The government has pledged to require all commercial non-domestic buildings to achieve an EPC B rating by 2030. What does that mean for LondonŌĆÖs commercial real estate? What work might be required and how much could it cost? Turner & Townsend Alinea, Arup and Capital Real Estate Partners investigate

01 / The scale of the challenge

The Minimum Energy Efficiency Standards (MEES) have been in force since 2018 and to date have required buildings to attain at least an E rating before they can be let to new tenants. From April this year, the rule applies to existing tenancies.

Data from the Department for Levelling Up, Housing and Communities reveals that 70% of office space in the City of London currently has an EPC rating of less than B. This essentially means that 75 million ft2 of space will need upgrading over the next seven years. The table below shows that the story is similar across the rest of London.

Table 1: London office space below B

| Office space (million ft2) | EPC rating of less than B | |

|---|---|---|

| City of London | 108 | 70% |

| Westminster | 97 | 73% |

| Tower Hamlets* | 54 | 82% |

| Hackney | 16 | 67% |

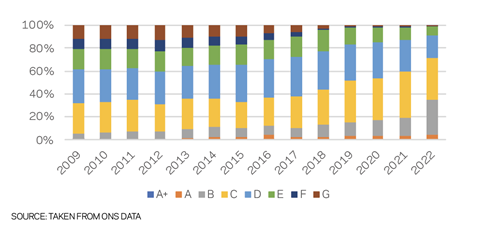

The EPC rating of non-domestic buildings across all of central London has shown incremental improvement as the MEES has tightened its requirements over time. Figure 1 clearly shows the near abolition of EPC F and G rated space; however, it also reveals a large number of C and D rated buildings.

The number of properties requiring an upgrade is sizeable, but it is difficult to accurately judge the true scale of the workload. For example, some older commercial buildings are likely to have halogen bulbs or fluorescent strip lighting, so the easy retrofit of LED lighting upgrading might help achieve a higher EPC rating. However, to achieve a B (or higher) rating, more significant issues will probably need to be addressed, such as the external fabric or heating systems.

Figure 1: EPC ratings in non-domestic buildings in London, 2009 to 2022

These more intrusive works may trigger the need to end leases and bring forward substantial refurbishment, potentially earlier than would otherwise have been planned.

Central London office stock totals in the order of 250 million ft2. The impact of hybrid working is likely to reduce this requirement over the short to medium term: estimates vary, but perhaps by up to 20%, leaving around 200 million ft2 of active space. If, say, 50% of the remaining space requires some form of EPC-driven upgrade, then that would imply an upgrade requirement of on average 14 million ft2 a year before 2030. While not all this work will trigger the need for substantial refurbishment, it is reasonable to assume that a significant proportion may do.

Given that each year in central London the construction market produces 5 million ft2 of new or substantially refurbished office space, meeting the 2030 target could be a challenge for the market (to say the least), raising doubt over the supply chainŌĆÖs ability to absorb that amount of work, not to mention its potential impact on prices.

There are real concerns that the investment required for many buildings could be too high to achieve a seven-year payback period. Inaction could leave assets stranded as tenants may not wish ŌĆō or will become unable ŌĆō to occupy operationally inefficient buildings, especially as the overall building quality benchmark will have improved in response to ever higher ESG ambitions.

The tightened MEES requirement could act as a market leveller, for in a world of EPC B buildings, how does a landlord differentiate its space from that of others? In reality, there is already recognition, including by the government, that EPC ratings serve only as an indicator of potential performance and do not accurately reflect actual energy use, so attention is turning to rating methodologies that better reflect the actual use of energy, or at least using EPC ratings alongside other assessments.

Energy performance certificates explained

What are EPCs?

Much like the stickers on new home appliances, energy performance certificates (EPCs) indicate a buildingŌĆÖs energy efficiency by rating it from A+ (very efficient) to G (inefficient). An EPC certificate must be obtained from an approved commercial energy assessor.

What is the legislative background?

Minimum energy efficiency standards (MEES) legislation for commercial rented property relates to the Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015 (the PRS regulations), which stem from the Energy Act 2011. The key aim of the regulations, recently confirmed in the governmentŌĆÖs energy white paper published in December 2020, is for all rented non-domestic buildings in England and Wales to reach EPC B by 2030, where ŌĆ£cost effectiveŌĆØ (meeting relevant criteria, in other words).

Since April 2018, subject to certain exemptions, it has been a legal requirement under the MEES regulations that a commercial building must have an EPC rating of at least E before a new lease is established or an existing lease is renewed. From April this year, this requirement extends to existing leases.

Government consultations

In 2021 the government issued two consultations on energy efficiency. The first consultation considered a performance-based policy framework in large commercial and industrial buildings in England and Wales above 1,000m2 (10,760ft2).

In the first consultation, the government highlighted that 7% of commercial and industrial buildings are larger than 1,000m2 and they use 53% of all the energy used by commercial and industrial buildings. While an EPC measures a buildingŌĆÖs potential efficiency, it does not measure the actual energy consumed or the carbon emitted. This depends on how a building is managed and used; a high EPC rating alone is therefore no guarantee that it will use less energy.

The consultation paper sets out government plans to introduce a performance-based energy assessment to sit alongside EPCs and which might be similar to NABERS (the National Australian Built Environment Rating Scheme) in requiring an annual submission of energy use data.

The second consultation considers a framework to improve the implementation and enforcement of the EPC B target by 2030 for privately rented non-domestic buildings. This builds on a similar consultation that was published in 2019. The second consultation considers an interim milestone of EPC C in 2027 to ensure early action is taken by the market, as well as a compliance window approach designed to simplify compliance and enforcement.

Formal responses by property industry bodies to the consultation have been generally supportive of the EPC B target by 2030. However, the Better ║┌Č┤╔ńŪ°s Partnership (BBP), the RICS and the UK Green ║┌Č┤╔ńŪ° Council (UKGBC) have flagged concerns with the practicalities of implementing the EPC C interim milestone.

The BBP and the British Property Federation (BPF) both suggested the need for measures to address actual operational energy performance. There were also concerns from some about buildings becoming unnecessarily stranded assets.

At the time of the consultations, it was anticipated that the government would publish responses in late 2021, and lay out regulations to amend the PRS regulations which are due to come into force on 1 April 2025. To date no government responses have been published, raising doubts about whether it will be realistic to impose an interim milestone for 2027.

02 / Effect on property values

The risk of stranded assets

The risk of stranded assets has been a point of increasing concern in the context of a low carbon agenda. The market is complicated by simultaneous changes in priorities stemming from the post-covid workplace. Investors and occupiers are increasingly stock-selective, with carbon and energy performance representing key selection criteria, alongside factors such as transport links, amenity and wellness. Assets are threatened not just by their carbon or energy credentials, but also by increasingly stringent location and quality criteria in a market that in future is likely to need less overall space, but better space.

The perspective of clients and funders

The environmental facet of ESG is rapidly becoming one of the keys to financial performance, and investor strategy has no option but to shift towards efficient buildings. Along with EPC legislation, there is increasing awareness of building environmental performance among occupiers and clients as well as a desire for more efficient use of space (in both energy and floorspace terms).

Prior to the pandemic, low carbon, energy-efficient investments were only loosely associated with increased rents and values, seen instead as a function of institutional or property fund ESG ambitions, or to provide the impetus for a new product which could attract a specific type of investor or occupier. ESG targets were ingrained into most large institutional investorsŌĆÖ strategies primarily to align with their own corporate values and those of their investors.

The move to legislate for efficient buildings now makes developing them a much clearer business driver for all clients and funders.

The value of a commercial building is generally based on its ability to generate a rental income, and the EPC legislation will increasingly lead to significant financial underperformance of buildings with poor EPC ratings, with a reduction in asset price to reflect the costs of upgrading to a compliant rating. In some instances, the pricing can be expected to reduce significantly as it is effectively a stranded asset. If a building is heavily multi-let, retrofitting it in order to achieve the necessary EPC would be severely hindered without vacant possession.

For investors, legislation and occupier awareness will encourage extra investment in refurbishments and developments to improve environmental performance, with confidence that they can recover their additional costs in higher rents.

How do occupiers see it?

Many occupiers have become less price-sensitive for the right building, as they seek to attract their staff back into the office post covid and to embellish their ESG credentials. Increases to hybrid working are putting a premium on highŌĆæquality and well-located space as employers seek to make coming into the office as attractive as possible. This is evidenced by City rents reaching record levels for the best spaces despite vacancy rates overall being significantly above the long-term average.

A high-quality workspace is increasingly synonymous with strong environmental credentials. Larger tenants in particular are demonstrating similar priorities to larger, institutional-style investors, whereby prioritising ESG considerations is an increasingly important part of their internal and external brand identity. This seems to have been accelerated by the covid-19 pandemic, as it encouraged more focus on how wellness is impacted by the environment, particularly for LondonŌĆÖs young workforce ŌĆō and approximately 63% of the CityŌĆÖs workforce are in the 20-39 age bracket, according to the 2011 census.

03 / Future legislative developments

To date, much of the focus for buildings has been on carbon credentials for in-use performance. In London, the planning system is increasingly focused on a whole-life carbon and energy assessment of proposed schemes which considers the energy used to refurbish and redevelop ŌĆō that is, embodied carbon ŌĆō as well as to run the building.

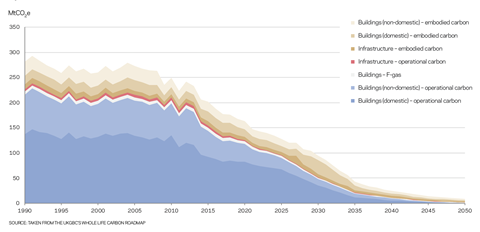

The UK Green ║┌Č┤╔ńŪ° CouncilŌĆÖs roadmap shows that if the government achieves its plan to decarbonise the power grid by 2035, beyond that the ability to achieve net zero by 2050 brings the reduction of embodied carbon into much sharper focus, and the planning system to increasingly favour refurbishment as opposed to new-build where feasible.

Figure 2: UK built environment emissions 1990-2050

04 / Is EPC compliance the complete answer?

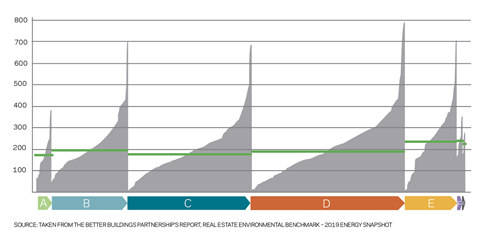

Some suggest EPCs do not provide a good indication of a buildingŌĆÖs actual energy performance. In 2019 the Better ║┌Č┤╔ńŪ°s Partnership produced a report that provided a snapshot of real energy performance of a range of building types. Crucially, it used real data, collected from members, which highlighted the lack of correlation between a buildingŌĆÖs actual energy usage and its EPC rating. The report was clear that ŌĆ£EPCs are not an indicator of operational energy use and a continuous ratcheting up of design ratings will not be an adequate policy tool to achieve the UK governmentŌĆÖs energy reduction targetsŌĆØ. The 2019 report showed that actual energy consumption can be significantly higher (and lower) than the energy rating suggested.

Figure 3 compares the energy intensities for offices with the EPC ratings for those properties. The grey bars represent a single officeŌĆÖs energy intensity over the course of a year. They are then grouped by their EPC rating. The green horizontal line represents the median value of each EPC group.

Figure 3: Office energy intensities 2018/19

While MEES aims to ramp up the EPC rating requirements to B by 2030, the findings of the BBPŌĆÖs report make it clear that this on its own will not be an effective policy lever for achieving genuine operational energy improvements. In fairness to EPCs, their primary purpose was to be a guiding measure of the quality of a buildingŌĆÖs fabric and the efficiency of its services, not an indication of how well run or operated a building is. At best they might indicate how efficient a building could be compared with others.

The governmentŌĆÖs analysis, cited in the 2021 consultation on introducing a performance-based policy framework, was that EPCs have helped drive improvements in buildings over the last decade. This is a positive message but, for building owners and occupiers seeking to reduce operational carbon emissions in their properties, it should be made clear that they cannot rely solely on a good EPC rating as a definitive determiner of good energy performance.

The governmentŌĆÖs 2021 consultation set out the ambition and sought views from the industry on the proposal to align building energy ratings with actual operational performance and to require these ratings to improve over time to meet the UKŌĆÖs climate targets. The proposals are built on and propose going further than the NABERS system, which is already being used to rate buildings in the UK, having been developed from the world-leading Australian system.

05 / Design interventions

As so many of todayŌĆÖs buildings will exist in 2030 when EPC B is expected to be the minimum standard, the focus of delivering measures that improve the energy performance of existing buildings is a key challenge if we are to achieve meaningful reductions in carbon emissions across the sector. The UKGBC suggests that 80% of the buildings in existence in 2050 have already been built.

Developing new buildings with low energy consumption is necessary, though well-designed and commissioned new-builds will further highlight the difference in performance and quality between the leading performers and those lagging behind.

For the office sector in particular, a key consideration in delivering impactful improvements is how these can be delivered without inconvenience to occupiers. Interventions aimed at reducing demand or energy usage must be developed and planned within the constraints of existing leases.

>>>Also read: NABERS: the energy ratings system that goes further than Part L

>>>Also read: ŌĆśWar effortŌĆÖ mobilisation needed to improve UK energy efficiency, says watchdog committee

Increasingly, construction projects are being carefully planned and programmed based on the ease of upgrade interventions. These are considered alongside their potential energy reductions, costs and, more recently, embodied carbon emissions, as part of a whole-life carbon approach.

Understanding lease periods is a key part of planning robust preventative maintenance schedules and other capital improvements. Many building owners are developing decarbonisation plans that appraise the practical delivery of measures in as much detail as the potential energy savings. These define an agreed performance end-point, which is then planned for through delivery in phases, often over a number of years, and prioritises the lowestŌĆæimpact measures so that tangible progress in reducing energy and emissions can be made quickly.

Low-disruption interventions

Many low-impact and low-cost interventions can be realised through ŌĆ£tuningŌĆØ buildings. This often involves carrying out rapid audits that assess the functionality of existing sensors and control systems. This approach can often deliver operational savings of between 10% and 15% without incurring significant capital expenditure or disruption.

Other low-impact measures include engaging with tenants on behavioural changes in how they operate and function within their space. This relies heavily on the existing design features of a building, measures such as night purging of spaces, better utilisation of opening windows for natural ventilation or effective mixedŌĆæmode ventilation.

The next level of interventions might include upgrades to fixed services such as lighting or the introduction of new or improved control devices or features which facilitate more efficient operation.

Measures within tenanted areas can be planned in conjunction with tenants, who are often keen to engage in delivering measures that help reduce their own carbon emissions and energy usage. This engagement is increasingly sought by occupiers, particularly larger organisations to enable KPIs or other corporate targets to be met.

Significant interventions

More significant interventions can still be delivered without vacant possession of all parts of a building. The electrification of heating systems, often by replacing gas or oil boilers with heat pump systems, can be completed without significant disruption to occupiers. However, this often requires specific solutions to be developed in response to the constraints and opportunities of individual buildings and the people who use them.

Electrification of heating is also often one of the most impactful measures and is high on the list for many organisations that want to reduce their dependence on fossil fuels.

Other central plant upgrades are often best planned to align with scheduled maintenance programmes, although there are also certain circumstances where combining several measures together can be complementary from a technical and cost perspective. Required upgrades to distribution systems such as pumps might be brought forward to align with a heat electrification project, enabling the latter and sharing costs more effectively.

║┌Č┤╔ńŪ° fabric considerations

Many of the measures discussed so far focus on reducing energy demand or improving the efficiency of building systems. Improvements to the building fabric can be harder to deliver around sitting tenants and are often better suited to more major refurbishment work when a building is empty.

For some buildings with large roof areas, improving roof insulation can be used to reduce U-values and help reduce heating and cooling demand with very limited tenant impact, as this is generally carried out without interference to workspaces. Understanding constraints around roof plant and tenant plant areas is important in determining the practicalities of such measures. Glazing replacement can enhance the appearance of a building, and a higher specification of glass can provide improved solar control, reduced heat loss and the opportunity to naturally ventilate spaces.

It is critical that the path to delivery is considered at an early stage. Theoretical savings based on high-level studies can qualify what is possible and what the funding requirements are. ║┌Č┤╔ńŪ° owners need to be fully informed on how interventions at different scales will impact the letting and occupation of a building. There needs to be a full understanding of costs (and expected future savings), whole-life carbon impacts and how the works will affect occupiers.

This analysis will vary dramatically between different buildings, depending on the insitu plant, the building fabric and how the building is occupied. A rigorous building-specific and technical approach is needed to optimise the use of energy-saving and enhanced sustainability measures if real energy and carbon reductions are to be delivered.

06 / In summary

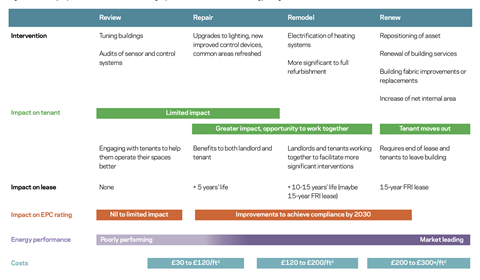

Figure 4 summarises the spectrum of works that a landlord might consider from ŌĆ£reviewŌĆØ to ŌĆ£renewŌĆØ. As described above, the ŌĆ£reviewŌĆØ stage is more about retuning a buildingŌĆÖs existing equipment or improving tenant education on how best to use the building. This may achieve energy savings with only limited capital cost. It is, though, unlikely to improve the EPC rating as nothing is being changed. The ŌĆ£repairŌĆØ and ŌĆ£remodelŌĆØ categories assume working with existing tenants to make changes to a building to address EPC levels as well as energy performance.

Figure 4: Summary of possible interventions considering impacts on tenants, leases, EPC/energy ratings and construction costs

Dealing with the fabric of a building (the facade and roof) is much harder with tenants in situ. Lease events therefore provide the opportunity for much more significant ŌĆ£renewalŌĆØ work than that and may go well beyond the requirements mandated by EPC legislation, often adding additional office space to help fund the works. Planned lease events that are due to occur before 2030 give the landlord the opportunity to comply with EPC legislation but may still bring forward significant expenditure which may not have been previously anticipated.

The EPC or energy improvements to be achieved and hence the cost involved in carrying out improvement or upgrade works is very much dependent upon the age, specification, condition and complexity of the individual buildings.

The chart below provides broad bands of cost for the categories from repair to renew, but obtaining actual costs to achieve incremental EPC improvements requires more detailed consideration of individual buildings, an issue with which landlords with a portfolio of buildings are currently having to wrestle.

07 / What next?

EPC legislation will naturally run its course, hopefully reflecting consultation responses and, crucially, timescales that are feasible for owners and realistic for the UK construction supply chain to implement.

The MEES legislation is founded on admirable principles ŌĆō anything that encourages reduced energy use and lower carbon emissions must be applauded. However, the fact that EPCs do not measure the actual energy performance of a building raises the importance of appreciating performance gaps, which further guidance will look to address.

The volumes of legislation and guidance in existence mean getting to the right answer is already often a bit of a minefield for building owners, tenants and designers. Any prompt for building owners to undertake actual energy measurements is welcome, but it is to be hoped that some consolidation of guidance will be available soon. This is necessary given the imperative to resolve energy issues generally as well as the potential for waste in (under- or over-) designing and upgrading buildings.

Despite these challenges, it is positive that the various facets of a sustainable building are being brought to the fore, together with methodologies for assessment ŌĆō and just as positive that the financials of building ownership and development recognise the value of a ŌĆ£flight from carbonŌĆØ.

Acknowledgments

Turner & Townsend AlineaŌĆÖs Michael Cracknell, Steve Watts and Rachel Coleman, ArupŌĆÖs Michael Edwards and Capital Real Estate PartnersŌĆÖ Mark Ridley all contributed to this article.

No comments yet