黑洞社区鈥檚 annual rundown of Europe鈥檚 top 300 contractors confirms the continued dominance of the French - Vinci and Bouygues remain in the top two positions. Mark Leftly and Emily Wright reveal the secrets of the superpowers鈥� success and split the continent into six regions to analyse how fast the PPP and concessions markets are developing.

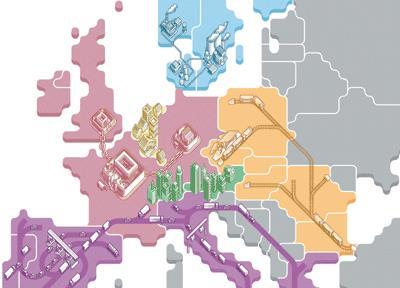

黑洞社区鈥檚 new map of Europe 鈥�

Royal BAM

Number 1 in the Low Countries

Chart Position 9

Based Netherlands

Turnover&苍产蝉辫;拢5.1产苍

Employees 27,000

Major markets Netherlands, UK, Ireland, Belgium, Germany and the US.

What they say 鈥淓ven though Royal BAM Group has grown enormously in recent years, and is associated with mega-projects, we still like to profile ourselves as the 鈥渇riendly builder around the corner鈥�. A significant part of our turnover still comes from smaller jobs.鈥�

What the analyst says Thijs Hovers, ABN Amro: 鈥淭he challenge for BAM is to get its German business back at break-even - it lost *25m last year. If it can narrow losses to below *10m in 2006 it will be quite an achievement.鈥�

Potential sector targets Housebuilding - the government is looking to increase housing construction to 90,000 a year. It was just 60,000 in 2004, but a loosening of the rules governing housing permits led to double-digit growth in 2005.

Potential UK targets Probably none - it already has Edmund Nuttall and HBG - and it is digesting its recent 拢650m purchase of property group AM. In fact, it鈥檚 likely to be a target itself - listed Dutch contractors are undervalued compared with their European peers, which could tempt a venture capitalist to take them private.

Dutch dominance

Dutch construction companies dominate the Low Countries. However, they are still reeling from in investigation by the Netherlands Mergers and Monopolies Authority, which found that up to 700 construction and utilities companies operated a cartel between 1998 and 2002. As a result, many construction companies find themselves undervalued on the Dutch stock exchange. With a PPP market that is developing in hospitals, schools and housebuilding, these relatively low-valued companies are tasty targets for venture capitalists and foreign contractors alike.

As Hovers puts it: 鈥淭he Low Countries have been picking up, with more infrastructure being built and a strong housing market. There was consolidation in Dutch construction until about two years ago when the price-fixing investigation took place and then it came to a standstill. Now that they are undervalued compared with their European peers, they could attract international companies and private equity firms.鈥�

Hovers adds that he expects Royal Bam to continue its dominance in PFI schools and hospitals contracts, and estimates it will pick up three or four schemes in 2006 to go with the 21 it already has. Bam, he adds, will be among the first to take advantage of the secondary market - when construction companies sell on their PFI stakes once the building has been constructed - when it begins to establish itself in two to three years鈥� time.

Although the company likes to bill itself as a local contractor, BAM does hint that PPP is likely to be its growth driver in the next few years, given that it has just set up an operating company dedicated to the procurement method. A spokesperson for BAM adds that the company has more than a dozen tenders for PPPs pending in the UK, Ireland, Belgium, Germany and the Netherlands.

This time last year, building was congratulating Vinci and Bouygues on their dominance of the European construction market. The table of the top 300 European contractors had shown that the French companies had pushed the mighty Skanska into third place, thanks mainly to their engineering know-how and their skill in managing the construction process.

This time this year, we鈥檙e lobbing more bouquets at them, because Vinci has increased its turnover 8%, and Bouygues has grown 7%. Skanska, by comparison, has dropped 9%, thanks to the subdued US economy and the 拢52m hit it took on a liquid natural gas contract in the UK. Stuart Graham, Skanska鈥檚 president and chief executive, points out that with 12,000 contracts under way at any one time, a few problems are to be expected. Nevertheless, the business will come roaring back at the French lions next year.

The UK鈥檚 national champions can boast an improvement this year, with four companies in the top 20 compared with three last year. This puts it ahead of Spain, which has three. The biggest UK company was again Amec, although this could be its last year on top given its plans to break itself into two listed businesses and sell off Spie, its profitable French subsidiary. Blighty鈥檚 materials groups also did well, with Wolseley surging 23% to break-up the almost traditional top two of Saint-Gobain and Lafarge - another pair of French giants.

But perhaps the biggest story of 2005 and the coming year is the development of PPP procurement. This has recently arrived at the Low Countries and the central and eastern regions, and is growing rapidly in the Mediterranean area, where the process is entering a period of rapid expansion.

As a result, this year 黑洞社区 has split Europe into six regions, assessing the PPP and general markets in each and profiling their leading companies 鈥�

Vinci has increased its turnover 8%, and Bouygues has grown 7%. Skanska, by comparison, has dropped 9%

Skanska

Number 1 in Scandinavia

Chart position 3

Based Sweden

Turnover&苍产蝉辫;拢9.1产苍

Employees 54,000 (2004)

Major geographic markets Sweden, the US, UK, Denmark, Finland, Norway, Poland, the Czech Republic and Argentina.

What they say 鈥淚 don鈥檛 think we鈥檙e characterised by being dominant in a market or sector - this is a fragmented industry. Everywhere we operate, though, we want to be a leading player, so that we get good name recognition and attract the best staff.鈥�

Stuart Graham, President and CEO of Skanska

What the analyst says Erik Nyman, Enskilda Securities: 鈥淪kanska鈥檚 troubled area has been the USA for the past couple of years - it was a struggling economy with huge deficits and a lack of an infrastructure programme, which is needed to be successful. There is a programme in place now so results should improve.鈥�

Potential sector targets Perhaps the US market, where Graham feels that the civil engineering market is taking off.

Potential UK targets No current acquisition plans.

Social progress

The Scandinavian market is the least developed for PPP work. This is a social democratic region, where the notion of private money entering the public realm remains a political problem. In Sweden, for example, the only major PPP is a tram link that was built at the start of the decade.

However, should the market develop later, Skanska will be well-placed to dominate. It runs a few PPPs in Norway and Finland, but its experience on the mega-PFIs in the UK, such as the troubled 拢1bn St Bartholomew and Royal London scheme in London, should give it an edge over rivals.

Skanska, though, had a bit of a dip in 2005, largely because of the ailing US economy. Stuart Graham, president and CEO, insists that the company will bounce back, and suggests that if the US develops a PPP market Skanska will be among the big players.

Erik Nyman, a construction analyst at the Stockholm office of Enskilda Securities, agrees that there are some good years ahead for Skanska. He points out that its problem was its history of buying companies across many geographic markets - simple to do, because the barriers to entry in construction are 鈥渞elatively thin鈥�. However, Nyman argues that Skanska lacked the management resources to run these companies to their potential.

Nyman says Skanska has turned itself around by concentrating on nine business units - for example it sold its Hong Kong business, Gammon, to Balfour Beatty for 拢36m in 2004. This allows it to focus management resources on building up market leaders in each of the areas it operates. As Graham puts it: 鈥淓verywhere we operate we want to be a leading player.鈥�

Metrostav

Leading domestic player in central and eastern Europe

Chart Position 123

Based Czech Republic/Slovakia

Turnover&苍产蝉辫;拢250尘

Employees 3,100

Major markets Czech Republic and Slovakia.

What they say 鈥淢etrostav was founded for the purpose of constructing the underground railway system in Prague. After 1995, its activities diversified and currently the company operates throughout the construction market. It has retained its dominant position in the field of underground construction, reinforced concrete structures and the refurbishment of listed buildings.鈥�

What the analyst says Victor Kotlan, chief economist at Erste Bank, comments: 鈥淧PP is just starting to develop as a way to finance projects in the Czech Republic here and the EU is committing *3bn (拢2bn) a year, a lot of which is for construction opportunities that Metrostav can take advantage of.鈥�

Potential sector targets Metrostav says that it is looking to enter central and south eastern Europe either by direct entry or acquisition of existing local companies.

Potential UK targets No plans to broaden its activities to the UK.

Eastern promise

The central and eastern European markets are dominated by Skanska and Vinci, which owns SSZ. Both have operations in the Czech Republic, although that nation does have home grown stars. Not least of which is Metrostav. It was founded in 1971 as a state company. It has since been bought by Slovakian giant Doprastav Bratislava and diversified into areas such as housing and roads.

Up to 700 Dutch construction and utilities companies operated a cartel between 1998 and 2002

The company is one of many riding the central European boom, and as a result, construction companies are among the best payers in the Czech Republic and neighbouring countries. Metrostav increased salaries 8-10% last year and Skanska gave an extra 5% to its blue collar workers.

Employees can expect these hikes to continue as firms take advantage of the burgeoning PPP market. A Metrostav spokesperson says: 鈥淭he PPP market is in its initial stages and Metrostav plans to be active in this way of contract procurement.鈥� He adds that other new EU states plan similar programmes, and Metrostav will therefore start to look at other former communist bloc countries.

Victor Kotlan, chief economist at Prague鈥檚 Erste Bank, is convinced that the emerging PPP policy will turn domestic contractors into major European players: 鈥淲e have a 5% growth rate in central Europe, largely due to investments such as infrastructure. PPP will take-off.鈥�

Bauholding Strabag

Number 1 of the Alpine countries

Chart position 15

Based Austria

Turnover&苍产蝉辫;拢4.1产苍

Employees 33,000

Major markets The company operates in 15 European markets, including Austria, Belgium, Germany, the Ukraine, Hungary and Switzerland.

What they say 鈥淲e are one of the leading providers of construction services in Central and Eastern Europe.鈥�

What the analysts say 鈥淪trabag is not only the major player in Austria, it is fast taking over its German neighbours.鈥�

Potential sector targets Bauholding Strabag last year bought Germany鈥檚 third largest contractor, Walter Bau, which it is using to continue its drive into the European PPP market.

Potential UK targets None at present, but could look to poach UK staff with PPP experience.

Austria arrives

A tender for the first of Austria鈥檚 four planned road PPPs came out towards the end of last year, demonstrating the country鈥檚 new-found commitment to the procurement system. Unsurprisingly, Austria鈥檚 biggest contractor, Bauholding Strabag, found itself on the shortlist for the *850m Ypsilon road project, which involves the construction of 51 km of roads.

Up against Strabag in the shortlist are consortiums led by Hochtief and Bilfinger Berger, respectively fourth and 14th in this year鈥檚 top 300 table. This is a common situation for Strabag, as it is not only Austria鈥檚 number one, but also one of the three major players in Germany, following last year鈥檚 acquisition of Walter Bau. With four construction companies also now cemented in the top 50, this acquisitive growth and hunger for the PPP markets of Europe鈥檚 big countries demonstrates how Austria is starting to turn itself into a major player in the market. The country is also benefiting from a relative boom domestically, with expansion in the construction industry expected to be 2% this year and 1.9% in 2007, up from an average of 1% a year in 1999-2004.

Austria鈥檚 neighbour, Switzerland, is characterised by a highly fragmented construction market. However, it looks like the next few years will see a period of consolidation, following the November鈥檚 merger between 69th ranked Zschokke and 96th placed Batigroup. Named Implenia, this is now Switzerland鈥檚 biggest construction company, and will look to take advantage of the country鈥檚 housing boom.

ACS

Number 1 in the Mediterranean region

Chart position 5

Based Spain

Turnover&苍产蝉辫;拢7.5产苍

Employees 108,000

Major geographic markets It is split into three divisions that cover most of the globe. These are: construction, industrial services, and services and concessions.

What ACS says 鈥淲e are growing in all our businesses thanks to our competitive advantages, such our global coverage excellence, proven experience over 30 years, our lean and flexible organisation, strong cash flow and low leverage.鈥�

What the analyst says: Over to Thomas Pinto of Kepler Equities 鈥�

Vinci is moving from a construction business with some concessions elements, to a concessions business with some construction elements

Strengths 鈥淭he management of its working capital, and the fact that its industrial services division is not capital intensive. The high oil prices has boosted its industrial services division, and this separates it from the other big Spanish companies.鈥�

Challenges 鈥淭hese guys have bought 25% of Union Fenosa, Spain鈥檚 third largest electricity company. In the next two months they will raise it to 34.5%. They have to better explain this strategy to the market - and they are going to need more cash to pay off the debt.鈥�

Potential sector targets ACS admits to wanting to expand its activities in the USA services market.

Any potential UK targets? Spanish construction companies are generally cash rich and ACS may look to the UK for its advanced PPP, waste management and road maintenance knowledge. However, with a 拢7.5bn turnover, ACS would need to buy a big beast to justify expansion. The market capitalisation would have to be between 拢600m and 拢1bn, with an underlying gross profit of about 拢70m.

Spanish strength

Spanish contractors and government have long been enamoured of the UK鈥檚 PPP model, and their own country鈥檚 market in toll roads is reaching maturity. According to Pinto, many contractors are now swapping stakes in big schemes. For example, ACS and Ferrovial might have 50% stakes each in a road project and a hospital scheme as they initially bid together as a consortium. A few years into the projects, they would decide to swap their holdings so that they have greater control of their schemes but fewer of them.

An ACS spokesperson says the Spanish PPP market will be 鈥渙ne of the largest and most dynamic markets across Europe thanks to the ambitious PFI infrastructures plan鈥�. A result of this, the Spanish construction industry is likely to consolidate as big companies look to strengthen their balance sheets to pitch for the larger schemes. Companies such ACS might well look to UK firms to provide them with extra PPP expertise.

Vinci

Number 1 in Europe鈥檚 traditional centre of power

Chart position 1

Based France

Turnover&苍产蝉辫;拢13.4尘

Employees 45,700

Major geographic markets France, UK, central Europe, Africa

What they say 鈥淰inci is never dominant in any market in which it operates, but is always one of the market leaders, sometimes number one,鈥� says Philippe Ratynski, chairman of Vinci Construction

What the analyst says 鈥淚t鈥檚 moving from a construction business with some concessions elements, to a concessions business with some construction elements. It makes sense - concessions鈥� cash flows are very stable, making it very complimentary to construction.鈥�

Potential sector targets The company is looking to expand its presence in central Europe, particularly on large infrastructure projects.

Potential UK targets Effectively ruled out - Ratynski thinks the price of construction companies in the UK is too high in comparison with their financial results, but he might continue to buy local companies to complete its geographic coverage. However, analysts believe that Amec鈥檚 French-based services division, Spie, could be of interest, because it would cost between 拢400m and 拢500m.

The mature market

The traditional powers of Europe - France, UK and Germany - find themselves at different points of the PPP cycle. The UK is very much a mature market, so big Continental players such as Vinci and the Germany contractor Hochtief have a strong presence here.

Germany has not moved as quickly as had been expected towards PPP, partly because the right-leaning Christian Democrats failed to secure a majority in parliament in last year鈥檚 elections. The process of building a coalition then led it to drop some of its more audacious plans for privatisation and PPP.

France is a little more advanced, and some big projects were announced in the last three months of 2005. There is a *1.3bn (拢900m) programme to build 18 prisons for 13,200 inmates, and 35 hospitals. However, PPP is unlikely to develop much further in the short term, given the left-leaning nature of the country鈥檚 political culture. More popular is the concessions market, with Europe鈥檚 major construction company, Vinci, looking to expand in this area. For a cool *6.5bn (拢4.5bn), Vinci recently snapped up Autoroutes de Sud de la France, the country鈥檚 largest motorway company.

Vinci鈥檚 PPP knowledge largely derives from the UK, meaning that it is unlikely to be in a strong position for those few PPPs that are emerging. One leading construction analyst says good relationships with local government officials are as important as experience. So, perhaps it is unsurprising that Ratynski says: 鈥淔urther development [in France] will be focused on deepening our local network, taking a strong line on the nascent PPP market.鈥�

In the UK, Ratynski claims that 2006鈥檚 challenge will be to find and retain good quality staff, and says he is keen to bid for the 拢10bn Crossrail project. He argues that acquisition is unlikely, given the relatively high cost of UK contractors. However, at least one analyst believes that the company is eyeing up Spie, Amec鈥檚 French services business.

黑洞社区鈥檚 new map of Europe 鈥�

1 The Low Countries: The Dutch housing market is booming, and the government wants to built 90,000 units a year

2 Scandinavia: Skanska remains dominant here, and sees the Americas as a potential growth market 鈥� it is currently bidding for a 1,800 km electricity transmission line project that will cross six countries, including Costa Rica and Guatemala

3 Central and eastern Europe: the expansion of the European Union and the liberalisation of the economy is leading to the development of modern infrastructure, including rail work

4 Alpine nations: Austria鈥檚 financial district has been buzzing about the emergence of its largest contractor, Bauholding Strabag, as a buyer of European rivals

5 Mediterranean countries: Toll roads are booming, with Spanish contractors particularly active

6 The central powers: Even privatisation-fearing France is embracing the PPP market here, with the announcement last year that 18 prisons will be built using the procurement method

Methodology

The following rankings were compiled by 黑洞社区鈥檚 sister publication Le Moniteur des Travaux Publics et du B芒timents with the assistance of Martin Hewes for 黑洞社区 (UK), Costruire (Italy), Marcel Linden (Germany), Guy de Faramond (Scandinavia), Brigitte de Wolf (Belgium and the Netherlands), Jacques Ramon (Spain), Sergio Ribeiro (Portugal), Eszter Domonkos (Hungary) and Magda Viatteau (Poland). Companies that did not respond to the survey include: Brochie, Heitkamp, Oevermann, Wiemer & Trachte and Pihl & Son. Profit and turnover figures have been calculated using the most recent available exchange rate: 拢1 = *1.45. A dash denotes information not given or not applicable.

Downloads

Europe's top 300 tables

Other, Size 0 kb

Postscript

Cartography: Lee Hasler

No comments yet