Experian Marketing Information Services’ analysis of the first quarter of 2011 shows that despite poor performance in new orders, some sectors - such as private housing - have seen improvement

01 / OVERVIEW

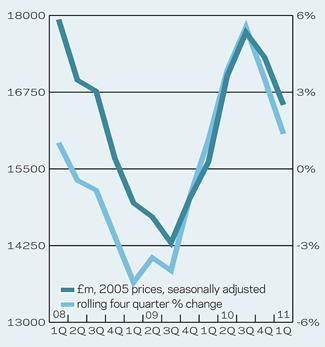

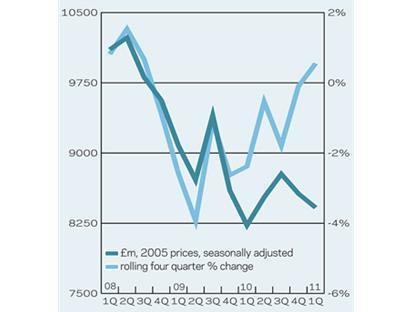

Latest figures from the Office for National Statistics show that construction output totalled just over £25bn, in 2005 prices, in the three months to March 2011. This was 3.4% below the final quarter of 2010, but 5.2% higher on an annual basis. Year-on-year, growth was slightly stronger in the new work sector, where output rose by 6%, compared with a rate of increase of 4% for repair and maintenance.

This was in contrast to an unexpectedly strong outturn in 2010, although the industry suffered from strong deflation last year, which had an impact on the real output figures.

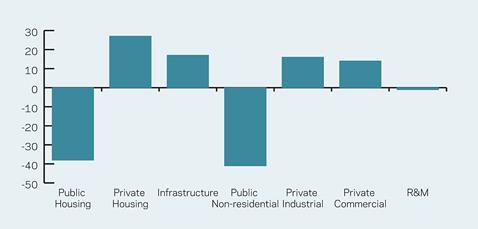

In the first quarter of the year, the public housing repair, maintenance and improvement and commercial sectors were the only ones to see falling output

on an annual basis, down by 6% and 1%, respectively. Public housing saw the strongest growth, with output 16% higher than in the corresponding period of 2010. Double-digit increases were also recorded in the private housing and industrial sectors, with output rising by 14% year-on-year in both.

The infrastructure sector saw growth of just 3% year-on-year in the three months to March.

New orders for public non-residential construction held up better than expected in 2010, so growth of 9% year-on-year in output in the first quarter of 2011 is not entirely surprising. Despite the ºÚ¶´ÉçÇø Schools for the Future programme being cancelled last year, there is work to complete on schemes that were not scrapped but this is likely to start to wind down this year.

Following growth of 4% in 2010 as a whole, new construction orders dropped by 18% year-on-year in the three months to March, to total £11.2bn, in 2005 prices. This was also 23% below the final quarter of 2010 and the lowest quarterly figure for two years. The private housing sector was the only one to see an increase in new orders in the first quarter of 2011 as they rose by 16% from the corresponding period of 2010.

The infrastructure sector saw a marked drop of 45% in new orders, although this was compared with a strong first quarter last year when a number of contracts for Crossrail were let, and the public non-residential sector recorded a 24% decline in new work orders.

New orders for the industrial sector totalled £476m, in 2005 prices, in the three months to March, 3% lower on an annual basis, but this was the weakest quarterly total on record.

The very weak performance in new orders at the beginning of the year does not bode well for output in the shorter term, although some sectors are likely to see some improvements.

02 / NEW WORK OUTPUT

03 / R&M OUPUT

04 / NEW WORK ORDERS

05 / 2010-13 FORECAST

The chart (below) presents sectoral forecasts for 2010 to 2013. The weakest performances are expected to be from public housing and public non-residential, in light of significant government spending cuts. However, the level of output in the public non-residential sector reached a record high in 2010, so output is still expected to be higher than it was in 2008 by 2013. Private housing is expected to be the most buoyant, with a strong recovery towards the end of the period as demand begins to return. The infrastructure sector will benefit from work gathering pace on Crossrail, although the peak year of work on the project is not expected until 2013/14.

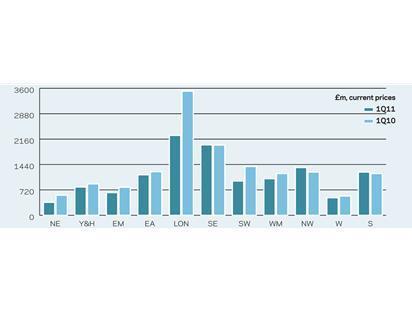

06 / REGIONAL NEW WORK OUTPUT

With the exception of the North-west and Scotland, new work output rose year-on-year across all regions and devolved nations in 1Q11. The strongest growth was in Wales, where output increased by 11% from a year earlier, but the North-east, East Midlands and West Midlands also saw growth of 9%. The increase in Yorkshire and Humberside was 1% and output fell by 1% in the North-west and 6% in Scotland.

07 / REGIONAL R&M OUTPUT

08 / REGIONAL NEW WORK ORDERS

No comments yet