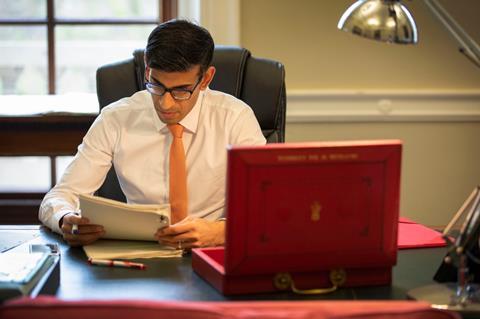

Rishi Sunak announcing spending review on Wednesday

The government has said it will not resort to sweeping public spending cuts in its efforts to rebuild the economy in the wake of the covid-19 pandemic.

Chancellor Rishi Sunak said yesterday people “will not see austerity” when he announces his spending review on Wednesday, referring to the controversial belt-tightening policies seen in the years following the 2008 financial crisis.

He added: “What you will see is an increase in government spending, on day-to-day public services, quite a significant one coming on the increase we had last year.”

Announcements will include the launch of a new National Infrastructure Bank to funnel billions of pounds into capital projects as part of the government’s ‘levelling up’ agenda, according to government officials.

The Treasury has said that the new lender, which was recommended by National Infrastructure Commission chair John Armitt, will be based in the north of England and will be operational by next spring.

It is being designed partly as a replacement for the European Investment Bank, which the UK will leave after the Brexit transition period ends next month on 31 December.

Sunak is also expected to tear up the Treasury’s ’green book’, a set of rules used to allocate funding to major projects, which has been criticised for being unfairly weighted towards already wealthy regions such as London and the South-east.

The government has said that Wednesday’s spending review will cover just one year, instead of the usual three or four years, because of the difficulty in long-term planning caused by covid-19.

Prime minister Boris Johnson added that tax rises might not come until after the next general election and were not a “super urgent” part of the government’s response to the economic damage wrought by the pandemic.

But Sunak (pictured) said that the record levels of government borrowing needed to deal with the impact of the pandemic would need to be “grappled with”, while Johnson warned that tax rises could end up being “quite significant” when they do come.

The government had expected to borrow around £55bn this financial year but it has already borrowed £215bn in the last seven months with borrowing expected to be more than £370bn by the end of the year.

Hopes that construction firms would be spared a new tax on off-payroll working rules look set to be dashed after HMRC started warning the industry to prepare for the coming changes last month.

The IR35 tax is now set to be introduced in April 2021 after being delayed for a year during the height of the pandemic to helped businesses and individuals deal with the economic impact of the covid-19 lockdown.

In September, HS2 minister told an AGM for trade body Build UK that the government was keen to “reflect” on a host of tax changes, including IR35, the reverse VAT charge and a tax relief on red diesel, which are due to come into force over the next two years.

No comments yet