Phil Birch and Adam Mactavish of Sweett Group summarise some of the key elements in the draft bill to reform the electricity supply market, and consider the implications for commercial property

01 / INTRODUCTION

The Government’s recent draft Energy Bill sets out the proposed steps to electricity market reform (EMR). It is fair to say that the bill has received a mixed reception. While some parties expressed gratitude to see a significant piece of energy legislation published, others are less positive in their feedback. Their concerns are that it lacks clarity and is insufficient for decarbonising the UK’s energy supply in a cost-effective manner.

On publication of the draft bill, the energy secretary, Ed Davey, summarised the need for the EMR: “By reforming the market, we can ensure security of supply for the long term, reduce the volatility of energy bills by reducing our reliance on imported gas and oil and meet our climate change goals by largely decarbonising the power sector during the 2030s.”

Expanding on this, Davey highlighted the following drivers behind the introduction of the EMR:

- Over the next decade, around a fifth of existing power generating capacity will come offline

- £110bn of investment is required to bring forward new low-carbon power generation for the 21st century

- The UK could face blackouts if actions are not taken soon to upgrade its energy sector

- The UK has become increasingly reliant on imported energy from potentially politically volatile countries

- Electricity demand is likely to double by 2050

- The cost of global gas and oil is what is driving energy bills for households; this trend is predicted to continue.

02 / WHAT’S BEING PROPOSED?

The principal measures set out within the draft bill include:

- Feed-in tariffs with contracts for difference (CfDs) - long-term instruments under which the amount of tariff payment is adjusted to provide a consistent revenue to the generator, thereby providing stable and predictable incentives for companies to invest in low-carbon generation

- The introduction of an Emissions Performance Standard (EPS) will curb the most polluting fossil fuel power stations (to 450g/kWh)

- A carbon price floor to incentivise the move away from high carbon technologies by increasing the price paid for emitting carbon dioxide

- A capacity market will be established to reduce the likelihood of future blackouts by ensuring there is sufficient reliable capacity to meet demand, allowing consumers to continue to benefit from reliable electricity supplies at an affordable cost

- Measures relating to conflicts of interest and contingency arrangements

- Renewables transitional measures will ensure that existing investments under the Renewables Obligation remain stable.

Despite the bill setting some bold targets and requirements, concerns have been raised. These include:

- Anxiety that the EMR will load electricity bills with expensive subsidies

- The CfD approach is complex and risks skewing the market towards nuclear and offshore wind generation (the government expects offshore wind generation to provide 20% of Britain’s renewable energy by 2020). Both are considered expensive options

- A capacity market is a significant intervention with potentially very high administration costs. This will disproportionally impact smaller generators ,and hence favour the big six energy suppliers. The details of how the capacity market mechanism will work are very high level. Further information is not due until late 2013

- Lack of clarity as to whether the EMR will provide incentives for energy efficiency

- The timescales proposed are extremely tight to achieve wholesale changes

- The EPS limit may still facilitate the development of new coal fired power stations without Carbon Capture and Storage (CCS).

03 / POTENTIAL IMPACT ON ENERGY PRICES

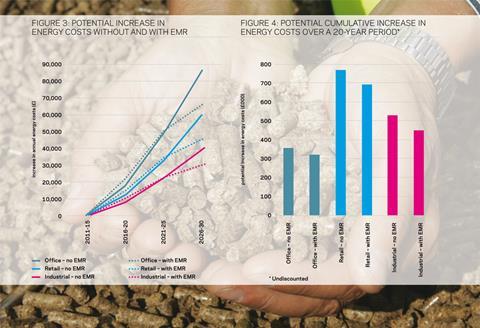

As well as providing proposals for the structure of electricity markets, the draft bill provides some interesting insights into the future costs of energy in the UK. The projections of the Department for Energy and Climate Change (DECC) suggest that market reform will help to mitigate the potential for future price rises, but that this greater future security will come at the cost of higher energy prices up until 2020. Effectively, the policy will begin to protect the UK from unstable fossil fuel price levels, but this will incur significant transitional costs of about £110bn, which will need to be recovered through energy bills.

It is clear that with or without EMR the future of level of electricity bills is only likely to go up. Most people have expected this for some time, but the analysis supporting the draft bill provides a stark reminder. By 2030, energy costs in a typical office could be up to 8% of total occupancy costs and for many the costs could be 10% or more. The increase in the relative significance of energy costs together with regulations restricting the letting of buildings with poor energy perfprmance certificate ratings (F or G) means that energy performance should continue its inexorable rise up the agenda of developers and property companies.

The analysis below looks at the impact of projected increases in energy prices on operating costs for different buildings and provides some options as to how this impact might be mitigated. Figure 1 provides an excerpt from the impact assessment, setting out how energy bills are predicted to increase for the non domestic sector.

FIGURE 1: FORECAST INCREASE IN NON-DOMESTIC ENERGY COSTS

| Period | Forecast impact on energy costs (%) | |

| No EMR | With EMR | |

| 2011-15 | - | 0.1 |

| 2016-20 | 10 | 12.5 |

| 2021-25 | 28 | 28.5 |

| 2026-30 | 50 | 37.8 |

To assess the impact of the proposed increases, three building types have been investigated; these are described in figure 2.

FIGURE 2: BUILDING TYPES INVESTIGATED

| �ڶ����� (all assumed to have floor area of around 5,000m2 | Description | Baseline gas consumption (kWh/m2) | Baseline electricity consumption (kWh/m2) |

| Office | Constructed in 2002, air-conditioned, deep-plan | 33 | 120 |

| Retail | Constructed post-1990, supermarket, deep-plan | 86 | 255 |

| Industrial | Constructed post 1990, deep-plan |

48 | 189 |

04 / POTENTIAL ENERGY EFFICIENCY UPGRADES

There are number of options available that when deployed at the appropriate moment (that is, at the correct time within the maintenance cycle) can make a significant dent in energy consumption. A range of “quick win” options are presented below in figure 5. The payback periods presented are discounted and based on DECC’s “Central” price scenario. DECC produces a range of different energy price scenarios, the central scenario is the middle option.

It should be noted that given the potential increase of energy costs put forward in the draft bill, many of the longer payback periods will be reduced considerably (further justifying the business case for deployment of the measures).

FIGURE 5: QUICK WIN ENERGY EFFICIENCY UPGRADES

| Option | Capital cost (£) | Discounted payback (no of years) |

| Office | ||

| Daylight sensing | 12,160 | 2 |

| Variable speed pumps | 3,840 | 2 |

| 0.95 power correction factor | 2,133 | 3 |

| Chiller (coefficient of performance = 5.4) | 25,601 | 3 |

| T5 lighting | 38,401 | 6 |

| Retail | ||

| 0.95 power correction factor | 2,133 | 2 |

| Heating and cooling - variable speed pumps | 5,973 | 3 |

| DC drive fan coils | 32,001 | 6 |

| Air tightness | 21,300 | 9 |

| Heat recovery | 35,142 | 12 |

| Industrial | ||

| 0.95 power correction factor | 2,133 | 6 |

| Heating - variable speed pumps | 569 | 13 |

| 95% efficiency boilers | 4,053 | 18 |

The numbers from the above table have been extracted from work that Sweett Group has recently undertaken on behalf of the Investment Property Forum (IPF). This report analyses a wide range of energy efficiency options and identifies the most effective ways to improve the energy efficiency of existing buildings. The report will be released towards the end of the summer.

05 / SUMMARY AND CONCLUSIONS

Before the draft Energy Bill gains royal assent, further analysis will need to be undertaken so the government can confirm that it represents the most logical strategy to providing secure, affordable, low carbon energy in the future.

Analysing the forecast increases in energy costs demonstrates that the route to decarbonised energy is likely to be an expensive one, even if the alternative of relying on imported fossil fuels is even more costly.

If the transition to decarbonised energy is achieved, there still remains the need to reduce energy consumption on the basis that the cost of the “decarbonised” energy will be so high. Taking steps to make marginal investments in higher levels of energy performance during periods of planned investment, refurbishment or development is likely to pay significant dividends in the future.

Critics have raised concerns that the bill doesn’t provide assurance regarding requirements for energy efficiency to be addressed.

The underlying fact is that regardless of the EMR, energy prices are forecast to increase. Businesses wishing to retain a competitive edge should ensure that their buildings operate as efficiently as possible.

KEY DATES

2012

Strategy regarding role of gas to be developed

Operational framework for Implementation Roadmap due to be published in autumn

2013

Royal assent of the full bill

Consultation on first set of strike prices for renewable technologies

Carbon floor price of £16/tCO2 introduced

2014

Delivery plan for CfDs

2017

Phase out of Renewable Obligations (RO) to be replaced by CfDs

2020

UK committed to make a 34% reduction in CO2 (compared to 1990 baseline)

Carbon floor price at £30/tCO2

2022

Approximately 20% of power stations to come offline

2045

The EPS for gas will allow some power stations to operate until now

2050

CO2 emissions to be reduced by 80% (in comparison to 1990 baseline)

No comments yet