the infamous World in Action investigation into vulnerabilities of BarrattŌĆÖs timber frame systems to rot and fire ŌĆō after which Barratt took ŌĆ£three years and a management changeŌĆØ to recover. ŌĆ£The brand of housebuilders is becoming more and more important, and Bovis is now the poster-child for these kind of problems,ŌĆØ he says.

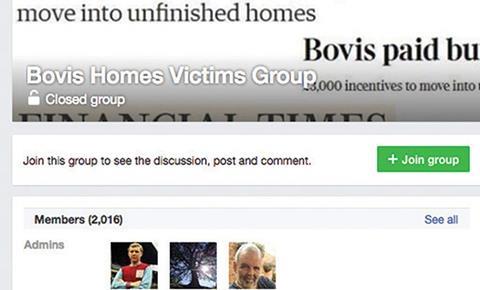

BovisŌĆÖ construction delays were serious enough to prompt a profit warning, but this financial hit was compounded by the tales in national newspapers of unhappy consumers, derived by journalists from a Facebook group, entitled Bovis Homes Victims Group, with more than 2,000 members. The groupŌĆÖs administrator Helen Bonner says that despite improvements since the departure of David Ritchie, members of the group are still planning to protest at the firmŌĆÖs AGM in May.

CastŌĆÖs Farmer says this potential provided by social media to marshal discontent and propel it straight into the public domain is now forcing firms to take build quality seriously. ŌĆ£TheyŌĆÖve seen in the last three months what can happen if they donŌĆÖt get to the bottom of the quality issue ŌĆō it could have been any one of them. This fear of reputational damage will drive improvement.

ŌĆ£ItŌĆÖs the bringing in of this culture of consumerism, the TripAdvisor effect, the immediate ability to rank providers that is going to come into this big housebuilder world,ŌĆØ he says.

Unsurprisingly, the HomeOwners AllianceŌĆÖs Higgins says she is working to set up exactly such a thing, where prospective homebuyers can see all developers rated by the average number of snags buyers experience. CenkosŌĆÖ Cammack says: ŌĆ£No doubt the housebuilders are starting to put far more credence on their [HBF] star [quality] rating.ŌĆØ The NHBCŌĆÖs Jefferson agrees: ŌĆ£In the past itŌĆÖs been disappointing to see the lack of interest from some [City] analysts to these quality issues. But increasingly weŌĆÖre getting questions from analysts on this topic.ŌĆØ

Nevertheless, the evidence suggest that if things are to get better, there is in some cases still a long way to go.

2 Readers' comments