QS aims to safeguard independence by doubling turnover in the next three years

Cyril Sweett, which on Wednesday became the only QS to list on the stock exchange, aims to use the funds for a buying spree in the UK, India and the Middle East.

The consultant, which has floated 30% of its shares on the alternative investment market, now has a market capitalisation of about £60m.

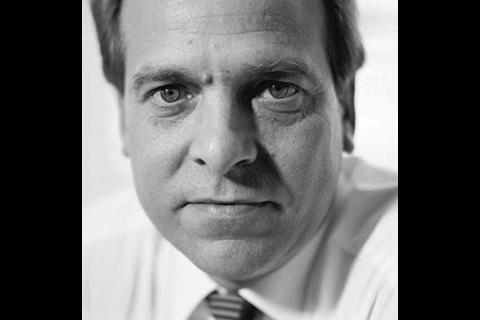

Dean Webster, the chief executive, said: “We want to grow through a buy-and-build policy. We’re hoping to raise £8.5m from the flotation, which will give us an acquisition fund of between £25m and £30m. Our aim is to double turnover from £50m to £100m in the next three years.”

Webster said he was looking at acquisitions in the UK, India and the Middle East, but declined to name the firms on his hit list.

He insisted that he had no interest in purchasing firms in other disciplines. He said: “We’re a pure project management and QS firm. Our acquisitions will be about what we do and what our clients expect of us.”

The ultimate goal of the flotation and the acquisitions is to secure the firm’s independence. Webster said: “The market is consolidating. You only have to look at the way engineers are sweeping up substantial QS practices.”

Webster declined to say how many shares he and other senior staff at the QS would hold. He said: “That’s a matter for Mrs Webster and me, but we have 580 shareholders in this business and nobody wants to sell.”

Before the offering, about a fifth of the firm’s shares were owned by Webster and company chairman Francis Ives.

Earlier in the week, the company said it had raised £26m before expenses on placing 9.1 million shares at 110p each.

The shares were priced at 122p at midday on Wednesday.

Postscript

The background to Cyril Sweett’s listing is at

No comments yet