Overall the outlook for Germany is reasonably bright, but construction will feel the pain as the effect of the economic stimulus measures wears off

The Frankfurt skyline ŌĆō the investment focus in 2010 is expected to be on residential, retail and office buildings

01 / The economy

In the last few years, GermanyŌĆÖs economy has been severely hit by the global economic slowdown and the country has experienced the deepest recession since the establishment of the Federal Republic of Germany in 1949.

However, the worst now seems to be over and the downturn is a thing of the past. In spring of this year, the German Federal Statistical Office recorded the strongest economic growth since reunification, with GDP up by a remarkable 2.2% in the second quarter of 2010 compared with the previous quarter.

The growth has, in the main, been driven by the export of high-quality goods to Asia, which has compensated for the declining demand from the US.

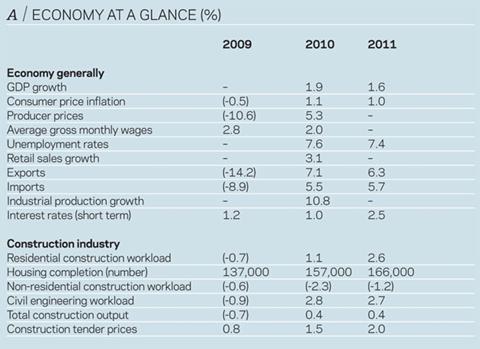

As a result, the GDP growth forecasts have been revised to show more than 2% growth this year and an average of 1.2-2.0% in 2011, according to forecasts prepared by a number of national and international institutes.

The prime reason why German recovery has leapt ahead of other European countries is that Germany did not make the mistake of focusing on the services sector at the expense of the manufacturing sector as so many Northern European and former industrial countries did.

Assuming the usual economic cycle in Germany, it can be expected that the domestic economy will follow foreign trade in recovering due to increasing domestic investment and private consumption.

There is, however, some concern that economic development across the European Union is extremely inconsistent, with troubles arising first in Greece but also in Spain and Portugal, all of which face poor economic growth and rising unemployment, particularly among young people.

02 / Sector overview

At the beginning of 2009, the German construction industry was finally hit by the worldwide recession. Turnover dropped and construction orders fell dramatically. The result was a decline in turnover of 4% to Ōé¼82.2bn (┬Ż68.7bn).

This year the situation has stabilised, with only a minor decline in turnover anticipated. However, the outlook for 2011 is poor - turnover is expected to drop to Ōé¼80bn (┬Ż66.9bn).

The current index for the business climate in the construction industry (the ŌĆ£ifoŌĆØ index) has significantly recovered in the last three months, although the business expectation for the six months from July is slightly less optimistic. The positive figures mainly result from activity in the building sector, whereas in civil engineering the current climate and future expectations for July are worse than in the previous month.

03 / The property sector

The volume of real estate transactions in Germany collapsed in 2008. Completed transactions amounted to Ōé¼25.9bn (┬Ż21.6bn), a fall of 50% compared with 2006 and 60% compared with 2007. Even so, the crisis did not bottom out in 2008, and completed transactions halved in 2009 to Ōé¼13.4bn (┬Ż11.2bn), although there were some signs of recovery later that year.

Due to the ongoing difficult financing situation, including fewer distress sales and smaller transaction volumes, recovery is expected to be a slow process. Volume is not expected to rise significantly in 2010, although the worst seems to be over and Germany has seen more major deals, such as the Sony Centre in Berlin (pictured above).

Investment in commercial real estate amounted to Ōé¼4.3bn (┬Ż3.6bn) in the first half of 2010, which is way above the same period in 2009 (Ōé¼1.2 bn). The market, which is dominated by institutional investors, predominately consists of inner-city shopping centres (56%) and commercial buildings (15%).

As in previous years, Germany is largely seen to be an attractive real estate investment market, both in general, and when compared with other European countries. One reason is the low level of volatility; the second is the relationship between return and interest rates.

The investment focus in 2010 is expected to be on residential, retail and office buildings, while logistics and hotels are considered to be less attractive.

04 / Construction workload

The prognosis by the Central Association of the German Construction and ║┌Č┤╔ńŪ° Industry for different sectors shows a varied picture.

Whereas the turnover forecast for the residential sector shows an upward trend of 0.5% for 2010 and 2.0% for 2011, the commercial sector is expected to decline by 8.3% in 2010 and then remain stable at this level in 2011.

In contrast, the public sector is still benefiting from the economic stimulus package. It is expected to rise by 7.4% in 2010, but then fall straight back down again by 7.4 % in 2011.

05 / Prices

Construction prices barely moved in 2009. Inflation was 0.2% for residential buildings over the past year, with 1.1% for offices and industrial buildings. Inflation in road prices is expected to be about 2.0%. The expected rise in prices from the economic stimulus packages did not come about.

No increase is expected in building prices in 2010 because of the fall in demand, although a considerable increase in road prices is probable.

An increase of 3-6% in the price of mineral materials (concrete, cement and plaster) balanced a reduction in the price of reinforcing steel, which fell by about 40% in 2009. There was a considerable rise in the costs of road-making materials, primarily because of a remarkable increase in the price of bitumen compared with other mineral oil products.

Because of high social security contributions in Germany, on-costs add some 80% to actual hourly rates, and labour costs represent about 40% of turnover. Standard wages in Germany in 2009 rose by 2.3%, while the legal minimum wage rose 0.9% in the old western states and 2.8% in the more newly-formed German states.

06 / Construction outlook

Despite the positive outlook of the economy in general, construction companies face the future with mixed feelings. Public stimulus packages are running out and construction traditionally follows the general economic development pattern after a certain time lag.

With orders and order backlogs shrinking, the omens for 2011 are not good. While the public sector has an investment backlog of Ōé¼84bn (┬Ż70.2bn) for buildings and infrastructure, 27% of that is expected to be spent this year, and budget cuts prevail.

The situation is difficult, especially for small businesses, but there is no general lack of credit.

Employment

Since 2007 the number of people employed in the construction industry has fallen from 714,000 to an estimated level below 700,000 in 2010.

The figure represents a drop of about 50% from the highs of 15 years ago. This decline contradicts the general trend in Germany, where the labour market has survived the crisis in a remarkably good condition.

07 / Summary

In comparison to its European counterparts, Germany seems to have overcome the economic turmoil relatively fast. The latest figures are promising, with an unexpected 2.2% GDP increase in the second quarter of 2010 and a revised forecast of more than 2% for the year in total.

However, this is dependent on exports at the moment as the domestic economy is still weak. An additional danger to recovery is the economic risks across the rest of the Eurozone, with problems in Greece, Spain and Portugal to name just a few.

The property sector, although far from the heights of previous years in terms of transaction volume, seems about to pick up, as Germany has relatively low volatility and interest rates.

The immediate outlook for construction is mixed: there is some positive influence from public spending in 2010, but a reduction in this spending suggests gloomy prospects for 2011. Prices are expected to remain more or less level and are likely to be influenced mainly by rising materials costs.

GermanyŌĆÖs high standards for green building will affect the industry but it is too early to assess the full impact. Despite savings in running costs over the long term, an increase in construction costs in the order of 10-20% appears to be quite realistic.

Additional reporting by Meinhard Rudolph and Christian Borusiak of EC Harris.

Downloads

B / costs (┬Ż/m2) [PDF]

Other, Size 0.11 mb

No comments yet