With minimum EPC rating requirements set to be raised to counter climate change, many buildings will become ÔÇśstrandedÔÇÖ and their value will plummet. Juan Jose Lafuente explains how the upcoming CRREM project will help identify buildings at risk and plan corrective measures

01 / Introduction

As a consequence of UK international commitments to reduce carbon emissions, the UK economy is transitioning towards a drastic decarbonisation in every sector, including construction and property. Every building, new or existing, is challenged to meet decarbonisation targets, which are expected to become even tighter in the future, to mitigate global warming. Furthermore, buildings will need to adapt to a warmer climate to guarantee a safe and comfortable environment for occupants with a limited availability of energy.

Despite global decarbonisation efforts, weather patterns are already changing ÔÇô temperatures are higher every year, while heat waves are more frequent and acute ÔÇô and many buildings are not designed for these new conditions. Large numbers may fail to meet decarbonisation targets or to adapt to these new climatic conditions to secure occupantsÔÇÖ comfort.

Most of these future underachieving buildings belong to the existing stock, but others have been recently completed or are currently being planned, designed and constructed. These buildings are at ÔÇťstranding riskÔÇŁ: the risk that in the near future they will become too expensive to operate, too expensive to retrofit, unable to reduce energy consumption and falling outside policy frameworks. As a result they face early obsolescence and will become ÔÇśstranded assetsÔÇÖ. Stranding risk will greatly impact these assetsÔÇÖ value, rent potential and expected return of investment.

There is a growing demand within the real estate sector to identify such assets, assess their risk level and act to reduce it. This need translates into new requirements from developers, building owners, investors and asset managers for design teams. Such demands can be summarised in one question: is this building future-proofed?

The Climate Risk Real Estate Monitor (CRREM) project, currently under development with funds from the European CommissionÔÇÖs Horizons 2020 programme, sheds some light upon this uncertainty. CRREM provides investors and design teams with the tools to identify today the assets at future risk and to understand the level of exposure of specific buildings and portfolios. CRREM encourages teams to define risk management plans with corrective actions and protect assetsÔÇÖ value and guarantee investmentsÔÇÖ returns.

02 / The carbon budget to limit global warming

The concept of stranding risk arises from the limited amount of carbon that the global economy can emit before average temperatures rise beyond 1.5┬░C or 2.0┬░C ÔÇô the limits agreed by the international community in the 2015 Paris Agreement. This fixed amount of carbon is usually called the ÔÇťcarbon budgetÔÇŁ and its size is well known: by 2050 the global economy can emit only 784 gigatonnes of carbon dioxide equivalent (CO2e) if global warming is to be limited to 2┬░C (the binding target), or 669 gigatonnes to achieve a 1.5┬░C warming scenario (the aspirational target). These figures are fixed regardless of how much the global economy grows.

The carbon budget represents a cake that needs to be distributed in fairly sized portions among every country, region and economic sector, including real estate, and from there down to each building. Each building needs to ensure that it does not consume its proportional part of this carbon cake before 2050. The CRREM project has calculated that the commercial property sector is 14 years behind schedule: at the current rate of emissions the carbon budget available for 2050 will be consumed by 2036. In a 2┬░C scenario, this budget will be consumed by 2039.

Much stronger efforts to reduce the carbon emissions of all buildings ÔÇô new and existing ÔÇô are required. These efforts can be distributed in decarbonisation pathways that limit the annual emissions allowed for each sector and country.

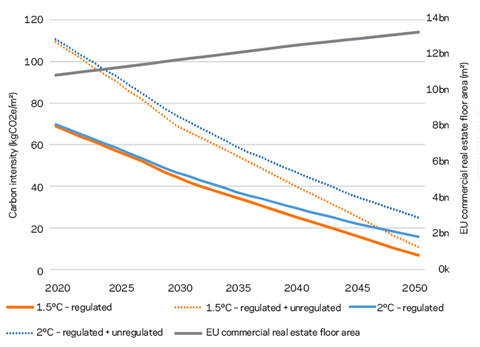

To achieve a 1.5┬░C warming scenario, commercial buildings need to reduce their carbon emissions by 91% by 2050. In a 2┬░C scenario, these emissions must be reduced by 78%. The pathways in figure 1 (below) show the average baseline emission intensity and target pathways for the total of EU commercial property; this includes all energy consumed within buildings.

Emission intensity (or ÔÇťcarbon intensityÔÇŁ) is the most common performance indicator with regards to greenhouse gas (GHG) emissions and is calculated as the total amount of emissions during one year divided by a buildingÔÇÖs floor area.

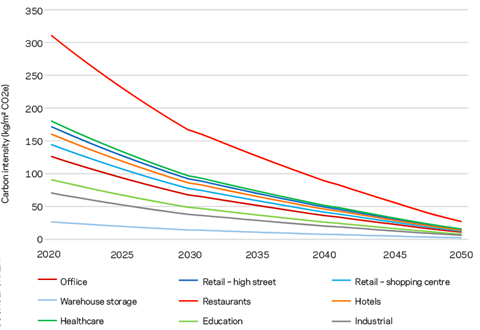

CRREM has also estimated the decarbonisation pathways for different types of commercial buildings in each EU member state; that for the UK is shown in figure 2 (below). These estimations consider the different energy consumption profiles and decarbonisation capacity of each building type.

03 / The financial impact of stranding risk

There are growing demands to disclose the financial risk of climate change on investments in the real estate sector. Following the recommendations from the Task Force on Climate-related Financial Disclosures (TCFD) established by the G20 Financial Stability Board, companies in the real estate sector are required to quantify and disclose to investors the climatic risks of their portfolios and the potential financial impact of climate change on their expected financial returns. As a consequence, they need to identify which buildings are at higher risk of stranding and quantify the potential costs (as well as benefits) of the steps ÔÇô such as retrofit works ÔÇô needed to meet regulatory requirements and avoid early obsolescence.

For new developments and acquisitions, investors will want to scrutinise these indicators very carefully to ensure that current predictions of return will not be jeopardised by global warming. These calculations will be incorporated in future building valuations and potential lease value estimations. Only future-proofed buildings that can demonstrate a secured return will proceed and design teams will be requested to provide these evidences.

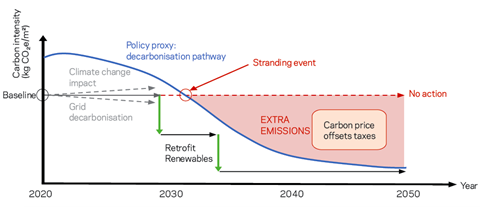

The graph in figure 3 (below) provides a schematic example of how stranding risk will occur and how it will impact buildingsÔÇÖ value, even in the case of a new building that currently complies with building regulations (shown as the baseline in the graph).

Adapting to policy change

Decarbonisation pathways (the blue line) can be regarded as a proxy of how future policy restrictions (for example, building regulations) will need to evolve to ensure compliance with international commitments. The pathway may vary slightly, but the total amount of carbon that the sector can emit (the white area below the blue pathway) cannot change.

For reasons of clarity, in this example the energy and carbon performance of the building (shown as the arrowed horizontal lines) does not change with time. In reality this performance would be affected by positive and negative factors (following the path of the grey broken arrowed lines): rising temperatures will reduce heating demand and increase cooling demand, and the efforts to decarbonise the electricity grid will reduce the carbon impact of electricity consumption.

As policies become tighter to ensure that the decarbonisation pathways are met, the buildingÔÇÖs performance will reach a point beyond which the building will be at increasing stranding risk. From here, to choose the ÔÇťno actionÔÇŁ path (shown in red) will lead to higher operational costs: for instance, excess emissions (the red area) will need to be offset (if regulations will allow it) at increasingly more expensive carbon prices, new taxes may be introduced for underperforming assets to incentivise the implementation of energy efficiency measures, and energy costs may rise, deterring potential tenants from renting and thereby increasing void periods. Besides, stricter policies may prevent stranded assets from being sold, leased or occupied, drastically reducing the expected yield and value of these properties.

Carbon management plans

To avoid the financial impacts of stranding risk, real estate assets and portfolios will require carbon management plans (shown as green arrowed lines on the chart) to reduce their emissions. These plans will schedule the implementation of carbon abatement strategies over time ÔÇô such as sustainable retrofit projects, or generation and use of renewable or low-carbon energy ÔÇô and will also involve monitoring the results to demonstrate compliance.

Planned decarbonisation strategies will require a stream of capital expenditure, but they will drastically reduce operational costs by, for example, reducing energy costs and carbon offset purchases, and they will secure marketability. The carbon management strategy and measures should be planned to ensure that implementation minimises factors such as tenancy disruption and maximises the lifecycle of each building component.

The accounting and reduction of embodied carbon emissions will become increasingly important. The reduction of operational carbon emissions in buildings should not entail larger embodied carbon emissions elsewhere.

║┌Â┤╔šă°s that delay adaptation or can reach it only through costly strategies will become stranded, will not meet market expectations and will be increasingly exposed to the risk of early economic obsolescence and writedown.

04 / The policy instruments

Even though the mid- and long-term targets and the potential financial impacts are clear, current short-term policies are failing to anticipate the resulting need for the development of plans with mitigation actions. Therefore, current targets and requirements are very likely to harden up to meet long-term targets. However, in long-life assets such as buildings, the capacity to react at a later stage is much shorter.

EU policy

The current policy setting carbon reduction targets for the EU economy, the Effort Sharing Decision (EU-ESD), requires member states to make an average reduction of 30% by 2030, compared with 2005 levels. The carbon reduction targets defined are different for each country, and the framework delegates to each member state the definition of specific carbon-reduction targets for each of its own economic sectors. The EU-ESD might be the most recent, most restrictive EU policy framework, but it is still way below the levels required to mitigate the risk adequately. Current EU pledges will lead climate change to an unacceptable 3.6┬░C warming scenario by the end of the century.

UK policy

In the UK, the Climate Change Act 2008 aims to achieve an 80% reduction in carbon emissions by 2050, compared with 1990 levels. There have been recent pledges from political parties propose even more ambitious decarbonisation targets. For example, the Liberal Democrats recently redefined their agenda for tackling the climate emergency, pledging that the ÔÇťUK would achieve net-zero carbon status by 2045 ÔÇô five years sooner than the current government goalÔÇŁ. These long-term targets are aligned with the maximum 2┬░C warming scenario and to EU long-term targets.

Brexit could change this status quo. It adds uncertainty, mainly regarding the extent and timeframe of UK to the Paris Agreement. These terms could be redefined after the country leaves the EU, even though the UK has traditionally set more restrictive targets than the EU. In spite of this uncertainty, unless the UK decides to withdraw from the Paris Agreement, which has already been ratified, or to substantially change its current carbon reduction policies, the carbon budgets and decarbonisation pathways that the CRREM project has calculated for the EU property sector and all member states will remain valid for the UK. They are not based on any political agenda but rather on the scientific requirements to limit global warming.

Part L of the ║┌Â┤╔šă° Regulations

However, current UK policies to meet these ambitious long-term targets in the real estate sector still fall far behind these expectations. The main policy instrument to reduce emissions in the built environment is Part L of the ║┌Â┤╔šă° Regulations, which is the national transposition of the EUÔÇÖs Energy Performance of ║┌Â┤╔šă°s Directive (EPBD).

There are several reasons why Part L still fails to meet the commitments of the Paris Agreement: First, the scope of ║┌Â┤╔šă° Regulations is limited. Part L applies only to new buildings and major refurbishments. For existing buildings, carbon reduction requirements are less strict. According to the UK Green ║┌Â┤╔šă° Council, 80% of what will comprise the UKÔÇÖs building stock in 2050 has already been built. Many of these buildings will not undertake major refurbishments in time and will not need to comply with ║┌Â┤╔šă° Regulations.

Second, Part L does not target all carbon emissions. Following the EPBD framework, Part LÔÇÖs carbon-reduction objectives do not target emissions from ÔÇťprocess loadsÔÇŁ, which are also called ÔÇťunregulated carbon emissionsÔÇŁ. The World Green ║┌Â┤╔šă° Council (WorldGBC) defines these emissions as the result ÔÇťfrom the consumption of energy in support of a commercial process other than conditioning spaces and maintaining comfort and amenities for the occupants of a buildingÔÇŁ. Examples are IT and medical equipment, or domestic appliances, commercial catering, refrigeration and laundry operations. The WorldGBCÔÇÖs Advancing Net Zero scope does include these emissions in its commitment.

Third, the carbon-reduction targets (target emission rates) defined by building regulations are insufficient to comply with international commitments. Local standards such as the London Plan push these targets further, aiming for zero carbon emissions (including offsets) but the London PlanÔÇÖs targeted emissions and scope of action are limited by building regulations: unregulated carbon emissions are not addressed and the plan is only applicable to ÔÇťmajor developmentsÔÇŁ. The Future Homes Standard presented this spring pledged for ÔÇťnew-build homes to be future-proofed with low carbon heating and world-leading levels of energy efficiencyÔÇŁ. This ambitious standard would need to quantitatively detail what ÔÇťfuture-proofedÔÇŁ means, but in any case, the standard seems to apply only to new homes, so the much larger existing stock as well as all the commercial stock would still be out of scope.

MEES regulations

The Minimum Energy Efficiency Standards (MEES), which came into force in 2018, is the main regulation to address carbon reductions in part of the existing stock. MEES promotes the refurbishment and upgrade of underperforming existing buildings that are in the real estate market. Properties that are not on sale or to let lie outside the scope of MEES. In essence, the standards prevent landlords and owners from selling or renting most properties that do not achieve an energy performance certificate (EPC) rating E or better, encouraging the implementation of energy efficiency measures to raise the certification above this level. MEES have already had a financial impact on the property market by reducing the value of nonÔÇĹcompliant properties, increasing void periods (which reduces yields) and requiring capital expenditure for retrofit.

TEG report will set new thresholds

MEES is only the first step in a direction that is very likely to get much tighter. In June, the EU Technical Expert Group on Sustainable Finance (TEG) published a draft of its taxonomy technical report, which defines the quantitative limits for any economic activity to be considered sustainable. The section defining targets for construction and real estate activities was co-ordinated by RICS, and sets this limit to the top 15% of the market. The TEG proposes to use buildingsÔÇÖ energy intensity (annual energy consumption per floor area) as metric in the beginning and include carbon intensity in later stages. New buildings and acquisitions will be considered sustainable only if they achieve an EPC rating of B or better. The limits for refurbishments are not as restrictive, but they need to ensure at least a further 30% reduction below building regulations targets. For the moment these requirements are not binding but the TEG taxonomy sends a clear message: EPC rating B is the new limit for sustainable buildings. Unsustainable assets will fail to comply with the commitments to the Paris Agreement and will become stranded.

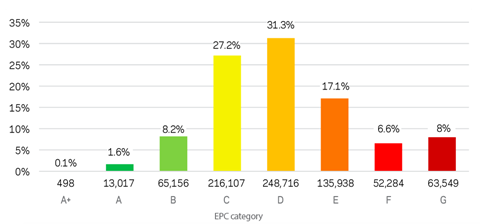

At least 90% of properties in England and Wales may be at risk of becoming stranded. According to figures from the Ministry of Housing, Communities and Local Government, 90.1% of nonÔÇôdomestic EPCs issued in the last 10 years (EPCs are valid for 10 years) were rated C or below (see figure 4, above). This figure could be even higher because only new buildings ÔÇô buildings that undertake major retrofit and properties that have been recently sold or leased require an EPC. Properties that have not been retrofitted or put on the market in the last 10 years, which are likely to perform worse than new and retrofitted properties, are not included in these figures. MEES seems to have had a considerable impact in this statistic: The percentage of F and G rated properties dropped from a 10-year average of 14.6% to a much lower rate of 3.5% in the last 12 months. However, still 85.7% of the EPCs issued last year were rated C or below.

The TEG report acknowledges the limitations of using EPC ratings to set quantitative targets for real estate activities, and the limits may soon be updated after consultation. The calculation methodologies to set EPC ratings differ in each member state, and the estimation of carbon emission rates from EPC ratings is seldom accurate. In any case, MEES can be expected to progressively tighten requirements to this range of demand. Raising an EPC rating from F or G to E does not require substantial capital expenditure, but achieving an EPC rating of B or A can be very costly and not all properties may be able to achieve it. The stranding risk of these properties will be much higher, and without adequate abatement strategies their value may plummet.

05 / Future implications and opportunities for design teams

Project teams should expect new, more restrictive requirements from developers and building owners to avoid stranding risk and to demonstrate the resilience of buildings to climate change. Complying with current policy frameworks, including building regulations, is not enough to protect future value and yields and avoid early obsolescence.

The decarbonisation targets for buildings are expected to tighten markedly and will demand high levels of compliance, comparable to EPC B rating for all stock, new and existing. This will open new opportunities for the construction sector, which will need to be ready to ensure the delivery of stringent carbon reduction plans.

Fortunately, new tools and initiatives such as the CRREM project provide the timeline, targets compliant with the Paris Agreement, calculations and solutions to anticipate the potential cost of future regulatory requirements, deliver resilience and avoid stranding risk.

Sources and methodology

Full data sources and challenges, as well as details on the methodology adopted to calculate carbon budgets, pathways, targets and so on, can be found in CRREMÔÇÖs first public report: Stranding Risk and Carbon. This is available at .

The CRREM project has received funding from the European CommissionÔÇÖs Horizon 2020 research and innovation programme under grant agreement no. 785058.

Acknowledgments

The author would like to thank the CRREM team partners Institut f├╝r Immobilien├Âkonomie, Austria; GRESB, the Netherlands; University of Alicante, Spain; the University of Ulster, UK; the TiasNimbas Business School, Tilburg University, the Netherlands; and especially Dr Jens Hirsch, Rik Recourt and Paloma Taltavull de La Paz for their support and contributions to the development of this article.

No comments yet