Output for sector in December fell for first time in seven months

Construction growth fell by 12.5% last year as the country’s economy shrank by the biggest amount in 300 years after being ravaged by the covid-19 pandemic.

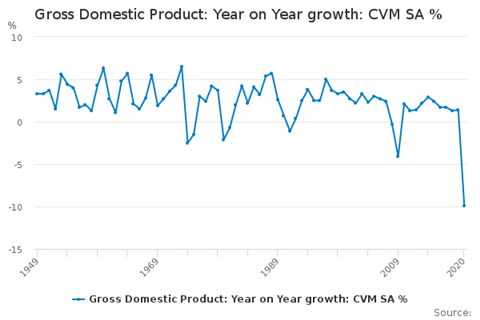

The slump is the largest since 1709 when the economy fell by 13.4%, though this is well before proper economic statistics became commonplace.

The Office for National Statistics said gross domestic product (GDP) fell by 9.9% in 2020 as no sector of the economy was left unscathed by lockdown.

Last year’s fall for construction was the biggest of all the four sub-sectors measured by the ONS with agriculture slumping 9.4%, services slipping 8.9% and production heading south by 8.6%.

According to international comparisons with other leading economies, UK output fell the most in the second quarter of last year when the pandemic first took hold with a fall of 19%. The next biggest faller during the period was Spain which saw its economy reverse by 17.9% with the falls for the US and Germany both below 10% - at 9% and 9.7% respectively.

The 19% fall for the UK economy followed a 2.9% slump in the first three months of the year which sent the country officially into recession.

Despite a fall in output in December, construction grew by 4.6% in the last quarter of last year helping the economy avoid a double dip recession, which overall grew by 1% in the last three months of 2020 following growth of 16.1% in the third quarter.

It said all types of work, apart from private commercial, contributed positively to growth during the three months with the largest contribution coming from private new housing, which grew by 6.7%.

But output in construction fell by 2.9% in December 2020, following seven consecutive months of growth.

All types of work fell during the month with the decline driven by falls in both private new housing and private commercial of 3% and 6% respectively.

A remarkable recovery and story of resilience

Prospects are improving but latest figures come with notes of caution, says Simon Rawlinson

Considering the shocking contraction in the second quarter of 2020, when output fell by a record 35% overall, the sector has staged a remarkable recovery. It is a great story of resilience, especially housebuilding which is pretty much back to normal after a 51% fall in private new housing in the second quarter.

As you would expect, infrastructure has seen a very strong recovery. It is also worth highlighting that the only sector to see a contraction in the fourth quarter of last year was commercial. It is the big “watch out” for construction and is still looking weak.

Latest figures saw the orders data come through and this brings a note of concern. Volumes in the third quarter were largely back to normal after a dire second quarter (down 50%) but there was always a worry that some of this was catch-up and that the underlying level of demand was not that strong. Q4 orders are 12.9% down, with commercial down by more than 20% on the long-term trend.

Commercial is looking pretty sick, as is the public sector in terms of building, such as hospitals and schools, but here we know that the spending is yet to come.

With industrial also bouncing back strongly, there is a strong picture of winners and losers, which can also be seen regionally, where there is a really robust pipeline in the East, North-west and Yorkshire contrasts with very weak data for London and South-east. The implications are that the market will remain competitive – even as prospects improve.

Simon Rawlinson is head of strategic research and insight at Arcadis

No comments yet