The private sector is showing tentative improvements and infrastructure is going strong, but with little public money available the outlook for the sector still looks downbeat. Experian Economics reports

01 / OVERVIEW

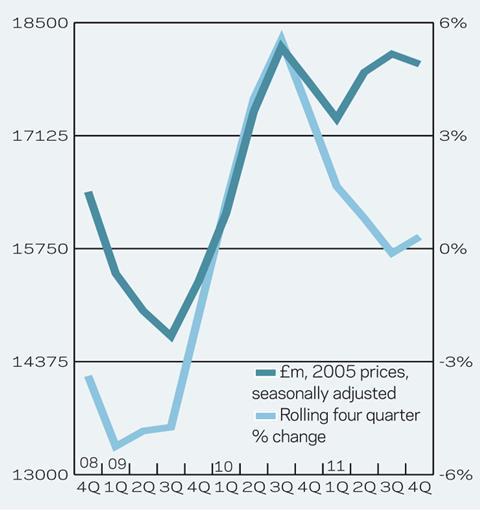

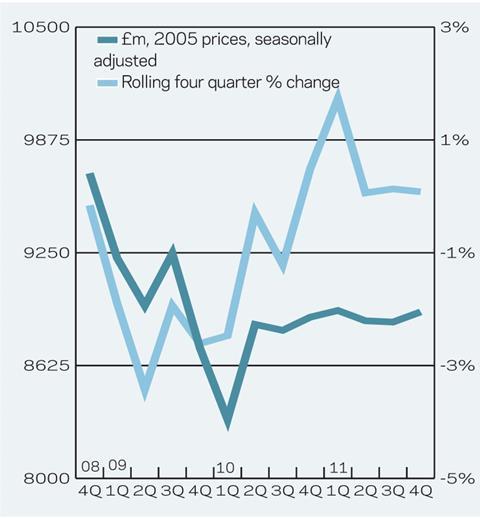

Construction output fell by 0.2%, quarter-on-quarter in the final three months of 2011, following two successive quarterly increases. For 2011 as a whole, construction output rose by 2.4% to a total of about ┬Ż107bn (2005 prices). Growth was slightly stronger in new work output (2.7%) than in repair and maintenance (2%) during the year.

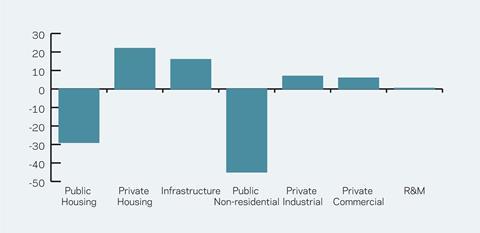

On a sectoral basis, growth was strongest in the private housing sector in 2011, where output rose by 9%. This was a second successive annual increase, as the sector continued to recover from marked contractions during the depths of the recession. However, it is worth noting that the outturn of just ┬Ż14bn in 2011 was still only 67% of its 2006 peak. Although there has been some improvement in demand, the housing market still faces a number of headwinds, namely tight credit conditions and continuing concern over potential job losses.

The infrastructure sector also fared well, as output rose by 8% to a record high of ┬Ż13bn. Work is continuing on a number of large projects in the sector such as Crossrail, various station upgrades and the London Gateway port, while work is due to complete shortly on the M25 widening scheme, which has helped to boost output in the sector over the past couple of years.

In contrast, although public non-residential construction output held up relatively well in the first half of the year, this was not true for the second half as output fell by 9.5%, quarter-on-quarter, in the final three months of the year. Output in the sector totalled ┬Ż12.5bn in 2011, a decline of 6.5% on the previous year. The indications are that contractors may have been bringing forward ║┌Č┤╔ńŪ° Schools for the Future (BSF) ŌĆ£legacyŌĆØ work to help maintain turnover in the short term.

2011 was also a tough year for the industrial sector as output fell by more than 9%. The outturn of ┬Ż3.6bn was only slightly above 2009ŌĆÖs record low. It was expected that the sector would benefit from the UKŌĆÖs anticipated export-led recovery, but that petered out towards the end of the year.

On the repair and maintenance side, the public housing sector was the only one to see declining output in 2011, which fell by 8% during the year. Most expenditure in this area is undertaken by local authorities, whose budgets are under severe pressure.

Construction new orders dropped by 14% in 2011 to just under ┬Ż43bn (2005 prices), the lowest annual total since 1980. The private housing sector was the only one to see any increase in orders during the year (by 6%). It was, not surprisingly, the public sectors, both housing and non-residential, where orders fell at the strongest rate (by 28% and 35%, respectively). Given this weak profile for new orders, the outlook for the construction sector is downbeat, certainly in the shorter term, with little public money available for substantial investment programmes and improving but still shaky performances from the private sectors.

02 / NEW WORK OUTPUT

03 / R&M OUTPUT

04 / NEW WORK ORDERS

05 / 2012-14 FORECAST

The chart (below) presents sectoral forecasts for 2012 to 2014. The public sectors are expected to fare the worst over the period to 2014, with public non-residential output forecast to decline by 45% over the period as work completes on the remaining BSF schemes and there is little or no funding available for any similar-sized programmes of work. The infrastructure sector will benefit from work on Crossrail gathering pace over the forecast period, with tunnelling for the scheme starting imminently at Royal Oak. Although work is due to complete on the M25 widening scheme this year, there are a number of station upgrade projects taking place and the London Gateway port is due to open in late 2013.

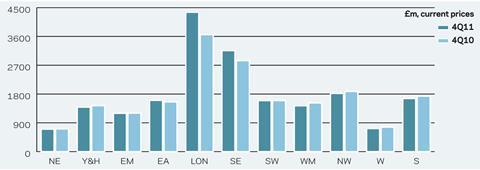

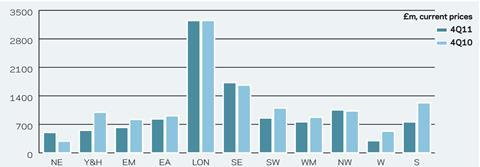

06 / REGIONAL NEW WORK OUTPUT

Only three of the eleven regions and devolved nations saw an increase in their new work output in the fourth quarter of 2011, although a further two (East Midlands and South-west) saw no change on an annual basis. Greater London saw the strongest rise (19%), followed by the South-east (11%) while new work output in the East rose by 3%, year-on-year. New work output fell 6% in Wales and the West Midlands, and 4% in Scotland.

07 / REGIONAL R&M OUTPUT

The strongest regions for R&M output in the fourth quarter of 2011 were also those in the greater South-east: Greater London (+18%), the East (+12%) and the South-east (+7%). The East Midlands saw a more modest rise of 2%, while R&M output in Wales remained unchanged from the same period in 2010. In contrast, R&M output fell 10% in the North-east and by 7% in Scotland.

08 / REGIONAL NEW WORK ORDERS

New orders in the North-east rose by a hefty 74% in the fourth quarter of 2011, albeit from a 10-year low the same time in 2010. The South-east and North-west were the only two other regions to see growth during the period, rising by 4% and 3%, respectively. Orders remained unchanged in Greater London. In contrast, in Wales and Yorkshire and the Humber orders declined by 44%, and by 38% in Scotland.

No comments yet