Agnieszka Krzyzaniak of Arcadis reflects on the resilience of the global construction sector in 2021 and some of the emerging short-term and long-term challenges the industry is facing as part of the recovery

01 / Introduction

To many, what happened in 2020 – and continues across much of the world – may seem like a disaster movie. Unfortunately, this time we are the main characters. There were no special effects and the damage done is counted not in buildings and roads demolished but in the suffering of millions as the pandemic continues to take its toll. Our world needs rebuilding. The abrupt halt to economies, especially in the services sector, led to a decrease in global GDP of 3.5% – but not only that. Behind this number, there are small businesses that went bankrupt, young entrepreneurs left without support, and millions of people who suddenly became unemployed.

The economic damage could have been even bigger if the construction sector had stopped working, as it accounts for 13% of global GDP. Luckily, except for in a few locations, building activity continued. As the economic outlook in many countries improves, construction still has a crucial role to play. Significant public sector investment in connectivity and improving living conditions in line with the UN Sustainable Development Goals are at the core of many countries’ recovery plans. Are we ready to tackle this challenge?

While many apocalyptic movies end with the need to reconstruct the world, so far no superhero film has been made that focuses on those efforts to clean up the mess and build anew. We have not been treated to a trilogy about planning, design and construction. Sadly, no “clapping for construction” initiatives have been suggested either. Maybe it is something to reconsider, for as 2020 showed us, building operatives can be quiet heroes.

Below, we examine how the pandemic has impacted the health of the construction sector and in what way it has driven movement within the International Construction Cost (ICC) Index. For selected locations, some details are provided of the current economic situation and the outlook for construction. While the world is still far from being back to normal, and construction demand is only beginning to recover, this article will point to the factors that need to be managed carefully in order not to halt the progress of building back better.

02 / Construction during the pandemic

The previous commentary in this series on international construction costs was published in August 2020, in the middle of what in the UK proved to be a temporary bounce‑back. However, while the subsequent two lockdowns added to the economic pain – albeit to a much lesser extent than originally predicted – the construction sector “kept calm and kept building”.

It must be acknowledged that the construction industry has proven incredibly resilient in the face of multiple national lockdowns, public health restrictions, and temporary supply chain breakdowns. Where possible, new ways of working have been introduced, with interventions ranging from staggered shifts to wider adoption of digital tools – not only for communication, but also for surveying and safety checks, among other purposes.

Anecdotal evidence indicates that the introduction of stricter operating procedures improved individual productivity, even though the productivity at project level has fallen by around 10%-20% on many sites. The need for alternative scheduling, with a limited number of trades on site at any one time, seems to be delivering unexpected benefits too, often in the form of time savings. Both clients and contractors came together and collaborated closely during this challenging time.

Now attention is shifting away from managing the crisis and towards stimulating the recovery, and capital investment will be used in many locations to create jobs and increase productivity. Construction will be both a big beneficiary and a major contributor to this process, provided that investment plans turn quickly into shovel-ready projects that can sustain the workload of a hungry supply chain.

Make no mistake, while the economic outlook has improved significantly, the resilience that many construction businesses displayed during the pandemic did not come without cost, and there is plenty of evidence of higher than usual levels of financial distress. We are not out of the woods yet, and a quick look around reveals multiple challenges emerging on the horizon.

03 / The cost index snapshot

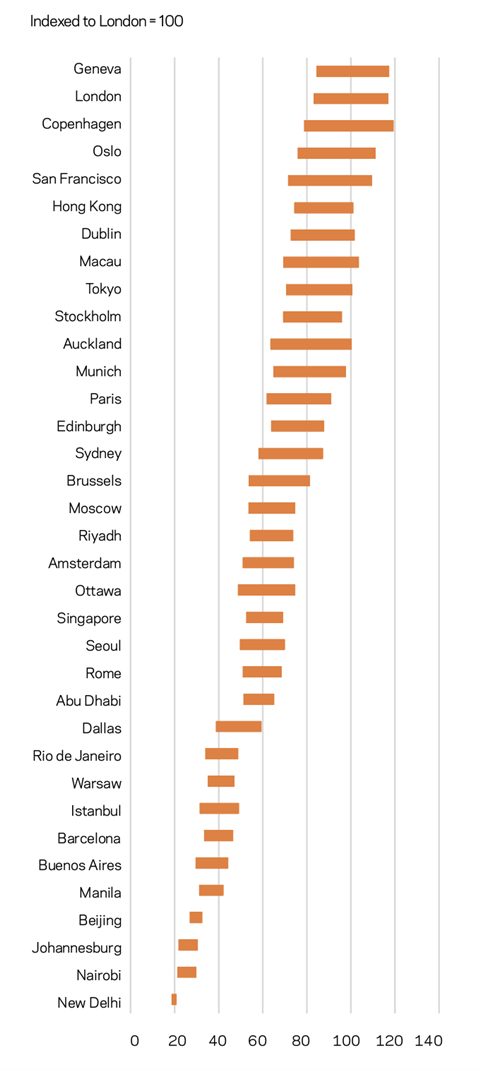

The ICC Index for 2021 covers 100 cities, and this year new locations from Europe have been included, such as Vienna, Oslo, Lyon and Nice. It compares projects on the basis of costs converted to US dollars.

Geneva is the most expensive location, followed by London and Copenhagen. In general, the top 10 is dominated by Europe. New York, Hong Kong and San Francisco are also in the top 10, albeit in lower positions. This trend has been driven by currency movements, which have affected the rankings more than construction price movements this year.

Throughout 2020 the US dollar depreciated against the basket of major currencies by an average of 5%. As a result, construction costs in the US have fallen relative to other locations, and US cities have shifted down the index. The depreciation of the dollar also affected the positions of cities in countries with a dollar peg, including in the Middle East and Singapore. The euro and other European currencies are up by 10%, with sterling and the Australian dollar also seeing material gains.

A further striking aspect of the 2021 ICC Index is the price stability seen during the year. In the past, a decrease in demand for construction resulted in construction prices falling sharply. But despite huge disruption in the markets last year, no major signs of deflation have been observed. This is a very positive outcome, signalling the markets are in a healthier state than might have been feared. Prices are largely flat, with some adjustments for quality and performance enhancements in certain markets such as the Near Zero-Energy �ڶ�����s Directive in the EU.

While the weaker dollar means fewer opportunity locations for dollar-denominated investors in 2021, now is still a good time to enter the market. We expect public sector infrastructure programmes will soon soak up capacity and start to crowd out other investments. At the moment, however, commodity and materials costs are at the top of inflationary concerns. In the long term, as demand returns and starts increasing, investors should note emerging evidence of the premium costs associated with new near-zero carbon regulations and higher costs of carbon allowances, which will in turn impact the quality of the assets (for example, improved insulation) and the cost of materials (especially concrete and steel).

Figure 1: International Construction Costs Index 2021

04 / National snapshots of demand and supply

China

First to be hit by the covid-19 pandemic, China was also the first to enter the path to recovery – which started in Q2 2020. After an initial fall of 6.8%, the country’s GDP grew overall by 2.3% in 2020 as a whole, an enviable outcome in the present circumstances. It is forecast to grow by 8.5% in 2021, but similarly to other countries, a slowdown is likely to occur in 2022, bringing it to 5.2%.

The Chinese construction industry performed exceptionally and managed to achieve an increase in output of 6%, driven mainly by the investment in infrastructure and housing. There is also a strong push for the creation of digital infrastructure, especially data centres and 5G networks. Following the lockdown, operating construction sites are required to include epidemic prevention practices as part of regular site management.

The outlook for 2021 is strong for the Chinese construction sector, which will continue to benefit from significant public investment. The increased demand is likely to create some inflationary pressures, especially regarding the accessibility of labour and materials. This is anticipated to translate into a 5% cost increase over the coming year.

EU

Covid-19 had a varied impact on the economies of EU countries, with GDP hit most badly in France, Spain and Greece, but suffering to a much lesser extent in Poland and the Netherlands. On average, EU economies contracted by 6.3% in 2020. Ireland was the only outlier, with an increase of 3% recorded. Following the approval of an $808bn recovery fund, hopes are increasing for a recovery this year, with the forecast of 4% average growth in 2021.

The EU remains committed to a green transition, and 37% of the post-covid stimulus has been ringfenced for projects that support climate change mitigation objectives. In the context of the construction industry, the regulations regarding near-zero energy buildings became effective for all new buildings from January 2021 (having been in place for public buildings since 2019). Even though each member state is left to define exactly its own criteria for the energy performance of new buildings, these new requirements create a cost premium and have been accounted for in this year’s index.

The EU construction sector performed in varied ways in 2020, depending on the extent and duration of lockdown restrictions in particular countries. France and Italy were among those seeing the deepest contraction, and monthly construction output fell there by 50% at the peak of pandemic. By contrast, Romania noted an overall 9% increase in construction output. Across the EU construction activity has fallen by approximately 8% and it is not likely to recover before the end of 2022, even in hotspots such as Ireland or the Netherlands. Infrastructure and residential sectors are expected to bounce back first, while non-residential buildings, especially outside the public sector, will lag.

Vietnam

Vietnam was one of few countries that managed to expand its economy in 2020, with GDP increasing by 2.9% and projected to further grow by 5.4% in 2021. This exceptional outcome can be attributed mainly to the strong performance of manufacturing and infrastructure investment.

Construction activity decreased by 5% and is poised for a sustained growth of 7.7% on average during 2021-24. This forecast is based on significant public investment aimed at improving regional connectivity through expansion of the transport network, especially rail. The Vietnamese government is also proactively encouraging public-private partnerships, especially in the housing sector, in response to accelerating urbanisation. Vietnam has sufficient construction labour available, but some pressure is likely to come from movements in the commodity markets and could result in a cost increase of approximately 2% in 2021.

US

Despite the dramatic course of the covid pandemic, the US economy recorded a relatively mild contraction last year, in the range of 2.4%. It has now entered the recovery path, supported with a record $1.9tn stimulus package and a very rapid vaccine rollout. The Federal Reserve committee is predicting economic growth of 6% in 2021, but the pace of expansion will slow after 2021 to around 3.7%.

The US construction sector entered 2020 in a strong position, with output in real terms at its highest levels since 2008 and employment at equally record high levels. The second quarter of 2020 saw the pandemic taking its toll, but the volume of the construction market still managed to increase by 1% compared with 2019, driven by strong demand from the residential sector supported by low mortgage rates.

The outlook for 2021 is to an extent uncertain – while the residential sector is expected to continue to blossom, there will be some contraction in commercial areas. Whether part of the stimulus money will be used by local government to invest in health, education and infrastructure remains to be seen. The returning demand will be met with challenges in terms of costs of materials and access to skilled labour, which could make for a bumpy ride.

Australia

A strong fourth quarter in 2020, aided by the return of demand for commodities and an increase in consumer spending, helped lift Australia from its first recession in 30 years. GDP is anticipated to increase by between 3% and 4% in 2021, but then slow down to 2%-3% in 2022. The construction sector has emerged from the pandemic relatively unscathed, with an overall decrease in activity of approximately 1.6%. While the property sector declined, the value of engineering and infrastructure works increased in 2020, driven by projects mainly in New South Wales and Victoria, the economic powerhouses of the country.

Yet the outlook for 2021 remains uncertain, particularly as public investment in infrastructure and social housing is not likely to materialise until the second half of 2021. In the short term, it is anticipated that the market will remain relatively competitive, and that slight deflation of around -1% is quite plausible. However, the distribution of the vaccine will also underpin consumer and market confidence and, as the pledged investment in Australia’s economic recovery gathers pace, it is likely that we will see strong growth within both property and infrastructure, with the construction sector approaching pre-pandemic levels towards the end of 2021.

About the Construction Costs Index

The Arcadis International Construction Costs Index provides a comparison of construction costs across 100 global cities. The report provides regional construction markets insights and highlights examples of post-pandemic investment priorities in major cities around the world. This article includes data for 35 cities. The full report, published in April 2021, can be accessed via arcadis.com. The index is based on a survey of construction costs of 21 building types, based on local specifications and denominated in US dollars to enable comparison. The index compares the costs of delivering a building function in different locations rather than a like-for-like comparison of the costs of a similar type of work.

05 / Currency trends

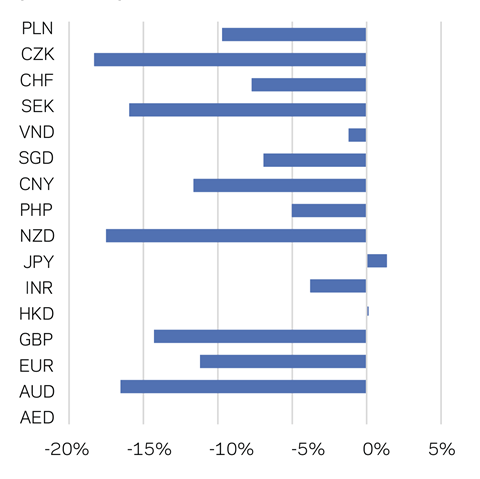

One of the striking insights regarding changes in the ICC rankings in 2020/21 has been the larger than usual effects of currency movements.

Dollar

The US dollar has been relatively strong for several years, and in the early stages of the pandemic it rose on the back of safe haven status. However, since April 2020 there has been a marked depreciation, averaging 8% against a basket of currencies, reflecting to a degree the impact of the US Federal Reserve’s ultra-low interest rate guidance. As part of this cyclical shift, currencies from Europe strengthened significantly against US dollar, with the euro recording 10% appreciation and the Swedish krona almost 16%.

Many are beginning to wonder what the future may bring. Concerns raised last year about the impact of political uncertainty in the US seem no longer to be valid, and with the stimulus plan in place the path to recovery seems clearer too. But those concerns have been replaced by new factors affecting the world’s top reserve currency. For example, China has significantly outperformed the US in economic recovery, reflected in the strength of the renminbi (12% appreciation year on year). Looking much further ahead, the potential for competing electronic reserve currencies – which is being explored by many countries and financial institutions – is likely to play a role too. The short-term depreciation, however, may be positive for the US economy, as it should support exporters.

Figure 2: US$ movement against other currencies, May 2020 to May 2021

Euro

As the value of the dollar peaked, many traders began switching to euro, which has fared quite well, avoiding any major depreciation events during the pandemic. Even though prolonged negotiations regarding the recovery plan and allocations in the 2021-27 budget may have provoked a temporary nervousness, this was mainly observed among politicians rather than investors.

While within the EU the impact of covid on particular economies has been significant, the block’s high ambitions, especially on greater financial integration, make it an attractive investment destination. As a result there is less risk of euro depreciation than might have been the case during the pandemic.

Sterling

Apocalyptic visions of sterling tumbling to parity with the dollar as a result of Brexit did not materialise. On the contrary, over the last year it has appreciated by almost 15% against the dollar and strengthened by 3% against euro. This trend is likely to continue, supported by a very successful vaccine rollout, optimistic economic recovery forecasts and political stability.

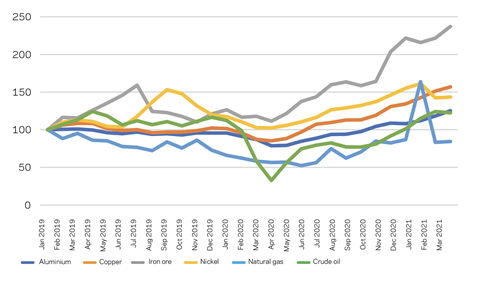

06 / Commodities

The spectacular recovery in commodity prices that we witnessed in 2020 continues today. After an initial shock caused by suspended demand, metal prices were quick to climb back, especially for iron ore and copper, which have gained 87% and 55% respectively since the beginning of 2020. The higher prices in commodities have now passed through to basic manufactured goods.

Figure 3: Commodity price indices, 2019 to 2020

Combined with materials shortages and higher costs of logistics and carbon taxes, materials price inflation associated with imported materials has become a major headache. For example, basic steel sections have grown in price by around 25% in Europe, while concrete reinforcing bars are 20% more expensive in the UK than they were a year ago. What we are experiencing is the result of the slow restart of steel manufacturing capacity, combined with lower output of iron ore in Brazil and larger than usual demand both from China and Europe.

Prices of timber and other products associated with housebuilding have grown in many markets too. In the UK imported sawn or planed wood recorded a 16% increase (six months earlier the price was showing a deflationary trend).

While the depreciation of the dollar by an average of 5% during 2020 has shielded many markets from the full effect of these increases, their extent is now too significant to be offset by currency movements and we see them contributing to inflationary pressure in wider markets.

These increases do have to be put into perspective. They apply to globally traded materials only, and some of these categories, coking coal for example, have fallen in price over the past year. For locally sourced materials, notably cement, concrete and aggregates, prices remain flat. Similarly, labour markets are stable. This means the inflationary pressure applies to only a portion of the full cost of a project.

In the short term, prices are likely to rise until the capacity of supply chains is fully restored. More importantly, the resulting temporary materials shortages might also cause delays to ongoing projects. However, in the medium term, prices are likely to stabilise – although the scale of demand created by the economic recovery programmes and infrastructure projects will need to be monitored.

In the long term, no major inflationary drive is expected from commodities. However, the production of many construction materials is carbon intensive and efforts to meet net zero targets are likely to be inflationary. Carbon prices have risen 60% in the past year and manufacturers will increasingly need to invest in low-carbon manufacturing processes. The transition to net zero manufacturing practices will take time and come at a cost – but must begin sooner rather than later.

07 / Conclusion

As we enter the recovery phase, many governments, including those of the US and the UK, are putting in place “build back better” plans focusing to a large degree on infrastructure and housing projects to create jobs and spur economic growth. Given their scale, there is a unique opportunity to deliver an optimised balance of economic and social value through these initiatives. But will these plans be delivered at the expense of our net zero ambitions?

The health crisis has of course been at the forefront of everyone’s attention in the last year, but our greatest challenge remains transition to net zero. Consequently, it is imperative that our sector plays its part by reducing its greenhouse gas emissions and by supporting the green and carbon neutral policies being promoted by many governments. This is important for our long-term resilience and licence to trade.

We are 15 years away from the UK 2035 climate target that aims to substantially reduce carbon emissions, and we are still delivering assets that will require retrofit before 2050 to make them net zero compliant. Many will argue that transformation is challenging and will not happen overnight – but this should only motivate us to act as soon as possible. This is why Arcadis has joined the ConstructZero initiative as a business champion.

There is so much that needs to be changed, including the adoption of industrialised construction to minimise waste, the substitution in all markets of carbon-intensive materials such as cement, and the adoption of low carbon electrical and hydrogen-powered plant as part of the construction process. This is a shared challenge across many markets but will be particularly difficult to implement in emerging markets where access to low carbon resources, products and machinery is so much more limited.

Covid-19 proved that our sector can be collaborative, adapt well to change and also go digital as needed, and this year must be about embedding these practices for good.

Let’s make 2021 a year of reconstruction and reinvention.

Acknowledgments

With thanks to Simon Rawlinson and Andrew Beard for their valuable insights in helping to produce this article.

No comments yet