The Structures and ∫⁄∂¥…Á«¯s Allowance was introduced a few years ago to extend tax relief from plant and machinery to cover other parts of a non-residential building or structure. It offers significant benefits, but can be burdensome to adminster. Tim Jackson of Aecom explains how it all works

01 / Introduction

There are a variety of tax reliefs and credits that can help property owners and occupiers mitigate expenditure on their buildings. The most recent to be introduced is the Structures and ∫⁄∂¥…Á«¯s Allowance (SBA), which arrived in the autumn Budget of 2018 and is applicable to contracts entered into from 29 October 2018.

Prior to the introduction of SBA, tax relief for building construction was usually limited to expenditure on plant or machinery, such as electrical and mechanical services installations, lifts, escalators, fire-fighting equipment, sanitary installations, telecommunications equipment and various other fixtures and fittings.

As items considered to be part of a building or structure do not ordinarily qualify as plant or machinery, the introduction of SBA is a welcome addition, intended to fill the gap in the capital allowances regime for other parts of non-residential real estate assets, and has been promoted as offering a significant benefit to property owners and occupiers.

However, while SBA does offer value, it also presents claimants with considerable compliance and administrative burdens. This article will outline the practicalities of claiming SBA, together with highlighting some of the challenges claimants may encounter. All statutory references within this article are to the Capital Allowances Act 2001, unless otherwise stated.

02 / How does the Structures and ∫⁄∂¥…Á«¯s Allowance work?

The SBA offers relief at 3% per annum (2% before April 2020) on a straight-line basis over 33.3 years. While it is not as generous as the faster-depreciating rates for plant and machinery, it should be noted that the expenditure qualifying for SBA will often represent the largest part of the expenditure incurred on a non-residential building and will also become a more significant proportion of the total annual allowances the longer the asset is held. It is therefore important that stakeholders understand the benefits of SBA as well as the practicalities in the administration of the relief.

The SBA can be claimed from the date when the completed building or structure (or relevant part) is brought into qualifying (non-residential) use. The value of SBA will be based on qualifying construction expenditure.

Qualifying expenditure

Qualifying SBA expenditure can include:

- Construction works

- Renovation, repair and conversion works

- Site preparation works

- Fitting-out works

- Design and other relevant professional fees

- Landlord contributions towards tenants’ fitting-out works.

The works must have been contracted on or after 29 October 2018. If any part of the works, such as demolition or site preparation, was contracted before then, the works in their entirety may be deemed non-qualifying for SBA. Earlier letters of intent might also compromise the availability of SBA, as could earlier development phases of more complex schemes. This is because SBA was intended to stimulate development activity with the decision to proceed taken after the autumn Budget 2018.

Qualifying expenditure for SBA does not include:

- The acquisition or alteration of land, including land remediation

- The provision of plant or machinery

- Any expenditure that is above the normal market rate for the works

- Planning fees and related costs

- Land acquisition fees, stamp duty land tax (SDLT) or devolved equivalent, or any incidental land acquisition costs

- Landscaping, other than to create a structure.

Date of first qualifying use

The point from which SBA can be claimed (and the commencement of the tax life) is dependent on either the date that the asset is brought into non-residential use or the date the expenditure is incurred on the asset.

The date that an asset is brought into (non-residential) use is relatively straightforward, as it will generally be physical use in the case of a trade or economic use in the case of a property business. The date that expenditure is incurred, however, is less straightforward as the taxpayer has various options when choosing which is applicable.

In summary, the date of expenditure for SBA can be defined as follows:

- Expenditure that is incurred before use – the date of expenditure is the date of use, because SBA is not available before that date (under section 270AA(2)(b)).

- Expenditure that is incurred after use – the date of expenditure is dependent on the chosen option (under section 270AA(2)(b) or section 270BB(3))

For expenditure incurred under section 270AA(2)(b), the date of expenditure will be the actual expenditure, with each payment date having its own separate tax life.

Where expenditure is incurred under section 270BB(3), this simplifies the option of section 270AA(2)(b) by grouping together several payments under one date and one tax life.

This option in turn consists of three sub-options to treat expenditure as incurred:

(a) on the date of the last payment;

(b) on the first day of the financial year (chargeable period) following the date of the last payment; or

(c) for payments within a chargeable period, on the first day of the following chargeable period.

It should be noted that options (a) and (b) above will result in one date only but option (c) could result in several dates depending on the number of years spanned by the payments, a likely scenario for more lengthy projects.

Proportionate adjustment

As SBA is only available from the later of the date of expenditure or date of first non-residential use, a time-apportionment will be necessary, unless the date happens to fall on the first day of the chargeable period.

However, if the building or structure falls into disuse after it has been brought into non-residential use, it is treated as remaining in non-residential use.

Allowance statement

In order to claim SBA, the current owner of the relevant interest in the building or structure must be able to provide evidence of the construction expenditure, otherwise the expenditure will be treated as nil. The evidence must be in the form of an “allowance statement”, consisting of a written statement that identifies the relevant building or structure and sets out the following information:

- The date of the earliest contract for the construction of the building or structure

- The amount of qualifying expenditure incurred on its construction or purchase

- The date on which the building or structure is first brought into non‚Äëresidential use.

Crucially, the allowance statement must be made by the person who incurred the qualifying expenditure on the construction or original purchase of the building or structure. If no allowance statement is prepared, a future owner of the relevant interest will be unable to claim the relief.

It will become good practice for the person who incurs qualifying expenditure to create an allowance statement when the expenditure has been finalised and to pass this (or a copy) to the new owner when the asset is sold. The necessity for a paper trail already exists in the capital allowances legislation, and it is expected that the allowance statement will become a readily accepted part of the purchase process along with the established currency of section 198 elections for plant and machinery fixtures.

This will also apply to developers, whose construction costs will represent the qualifying expenditure if the building or structure is sold after it has been brought into use. This would avoid the situation where the developer is requested by the buyer or a subsequent owner to provide construction cost information at a later date when such information is not as readily available. This could be many years in the future, by which time the original parties might no longer be active or contactable.

In fact, unless the seller is the developer who is selling the asset unused, it is advisable for buyers to make the provision of an allowance statement a pre-contract condition.

The case studies overleaf illustrate how the qualifying expenditure and date(s) of first use are established in a number of scenarios.

03 / Buying and selling

When qualifying expenditure has been incurred for SBA and the property is sold, the seller is no longer able to claim SBA and the new owner may continue to claim the balance of allowances, irrespective of whether any prior claim has been made. The qualifying expenditure is tied to the relevant interest in land in the building or structure held by the person who incurred the original expenditure. Therefore, if the qualifying expenditure was incurred by the owner of a 90-year lease, the SBA will be tied to that leasehold interest. The buyer of the freehold interest would not acquire the right to claim SBA unless also acquiring the leasehold.

The allowances flow naturally with changes of ownership during the tax life, passing automatically across to buyers without balancing adjustments or the need for specialist tax elections, unlike the treatment of plant and machinery fixtures. This prevents the double-claiming of allowances.

Qualifying expenditure for the new owner will be based on the original construction cost of the building where it is already in non-residential use. Where the purchase relates to an unused building acquired from someone who is not a developer, SBA will be based on the lesser of the original construction cost and the price paid for the building. The price paid would be determined by an apportionment between the parts that qualify for SBA and the other parts such as the plant and machinery, land or any other non‚Äëqualifying items.

Sales by developers

As is the case with other forms of capital allowance, the SBA is not available to developers who, in holding the property as trading stock, have not incurred capital expenditure. The legislation defines a developer as “a person who carries on a trade which consists in whole or part in the construction of buildings or structures with a view to their sale”. Although developers will not claim SBA, their status will be an important consideration for the buyer of the property.

If the developer sells the building or structure before it is brought into use, SBA for the buyer will be based on the price paid, which will require an apportionment as mentioned above. This calculation does not require any input from the developer. However, if the developer sells the building or structure after it has been brought into use, SBA will be based on the developer’s construction costs. Therefore, where a property is acquired already used from a developer, the buyer will require the co-operation of the developer in order to ascertain the qualifying expenditure. This may lead to an uncomfortable discussion regarding the disclosure of potentially sensitive information on the true cost and thus profitability of a development.

Claw-back on sale

It should be highlighted that the benefit of SBA may not be lasting, as any allowances claimed will be clawed back on sale through the capital gains tax rules unless the asset is sold at a loss. The mechanism for the claw-back is the addition of the SBA claimed by the seller to the sale proceeds (TCGA 1992, section 37B(2)). If the building or structure is sold for a capital gain, there will only be a temporary (timing) benefit from claiming SBA unless the seller has sufficient losses to absorb the gain.

Exception for occupiers

While claiming SBA may only represent a temporary tax benefit to property owners, the same is not true for occupiers. If a tenant has incurred expenditure that qualifies for SBA, it is unlikely that the tenant could crystallise a capital gain by disposing or surrendering the lease, which would be the relevant interest for the tenant’s qualifying expenditure.

Furthermore, since the restriction of losses by reference to capital allowances does not apply to SBA (TCGA1992, section 41(4A), there is no mechanism for the SBA to be clawed back when the tenant no longer owns the qualifying interest. Therefore, in the case of an occupier, SBA is likely to represent a permanent tax benefit.

Case study 1

Type of owner: property investment company (year end 30 June)

Description of expenditure: construction of four-storey office building

Date of earliest contract: 02/11/18

Brought into use date: 05/05/20 (date tenant signed building lease)

Summary of construction expenditure (excluding land costs):

| Year ends | 30/06/19 | 30/06/20 | 30/06/21 | Totals |

|---|---|---|---|---|

| Plant and machinery | £75,200 | £1,604,340 | £48,706 | £1,728,246 |

| SBA expenditure | £700,212 | £2,686,523 | £199,660 | £3,586,395 |

| Non qualifying | £25,000 | £0 | £0 | £25,000 |

| Total | £800,412 | £4,290,863 | £248,366 | £5,339,641 |

The SBA expenditure incurred before use of the building is £2,999,202, and the date of expenditure for payments made before use is treated as incurred on 05/05/20.

The date of expenditure for payments made after use could be any one of the following options:

- Treat each payment separately with its own tax life

- Treat all expenditure as incurred on the date of the last payment during the year ended 30/06/21

- Treat all the expenditure as incurred on 01/07/21 and commence claim in year ended 30/06/22

- Treat the expenditure incurred after use during the year ended 30/06/20 as incurred on 01/07/20 and commence claim in year ended 30/06/21, and treat the expenditure incurred during the year ended 30/06/21 as incurred on 01/07/21 and the claim made for the year ended 30/06/22.

The first option is rejected due to its increased complexity (multiple payments); the last option is chosen as it offers an optimal compromise between complexity and timing.

The information recorded on the allowance statement, in addition to that specified at section 270IA(3), is as follows:

| Date of expenditure | Amount of expenditure |

|---|---|

| 05/05/20 | £2,999,202 |

| 01/07/20 | £387,533 |

| 01/07/21 | £199,660 |

| Total SBA | £3,586,395 |

The SBA claimed in the chargeable period ending on 30/06/20 is based on expenditure of £2,999,202 for 57 days at the rate of 3% per year, which is £14,013 (57/366 x £2,999,202 x 3%).

The SBA claimed in the chargeable period ending on 30/06/21 is based on expenditure of £3,386,735 at the rate of 3% per year, which is £101,602 (£3,386,735 x 3%).

The SBA claimed in the chargeable period ending on 30/06/22 is based on expenditure of £3,586,395 at the rate of 3% per year, which is £107,592 (£3,586,395 x 3%).

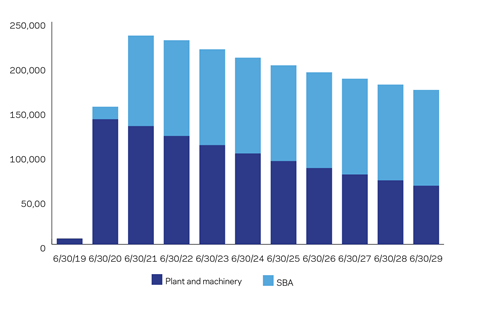

The bar chart below shows how the capital allowances for plant and machinery and SBA flow through to the owner of the relevant interest over a 10-year holding period. As the chart shows, the SBA gains greater importance for later years of the holding period. For the purposes of this illustration, it is assumed the annual investment allowance (AIA) has already been used against qualifying plant and machinery expenditure incurred on other assets. There is no AIA for SBA expenditure.

The ultimate cash benefit against corporation tax at 19% of SBA and plant and machinery (undiscounted) over time is £1,009,782 (£5,314,641 x 19%).

Case study 2

Type of owner: manufacturing company (year end 31 December)

Description of expenditure: purchase of single-storey industrial unit with integral office space acquired for owner-occupation

Seller: property investment company (acquired the land in 2014)

Date of earliest construction contract: 10/03/19

Date of acquisition: 02/03/20

Purchase price: £4,500,000

Brought into use date: 09/06/20

Summary of seller’s expenditure:

| Land acquisition | £790,000 |

| Land remediation | £95,825 |

| Plant and machinery | £412,002 |

| SBA | £2,975,234 |

| Other | £78,234 |

| Total | £4,351,295 |

As the building was acquired before it was brought into use and the seller was not a developer, the qualifying SBA expenditure for the buyer is the lower of the construction cost or the price paid (section 270BC(2)). As the purchase price was paid partly for assets that do not qualify for SBA, an apportionment is necessary in order to ascertain the qualifying expenditure (section 270BL(2)).

The apportionment must be made on a just and reasonable basis. Such a method of apportionment is already in common use for establishing qualifying expenditure on plant and machinery by utilising a formula that is readily accepted by HMRC.

A comparison of construction costs incurred by the seller and the apportionment of the price paid by the buyer is as follows:

| Price paid by buyer | Costs to seller | |

|---|---|---|

| Land value | £1,250,000 | £790,000 |

| Plant and machinery | £399,809 | £412,002 |

| SBA | £2,850,191 | £2,975,234 |

| Other | £0 | £174,059 |

| Total | £4,500,000 | £4,351,295 |

In this case study the lower figure for SBA is the apportioned cost of £2,850,191 even though the total price paid by the buyer is more than the seller’s total construction cost. It should also be noted that the seller’s land remediation costs and other costs are not relevant for the purposes of the buyer’s apportionment.

The date that the building is brought into use is later than the date that the buyer is deemed to have acquired the relevant interest and is therefore the date that SBA will become available (section 270AA(2)(b)).

The information recorded on the allowance statement in respect of the qualifying expenditure is as follows:

| Date of expenditure | Amount of expenditure |

|---|---|

| 09/06/20 | £2,850,191 |

The SBA claimed in the chargeable period ending on 31/12/20 is based on expenditure of £2,850,191 for 206 days at the rate of 3% per year, which is £48,126 (206/366 x £2,850,191 x 3%).

The ultimate cash benefit against corporation tax at 19% of SBA and plant and machinery (undiscounted) over time is £617,500 (£3,250,000 x 19%).

Case study 3

Type of owner: real estate investment trust (year end 31 December)

Description of expenditure: fit-out and alteration works to nine-storey office building in phases under a single construction contract

Seller: property investment company (acquired the land in 2014)

Date of earliest construction contract: 10/03/19

Date of acquisition: 18/06/19

Brought into use date: 01/03/20 (date of first lease for top floor)

Summary of fit-out and alterations expenditure:

| Year ends | 31/12/19 | 31/12/20 | 31/12/21 | Totals |

|---|---|---|---|---|

| Plant and machinery | £175,867 | £2,834,230 | £32,090 | £3,042,187 |

| Incidental to P&M | £29,109 | £154,900 | £2,030 | £186,039 |

| SBA expenditure | £329,454 | £2,200,980 | £15,909 | £2,546,343 |

| Revenue repairs | £15,000 | £73,101 | £968 | £89,069 |

| Total | £549,430 | £5,263,211 | £50,997 | £5,863,638 |

The expenditure for works that were incidental to the installation of plant and machinery and the expenditure incurred on repairs that were revenue in nature are shown separately in the table above in order to stress the importance of correct categorisation of expenditure. If the expenditure incidental to plant and machinery was not correctly identified, the expenditure would be included as SBA expenditure which is less tax-efficient. Likewise, correctly attributing the repairs as revenue expenditure ensures a 100% deduction in the years of expenditure rather than including the expenditure as SBA if the repairs are capitalised.

SBA expenditure incurred before use is £1,240,812.

The last payment was made on 02/01/21.

Works were carried out to a single building under one contract, therefore there is one brought-into-use date even though several floors remained empty for several months after the works were completed.

It was decided to adopt section 270BB(3)(a) and treat all expenditure incurred after the brought-into-use date as incurred on the date of the last payment on 02/01/21.

The other options would either have been more complicated (treating each payment as individually incurred) or have resulted in a less efficient cash flow benefit.

The information recorded on the allowance statement is as follows:

| Date of expenditure | Amount of expenditure |

|---|---|

| 01/03/20 | £1,240,812 |

| 01/02/21 | £1,305,531 |

| Total SBA | £2,546,343 |

The SBA claimed in the chargeable period ending on 31/12/20 is based on expenditure of £1,240,812 for 31 days at the previous rate of 2% per year and £1,240,812 for 275 days at the current rate of 3% per year, giving an allowance of £30,071 (31/366 x £1,240,812 x 2% + 275/366 x £1,240,812 x 3%).

Note: SBA rate changed from 2% to 3% on 1 April 2020.

The SBA claimed in the chargeable period ending on 31/12/21 is based on expenditure of £1,240,812 at the rate of 3% per year and £1,305,531 for 334 days at the rate of 3% per year, giving an allowance of £73,064 (£1,240,812 x 3% + 334/365 x £1,305,531 x 3%).

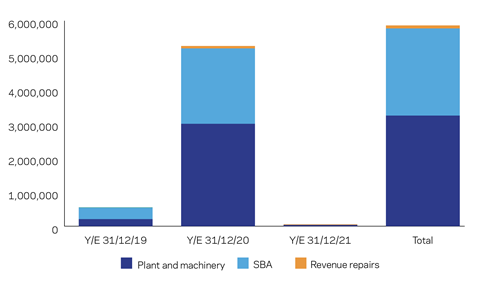

The chart below summarises how the different forms of relief are generated throughout the duration of the project:

The ultimate cash benefit against corporation tax at 19% of SBA, repairs and plant and machinery (undiscounted) over time is £1,097,168 (£5,774,569 x 19%).

04 / Summary

SBA was introduced as a means of stimulating and incentivising new construction activities in non‚Äëresidential properties. However, the administrative burdens are complex in terms of initial assessment and future ownership, and the benefits may be only temporary to some parties.

This article has, hopefully, illustrated some of the challenges of valuing and claiming SBA, not least that the need to keep accurate records in the form of SBA statements will be vital, especially when properties are bought and sold. This is particularly true for developers who, while not immediately benefiting from the relief generated by SBA themselves, may be able to secure enhanced sale prices by understanding the value of SBA, and other forms of relief, to potential purchasers.

The requirement to maintain accurate SBA records will be particularly acute for owners and occupiers of multiple properties, especially for tracking when specific SBA streams enter qualifying use. This will also be a challenge for landlords undertaking refurbishments of different areas of multi-let buildings, which may create numerous SBA streams, each with distinct tax lives.

Mixed-use properties comprising residential elements will also present difficulties in accurately valuing the relevant costs and establishing the dates on which qualifying works are brought into use.

As ever, shrewd claimants will need to ensure that their property expenditure is accurately classified in order to optimise their tax position, and the value of seeking expert advice cannot be underestimated.

No comments yet