The trade insurance market is in deep trouble, and the firms that rely on it are having to turn away work just when they need it most. Katie Puckett reports on what’s gone wrong, and how it can be rectified

Firms aren’t in the habit of turning down work these days, but Matt Bowyer does it every day. He is director of Ductwork UK, a provider of M&E staff, and he says he is unable to satisfy at least 10% of the enquiries he receives from existing customers and 70% of those from other businesses. What’s more, the rejection rate is inexorably rising. The galling thing is that he would dearly love to take this work on – but he can’t because his credit insurer will no longer cover his key customers.

“There’s nothing worse than having to turn to customers and say, ‘We can’t trade with you’. You’re basically telling them you think they’re completely uncreditworthy. They know it’s not our fault but the attitude tends to be, ‘If you can’t provide it, we’ll have to find someone else who will’. It’s a hard pill to swallow.”

Bowyer is facing a double hit, because there is less work out there and payment periods are lengthening, so he can ill afford to lose customers. “I’ve not seen so many contractors available for a long time. It’s frustrating – the best guys in the industry are sat at home and we can’t engage them.”

The reason for this exasperating situation is that there has been a sudden retrenchment on the part of global credit insurance firms. Underwriters understandably consider housebuilding and construction high-risk sectors right now, but their blanket withdrawal of cover from almost any firm exposed to these markets has provoked rising anger. Longstanding customers with sound balance sheets and strong workloads have suddenly been stripped of cover or have had their credit limits slashed with little or no warning, at the worst possible time. In many cases, companies must continue to pay a minimum premium – in Bowyer’s case, 0.7% of turnover, or £18,000 a year – even as their policies have become next to worthless. In the rare cases where new policies are available, the premiums are rising steeply. This has led many around the industry to wonder if the system can be fixed, reformed or simply bypassed altogether.

‘The most important issue in our industry’

“I get daily complaints from members,” says Michael Ankers, chief executive of the Construction Products Association. “It’s probably the most important issue in our industry and it has been for months. It’s got worse and worse and worse, and it’s really snarling up the system. Perfectly reputable companies are finding their credit insurance is withdrawn completely, not because of their business, but just because it’s construction.”

Ankers has been working closely with the CBI to make the government aware of the problem, and persuade the Treasury and business and enterprise department (BERR) of the necessity of a rescue scheme, similar to the government-backed credit offered to SMEs. They’ve been waiting for months now but while business secretary Peter Mandelson is apparently aware of the problem he is always a week away from making an announcement.

Construction has always been heavily dependent on credit insurance arrangements to protect firms’ cash flows. Companies take out policies to guarantee a level of payment should a customer fail while owing them money. They also use their insurers as a source of market intelligence on potential trading partners. But any confidence they might have had in insurers’ judgment is being quickly eroded.

Nicholas Howarth is the managing director of Howarth Timber Group, which has insured all its customer accounts with one of the largest providers for 30 years. Nine months ago, he noticed that it was progressively reducing its credit limits. “It’s almost across the board. If a company is a property developer or a private housebuilder, even if the housebuilder arm is a relatively small part of the whole group and there’s no chance of it going out of business, it is getting its limits zeroed. They’ve cancelled limits at quite short notice. In previous recessions, we’ve been able to use the lead taken by underwriters as a useful indicator of the probability of business failure. But because they’ve taken such a shotgun approach, you’ve almost got to ignore the fact that customers have got no credit.”

Howarth feels he has no choice but to disregard the insurers’ assessment: “If your main market is resi new build, and you’re in the position where two-thirds of your customer base has had their limits zeroed, you either continue trading or you shut up shop. If we couldn’t deal with 15 of the largest 20 housebuilders, we wouldn’t have much of a business.”

Non-negotiable demands

One of the most frequent complaints from construction companies is the insurers’ high-handedness. Last November, one large insulation company received a request for a meeting from Atradius, which insured many of its suppliers. The finance director duly went down to its Cardiff office and had what he recalls as a fairly amicable encounter. He worked with it to reduce credit limits by 40% – most suppliers take out far more cover than they need to be on the safe side – and hoped that would be the end of it. Then, without telling him, it started rejecting new applications for cover and threatened to pull cover completely unless the company provided a forecast for 2009 and regular trading updates. “We said, ‘We don’t have any relationship with you, so why would we?’ Why should we supply that information to Atradius when we don’t supply it to shareholders, to employees, to our suppliers? The next thing we knew, they’d written to our suppliers to say that unless we supplied information, they were withdrawing cover. Then in January, they did. It almost felt like once they get their claws into you, they will go as far as they can and ask for deeper and deeper levels of information.”

Atradius’ demands for information are in stark contrast with its own lack of transparency about how decisions are made; these are often hidden behind the confidentiality agreements it says it must give companies. The insulation supplier was told only that the information he provided would be scrutinised by “the committee” but his attempts to find out who they are or speak to them have been frustrated.

This is aggravating the sense of injustice, and feeding conspiracy theories that these global firms have made a unilateral decision to withdraw from UK construction. “In previous recessions, they didn’t take such a broad sector approach,” says Howarth. “They looked at company figures and took a company by company view, and they weren’t withdrawing cover but reducing it.”

In any recession there are winners and losers. Our role is to help our clients to pick those companies that have the greatest chance to withstand it fabrice desnos, euler hermes uk

How the insurance industry has changed

The difference in previous recessions, Howarth believes, is that the companies were UK-owned and had a long-term interest in the market. Three firms now underwrite more than 70% of the UK credit insurance market: Euler Hermes and Coface are both French and operate in more than 50 countries; Atradius is based in the Netherlands and majority-owned by a Spanish insurer, and trades over a similarly wide area. Euler Hermes and Atradius were the first to react, and Coface issued a statement detailing reductions in cover on 16 March.

Brokers also believe the withdrawal is part of a bigger picture. Sally Del Principe is an associate director at broker Perkins Slade and heads their credit insurance division. She is considered an industry expert and has been advising the Treasury on the impossibility of placing new business – some policyholders have had as much of 80% of their cover pulled. “It’s a nightmare, really. There’s no flexibility, no negotiation. They’re pulling cover in tranches. We’ve had five tranches of withdrawals, and there’s 100 customers in each tranche. I call it ‘culling’.”

She’s taken her clients’ customers to meet the major players to demonstrate that they are adhering to a clear risk-management strategy – to no avail. One senior underwriter told her that were it up to him, he would insure her client, but that the decision from Europe was to withdraw. “The committee” does exist, she says – it just has no influence.

Construction firms suspect that the insurers who happily took their premiums through the boom years have made a fast buck and now a swift exit, just as the policies they sold are most valuable. But figures from the Association of British Insurers show that credit insurers are losing more than they ever made. In 2007, they received £334m in premiums for 13,700 policies, covering £282bn of turnover. To put these figures in perspective, industry insiders estimate the collapse of Woolworths (under £385m of debt) last autumn could have cost insurers well over £100m. Del Principe’s view is that insurers acted irresponsibly, offering lower and lower premiums to win market share, but left themselves precious little in reserve for a rainy day – hence the hasty retreat as claims rise.

Insurers themselves blame the banking system for leaving companies with no access to credit, thereby increasing their own risk of claims. Nobody else predicted the scale of the economic collapse, they say, so how were they supposed to? “The scale of this thing is unbelievable,” says Bob Lilley, managing director of CIFS, one of the smaller UK insurers, which has taken a less draconian approach. “My finger hovers over the nuke button from time to time,” he admits. “It’s easy to go down that road, but it’s something we haven’t been doing. We’ve taken cover down but we haven’t done it in a knee-jerk way. We’re trying to manage our way through it through constant contact with policy holders. There’s a hell of a lot of work that goes on.” He did lose business to the big three during the buyer’s market of the boom, he says, because he was not prepared to cut his premiums.

As for the big three, they deny that they have taken a blanket approach to UK construction. “That’s totally untrue,” says Fabrice Desnos, chief executive of Euler Hermes UK. “The construction sector is obviously important for us, it’s always been important. We still have a huge number of clients that we’re trying to support in a particularly difficult time. In any recession there are winners and losers. Our role is to help our clients to pick those companies that have the greatest chance to withstand it. When we withdraw cover from a good and viable business, they will continue to trade and we will lose out.” Premiums inevitably rise with the risk – it’s up to companies to decide whether they can afford them.

Can the system be saved?

Fortunately, companies are mostly choosing to trade even without credit insurance, though those like Bowyer who use factoring arrangements – where they sell on invoices for money to maintain their cash flow – cannot supply companies not covered by insurers. The CBI is optimistic that Mandelson will soon announce a top-up scheme, as the French government did last autumn, under which it takes on half of the insurer’s risk. But it’s been considering such a scheme since January and critics complain that the longer it waits, the less cover there will be to top up. In any case, it is unlikely to be a panacea. As Desnos says, “Not all risk can be insured. It is not reasonable to ask the government to underwrite the whole economy”.

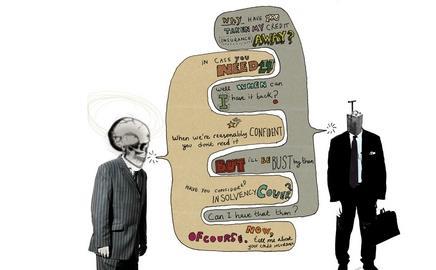

The most common analogy that construction bosses use to describe credit insurers is of umbrella salesmen who are happy to sell you a brolly in the sunshine but who whip it away as soon as it rains. So it is interesting that Desnos also compares his business to selling umbrellas, when he describes a large increase in applications for cover. “We are very selective in terms of our ability to take on new clients. If we were selling umbrellas and the rain starts to come, suddenly everyone wants to buy one.”

But a great many others are contemplating a future without these policies at all. Rudi Klein, chief executive of the Specialist Engineering Contractors Group, has tabled two amendments to the Construction Bill, currently going through parliament, which he hopes would render insurance largely unnecessary. Del Principe is working on a number of self-insurance arrangements for her clients, and Bowyer is among many reconsidering their business models.

Retirement housebuilder McCarthy & Stone had its cover withdrawn last autumn but Michael Ball, its chief financial officer, says its relationships with its hundreds of suppliers were strong enough to survive. A couple asked for reduced payment periods, but none stopped supplying it. But he wonders: “When there are happier times, firms will have to ask themselves whether they want to waste one, two, three per cent of their turnover on insurance.”

Desnos is not worried. “I see the number of companies that we are helping to keep in business by paying claims and I’m sure these people will remember.” He may be in for a shock when the sun comes out again.

The construction industry will certainly remember – but those memories will be of the betrayal they felt when the insurers they trusted deserted them at their hour of need.

Postscript

Original print headline: Terms and contradictions apply

1 Readers' comment