Aside from a boom in infrastructure, the first quarter of 2021 has not seen a continuation of the late 2020 rally in output. But while sentiment is high for a recovery, new orders are not fully mirroring this optimism, and a supply crunch is hitting the materials chain

01 / Summary

Tender price index&²Ô²ú²õ±è;â–º

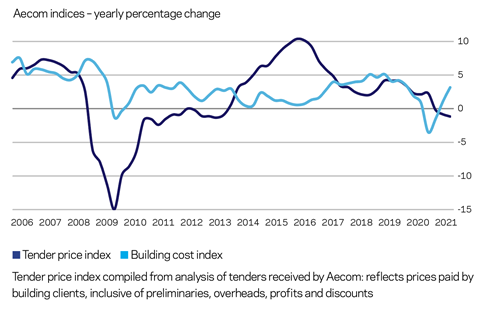

Tender prices moved negligibly over the 12 months to the end of Q1 2021. Market pricing is firming up for some trades as workload returns and input cost pressure builds.

ºÚ¶´ÉçÇø cost index â–²

A composite measure of building input costs increased by 3.1% over the year to Q1 2021. A combination of factors has propelled input cost inflation much more quickly over the first quarter of the year.

Consumer prices index â–²

The consumer prices index (CPI) rose by 0.7% in the 12 months to March 2021, up from 0.4% to February. Consumer price inflation is expected to increase further during the rest of 2021.

02 / Output

UK construction output

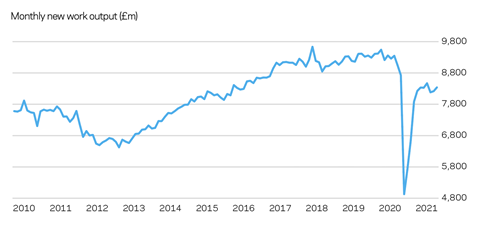

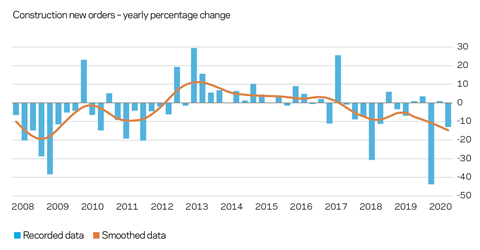

Since rallying through the second half of 2020, construction output has not continued its upward momentum into 2021, according to the latest data from the Office for National Statistics. After returning to somewhere near 90% of its pre-pandemic levels, new work output has been plotting a sideways track in the early months of 2021. All work construction output grew by 1.6% between January and February 2021. Following data revisions, 2020 annual construction growth was revised downwards by 1.5 percentage points to mark a drop of 14%. This is now the largest decline in yearly growth since annual records began in 1997. New orders data in Q4 2020 slipped again after posting a modest improvement over the 12 months to Q3 2020.

Infrastructure is clearly the strongest construction sub‑sector, surpassing its pre-pandemic peak. All other sectors appear to be struggling to return pre-pandemic levels of output, though. Notably, the private housing and commercial sub-sectors are some way off their early 2020 output levels, especially since they are the two largest segments, by monetary value, of the UK construction sector. The most recent data indicates that the output gap for these sub-sectors compared with late 2019 and early 2020 did not close significantly over the course of Q1 2021.

03 / Activity indicators

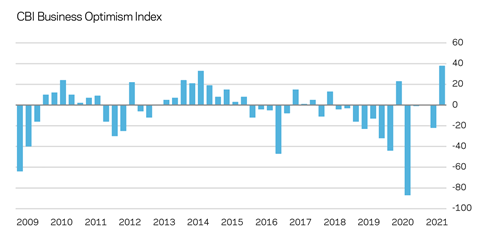

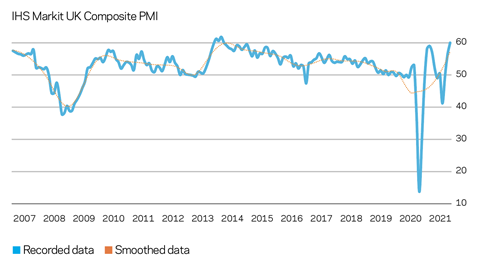

Business sentiment

Construction sector sentiment recorded strong rebounds over Q1 2021. Likewise, general business sentiment rose in response to the ending of lockdown, with retail, leisure and other sectors opening up a little more. Expectations of improved business conditions in 2021 are high, with most sectors forecasting better sales and revenue outcomes this year. Still, assessment on a relative basis is more revealing, and better sales than 2020 are obviously more likely for many firms, given the substantial disruption to commerce that took place.

This improved sentiment reflects the relatively sound return of activity, and expectations of higher future workload. Confidence and sentiment do not always translate to hard economic data, though. Despite improvements in construction and broader economic data, there is a considerable way to go before a recovery can be declared. The second wave of the pandemic in the UK, and its accompanying lockdown, interrupted the improving economic activity across the latter months of 2020. The UK’s GDP yearly growth rate was -7.3% at Q4 2020, marginally higher than the Q3 rate of change, but still negative over the yearly period.

Project restarts combined with a sprinkling of new projects are generating momentum, which is helping to improve optimism. A theme of higher employment levels is expected across all economic sectors for 2021, although business investment will remain subdued as there is a need to preserve cash and less requirement to expand capacity presently. Finances will take time to repair while inventory is unwound, and working capital issues remain front and centre this year. But changes to working capital processes have knock-on effects through supply chains, with the construction sector having discernible tensions in this area.

A stockpiling push in late 2020 underpinned trading and economic activity across the UK, in an otherwise fragile period. This preparation to build stock will ease some of the supply disruptions set for 2021. Nonetheless, higher demand will decrease the inventory. Lead times for key construction materials and components have risen. Current problems with sourcing and supply, driving delays and cost increases, should not be mistaken for a sense of the sector having fully recovered since 2020.

04 / ºÚ¶´ÉçÇø costs

Inputs

ºÚ¶´ÉçÇø cost inflation continues across almost all materials classifications. Aecom’s composite index for building costs – comprised of materials and labour inputs – rose by 3.1% in the 12 months to Q1 2021. The largest increases were in metals, timber products and aggregates. The quarterly movement from Q4 2020 to Q1 2021 was a rise of 1.3%, equating to a larger current annualised rate of change of over 5%. Elevated input cost inflation can be expected to continue throughout 2021, as the existing combination of supply and demand factors persist.

> Also read: Brexit risks worsening materials shortage crisis, Aecom warns

A range of factors are combining to propel input cost inflation. Higher international logistics costs, returning demand from industry workload, and higher global metals prices are some of the drivers speeding up building cost inflation, for example. Some EU materials exporters to the UK are adjusting to Brexit. EU markets have been a significant source of supply for a wide variety of construction materials and components. Some EU exporters are now deciding not to supply the UK at all, because the additional red tape involved makes it not commercially viable. Among other exporters, significant price increases are being applied to cover the permanent non-tariff barriers and additional administrative processes.

Other supply-side constraints add to the mix, with workforce capacity issues a perennial problem. Aggregate wage levels are nominally rising as lockdown ends, the economy reopens and construction activity picks up. ONS data on regular pay for construction employees shows weekly wages back to pre-pandemic levels. But other aggregate measures provide a more nuanced picture where wage levels are not quite at parity with those seen immediately prior to the pandemic.

05 / Tender prices

Resources

An aggregate measure of tender prices was mostly unchanged in the 12 months to the end of Q1 2021. After a slowing of tender price inflation in 2020, and some deflationary trends seen in parts of the supply chain, pricing is maintaining a steady course over Q1 2021. This is an aggregate measure, though, with discernible movement higher in some trades such as steelwork. Recent trends in global steel prices are moving quickly to increase input costs for these subcontractors, and in combination with prevailing capacity constraints across these areas of the supply chain.

Workload is improving slowly, although price competition remains evident across some trades. Ordinarily, with the combination of present inflationary strength for materials and components, and reasonable current activity levels, tender prices should be expected to plot an inflationary course through 2021. Expectations of higher future workload also add pressure. But any mismatch between expectations for new orders now and a less impressive reality further into 2021 will squeeze existing commercial dynamics for supply chain firms.

06 / Outlook

TPI forecast

Input cost inflation is elevated, picking up notably over the first quarter of 2021. While some of the factors are relevant across borders, the aggregate effect results from a particular mix hitting the UK. Global supply chain disruption as a result of the pandemic, logistics issues, unwinding of stockpiles built up prior to Brexit and now restocking demand, restarted construction activity, further workforce constraints as a result of emigration, and higher costs from permanent Brexit non-tariff barriers are all combining to bring a supply crunch in the first half of this year. All this is occurring against a backdrop of less total output than before the pandemic.

Additionally, and this is something that transcends borders, metals commodities continued rising in price up until March this year, with some metals recently hitting 10-year highs. As an example of flow-through effects, a significant pick-up in the yearly rate of change was recorded for structural steel in the first two months of 2021. For the months of January and February 2021, price rises of approximately 25% were recorded over the 12 months from their respective calendar points in 2020. Demand for underlying inputs to the steelmaking process – scrap in the case of steel reinforcement – higher demand for finished steel products, and global supply constraints have contributed to this notable rate of change.

Key global metals prices have steadily increased since last year. Global supply chain disruption and demand from major economies reopening pushed the trend. However, more recent price movements are not uniform, with some of these metals not marking any defining trend. However, up until the early months of 2021, and following their typical correlation, key global metals prices moved in sync with the US dollar. Taking steel, for example, since late February this relationship moved out of sync, notably so in recent weeks. Market factors – including increased demand, supply shortages and capacity constraints – have more strongly influenced the trend of dollar-priced commodities than the value of the dollar itself.

US economic conditions strongly influence the strength or weakness of the US dollar, and recent evidence that US consumer price inflation is not increasing as quickly as was forecast last year has undermined some of the recent support for the US dollar. As the dollar has weakened again through April, this will probably drive metals prices higher over the near term – or at the very least support current metals price levels. But the correlation is likely to return at some point this year, which means either the US dollar will increase in strength, or else global metals prices will fall, so that an equilibrium level is restored nearer to the normal correlation range.

Aecom’s baseline forecast scenario has an economic recovery at its core, but this is subject to ongoing potential risks that have the ability to dent a recovery path. Government capital spending that directly benefits the construction sector is not yet evident in substantial volume. Growing inflationary pressures are colliding with workload trends that are not yet rising in unison. This makes the outlook more problematic for supply chain firms in that sentiment is high for a recovery, but new work orders are not fully mirroring this high level of optimism.

Securing work overseas is much less certain now – both strategically and operationally – leaving the UK as the primary source of workload for many firms. Whereas a domestically focused industry was beneficial when workload was plentiful, it acts as a potential problem when market access outside the UK is squeezed because of covid restrictions and Brexit. Concentrated domestic focus adds to competitive pressures on tender price trends in the UK market, probably capping inflationary trends that would otherwise be let loose.

However, some firms are able to pass on their input cost inflation, in full or in large part, via higher tender prices where subcontractor capacity is restricted. Further, risk transfer is less readily accepted now where subcontractors know that delivery capacity and capability are constrained. Their negotiating position is stronger for having less competition. Other segments of the supply chain, though, are less able to pass through their costs into higher tender prices because of more competition at present.

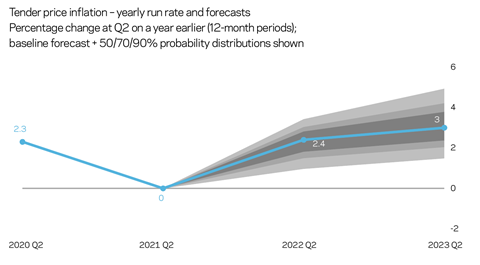

Aecom’s baseline forecast for tender prices are a 2.4% increase from Q2 2021 to Q2 2022, and 3% from Q2 2022 to Q2 2023. Risks are evenly balanced across the first 12-month period, and slightly to the upside over the second 12-month forecast period on the strength of greater optimism ahead.

No comments yet