Sonia Soltani looks at where development money is going in eastern Europe and how much of it is really for regeneration

As regeneration challenges go, these are the really big ones: buildings that were poorly constructed in the first place and are now crumbling into decay, economies that are fragile and struggling to overcome crime and corruption, a population whose well-educated young people have to go overseas to find work, and a housing market where ordinary working people cannot buy because there are no mortgages.

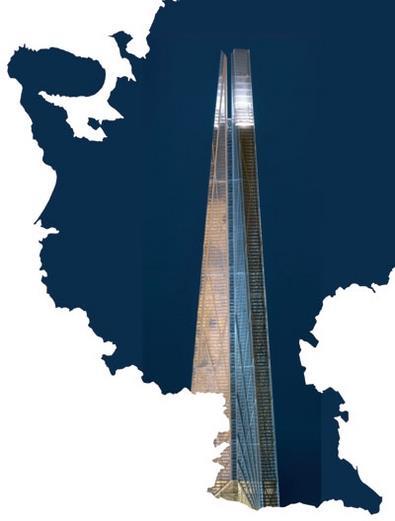

That is the picture in much of eastern Europe. January will mark the accession of two more countries to the European Union: Bulgaria and Romania. The EU’s newest members are expected to be prime recipients of the next round of EU structural funding to provide desperately needed infrastructure. But there is construction activity in the east, as anyone who attended the Mipim property show in Cannes this spring will have seen. There exhibition stands hosted by eastern cities showcased expensively produced models of ambitious schemes for retail malls, office blocks and upmarket apartments, none bigger and bolder than the Foster and Partners’ designed Moscow tower.

What was clear from the proposals was that virtually all of these schemes are targeted not at impoverished locals, but at the upper echelons of society and at foreign visitors. Some may complain that such schemes are mega-development rather than true regeneration, but given the massive challenges ahead in eastern Europe, the long and difficult process of change has to start somewhere. Change, though, is well and truly under way as the international projects featured here demonstrate (see boxes below).

It’s all change in Russia

A spate of contract killings have done little to quieten the Russian development market. Fred London, a director at John Thompson & Partners, an architect working on the masterplan of a new city in the western suburbs of Moscow, says: “The market is very dynamic. We’re getting approval for projects much more quickly. With the end of communism Russians want to change everything.”

And Russian developers like nothing better than signature architects. The planned 600m E E tall tower in Moscow designed by Foster and Partners is one of the most spectacular schemes emerging in the city. Paul Grace, director at the Davis Langdon Ruperti Project Services International office in Moscow which is working on the project, says only in Russia would it be possible to pull off such a scheme so fast: “It’s a very overheated market. Not all projects get done because there aren’t many international contractors here.”

But all this activity does not necessarily constitute regeneration. Developments are for the wealthy few and there are concerns about the apparent lack of long-term sustainable investment. Clem Cecil, member of conservation pressure group the World Monuments Fund in Britain, says the instability of the Russian market comes from the fact that investors expect to make their return in half the time of other European developers, hence the rush to get projects done.

The average resident is unlikely to see the benefits of the construction boom. Cecil says that in Russia, poor quality housing estates of the 1950s are now the target of dubious tactics aimed at taking ownership of them. “Sites are being declared unsound in order to privatise apartments for a lot of money,” she says. “Disputes in courts are a really big problem and affecting the middle-classes who now feel too insecure to buy properties.”

Romania’s legacy of dereliction

Dictator Nicolae Ceausescu, who was deposed in 1989, left his nation with a legacy of trauma, monster palaces and derelict sites. Following the country’s accession to the EU next year, things could change, as the country is expected to become a major recipient in the next round of EU structural funds and that will stimulate essential regeneration and infrastructure works. Len Cardwell, director of planning, landscaping and heritage at Atkins, which is working on two projects in Bucharest in partnership with Romanian consultancies, says: “A lot of infrastructure work is needed to bring services up to the standards of the rest of Europe.”

Since the fall of Ceausescu the country has opened up to tourism and the sites of buildings from the ancien regime are being redeveloped with mixed-use schemes. Following a meeting at last year’s MIPIM show in Cannes, a Romanian developer commissioned architect John Thompson & Partners to work on a masterplan to regenerate a factory site in Bucharest that had not produced anything in three decades. Atkins is also looking at the centre of the capital that the mayor hopes to transform into the Romanian equivalent of London’s Covent Garden.

Croatia is no Middle East

Croatia, which will join the EU in 2008, already has a booming market for tourism and second-home buying. After decades of low or no maintenance of its leisure stock, regeneration and refurbishment projects are in progress.

However, Joe Summerhill, managing director at CRE8 Management, warns that foreign companies should not expect Croatia to be the European equivalent of the Middle East. “There are no very large-scale developments here. There is a tight control on new build because they’ve been learning from other tourist areas.”

David Perera, associate at Jestico + Whiles, an architect working on two hotel projects there, is convinced that the new capitalist approach geared towards tourism will be the impetus for a wider regeneration. He says: “As with most regeneration projects, once you start putting up nice new buildings, local people are inspired to follow and start painting their own house.” But the absence of an established mortgage system to access property ownership means there is little scope yet for any large expansion in the new build housing sector.

Low-cost production in Poland

Poland is the place to recruit qualified town planners, designers and engineers. Atkins, which has a 200-strong office in Warsaw and is part of a Tesco framework in the country, regularly brings qualified Polish employees to the UK.

The country has retail, office, industrial, infrastructure and leisure schemes in progress. Mace is working on its largest project to date in Warsaw, a €250m mixed-use scheme. Director Peter Atkinson says foreign investment is going into Poland because many manufacturers like the low-cost production. This is feeding through to investment in existing housing stock. Mace’s mixed-use project near Warsaw includes housing, but as Atkinson points out, “there is still a need for good housing because of the abundance of buildings left from the communist era. There are concrete blocks that are falling apart”.

Czech Republic’s good offices

Development activity is primarily centred around the leisure, office and high-end residential market, the latter providing homes for foreign executives or wealthy locals. International design adds kudos, as with the River Gardens development in Prague, a mixed-use scheme designed by David Chipperfield Architects. Alexander Schwartz, project architect, explains that the project is in a hot-spot close to the historical centre. He says: “There are a lot of industrial buildings no longer in use in the city, so they are being knocked down and replaced by offices. There are even plans for a golf course.”

Russia

- Foster and Partners has designed the 600m mixed-use “vertical city” for Russian developer STT Group (shown here).

- Davis Langdon in partnership with Ruperti Project Services International is working on the 950,000m² Avia Park in Moscow for OAO Aviatsionny Park.

- A 70,000m² World Trade Centre is being developed in Moscow. Davis Langdon, along with RPSi, is acting as cost consultant.

- In St Petersburg, Paul Davis & Partners has masterplanned an £80m mixed-use scheme in a former factory on the city outskirts.

- PRP’s Rublevo Residence for Russian developer ST Group will comprise 134 townhouses, a spa and fitness centre.

Poland

- Jestico + Whiles is designing the four-star Andel’s Hotel in Krakow for Vienna-based developer UBM/Warimpex (pictured above)

- German developer Hochtief Development has hired Mace to project manage the €120m ONZ Rondo office scheme in Warsaw.

- ING/Rodamco, a Dutch developer, is building the €250m Zolta Tarasy mixed-use development in Warsaw for which Mace is the project manager.

Slovakia

- Ballymore has been granted planning permission for the first phase of the Eurovea International Trade Centre development in Bratislava, 230,000m2² of retail, leisure, office, hotel and residential space and a new public square (pictured above).

- Jestico + Whiles is working for ORCO Property Group on the development of 87 luxury apartments on the Koliba hillside.

Czech Republic

- Seven international practices, including David Chipperfield Architects (whose design is pictured above) and Feilden Clegg Bradley, have been appointed to design the River Gardens in Prague, a mixed-use development on the riverside.

Ukraine

- The €40m St Sofia Hotel in Kiev is being developed by local company Sofia Kyiv. Mace is providing project and cost management.

Romania

- John Thompson & Partners has designed for developer Cityring Property a mixed-use 207,00m² project in Bucharest consisting of apartments targeted at the middle classes. It will comprise 2,700 apartments, 8,000m² of commercial space, community, leisure and health facilities.

Serbia

- Mace is cost and project manager on the €60m Delta City Belgrade shopping mall.

- Serbian developer Blok 67 Associates has commissioned Mace to project and cost manage the €25m New University Campus.

Croatia

- Hotel Adriatic in the old medieval town of Hvar has been designed by Jestico + Whiles for ORCO Property Group.

Source

RegenerateLive

No comments yet