Our quarterly analysis of costs and prices shows the construction industry being squeezed by falling tenders and rising materials prices. Peter Fordham of Davis Langdon, an Aecom company, reports

01/ Key changes

- Construction cost inflation falling in the second half of last year

- Consumer price inflation rising above target and set to go higher

- Manufacturing input costs resurgent

- Construction materials stable or declining at the end of last year but set to climb again

- Metals setting new price highs; steel prices on the march

- Construction earnings still falling, wage settlements below inflation levels or unagreed

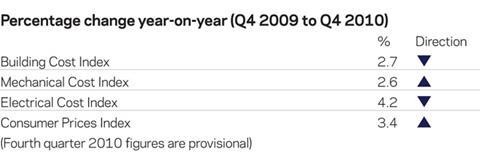

�ڶ����� cost index Materials prices steady in second half of 2010 bringing year-on-year inflation rate down.

Mechanical cost index Wage increase for heating and ventilating operatives in late 2010 helps push up inflation rate for fourth

consecutive quarter.

Electrical cost index Inflation trend remains the highest of the four measures above but is declining rapidly and next quarter will show a sharp reduction with electricians’ wage rates frozen.

Consumer prices index Higher transport and food costs push index higher before VAT rise kicks in.

Guide to data

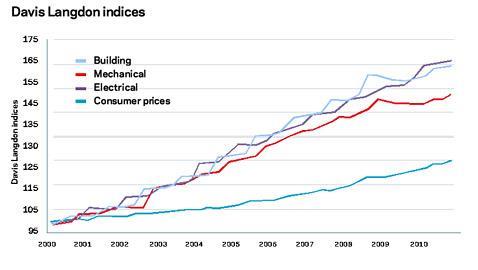

Davis Langdon’s cost indices track movements in the input costs of construction work in various sectors, incorporating national wage agreements and changes in materials prices as measured by the government’s index series.

They provide an underlying indication of price changes and differential movements in the various work sectors but do not reflect changes in market conditions affecting profit and overheads provisions, site wage rates, bonuses or materials price discounts/premiums.

In the current market, many costs recorded here are rising but prices charged to clients may still be falling. Market conditions are recorded in Davis Langdon’s quarterly Market Forecast (last published 28 January).

02/ Price adjustment formulae for construction contracts

Price Adjustment Formulae indices, compiled by the �ڶ����� Cost Information Service, are designed for the calculation of increased costs on fluctuating or variation-of-price contracts. They provide useful guidance on cost changes in various trades and industry sectors and on the differential movement of work sections in Spon’s Price Books.

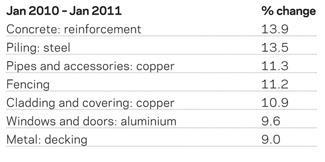

Over the past 12 months, between January 2010 and January 2011, the 60 building work categories have recorded an average rise of 4.5%, the same as three months ago. Over the past six months however, the average increase has been just 0.8%, as materials price inflation subsided.

The largest price increases over the year:

All of the above are associated with either the increase in steel prices seen in the first half of 2010 or the rise in non-ferrous metals prices in the second half of last year.

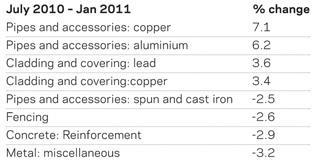

Over the past six months the largest changes have occurred in these materials categories:

Materials: Input costs soar; construction materials flat; copper and lead up 40%

03/ Executive summary

- Consumer price inflation continues to rise

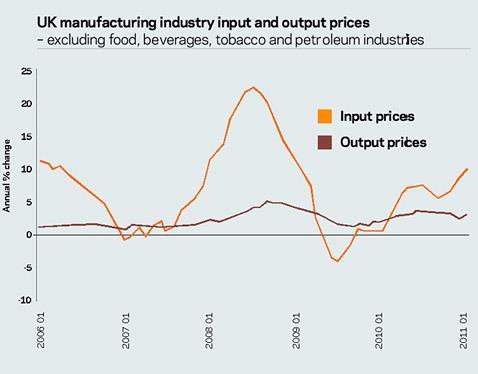

- Industry input costs rising at fastest rate for two years

- Output prices lagging but beginning to rise

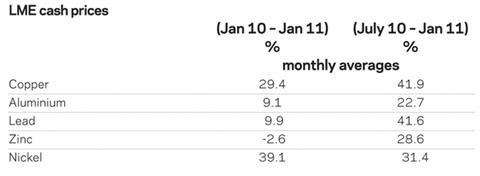

- Copper and lead prices climb 40% in six months

- Construction materials’ prices flat in second half of 2010

- Steel prices rising sharply now

04/ Key indicators

The Consumer Prices Index rose between December and January for the first time ever, largely due to the VAT increase. Other drivers have been transport (up 4.5% since November), largely due to a 7.3% increase in fuel costs, and food prices (up 3.0% since October). The Retail Prices Index continues at a higher level, 5.1% up over the year.

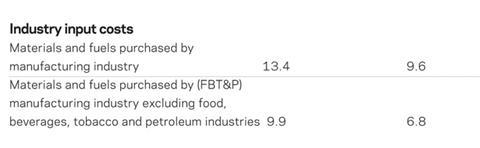

Input costs faced by the manufacturing industry have surged in the past four months, rising 9.1% since September last year, driven in particular by oil prices and the cost of gas.

Output price inflation of products excluding food, beverages, tobacco and petroleum remains relatively subdued given the input price pressures but showed a tick up in January, lifting 0.7% in the month.

Increases over the past six months in product areas associated with construction have been:

Metals prices

The table shows how metals prices have rebounded strongly in the past six months after Eurozone doubts caused a fall in prices in the first half of last year. With the exception of lead, metals prices have continued to climb in February, with copper passing above $10,000 a tonne, well beyond its 2008 high level.

Construction industry

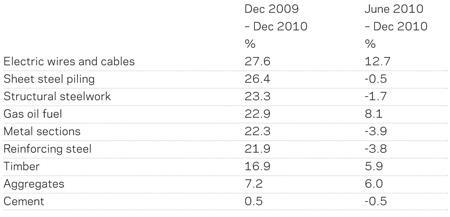

Materials price increases for the construction industry over the past year and the past six months (to December 2010) are detailed below:

Overall, construction materials rose by 6.8% over the year to December but by only 0.5% in the second half of the year. Materials for non-housing new work even registered a tiny reduction in prices in the past six months. The increase in the first half of the year was mainly attributed to a rise in steel prices.

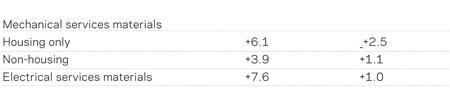

Mechanical and electrical services materials also display a sharply reduced rate of inflation in the second half of 2010. Housing materials prices began to increase again at the end of the year in quick reaction to the rise in copper prices.

Materials showing the most significant variation from the average trend over the past six or 12 months are shown below:

(Data sources: ONS and BIS)

(December 2010 figures provisional)

The table demonstrates the large increases in steel prices that occurred over the past year but also how those prices eased back in the second half of last year. Steel prices have begun to rise again early in 2011 as manufacturers try to pass on increases in raw materials prices.

Labour: Wages are up for plumbers but builders remain in limbo

05/ Executive summary

- Electricians and scaffolders were the biggest earners in construction last year, earning more than £560 a week on average

- Plumbers and heating and ventilating operatives saw the biggest increases in pay last year (although wage agreements were frozen) while floor and wall tilers and railway workers suffered the largest pay packet falls

- Plumbers in England and Wales, heating and ventilating operatives and engineering construction workers secured wage increases but builders and electricians rates remained in limbo

06/ Wage agreements

In 2011, only employees in the engineering construction industry (such as steel erectors) and plumbers in England and Wales have so far received any wage increase. Electricians, who were expecting an annual increase in January, have been denied by the employers and rates are currently frozen. A ballot of members overwhelmingly rejected the pay deal.

Plumbers in Scotland and Northern Ireland agreed a two-year pay deal last February that will see rates of pay and allowances go up 2% from June, the first increase since June 2009.

Engineering construction industry

Employees working under the remit of the National Joint Council for the Engineering Construction Industry (including steel erectors, pipefitters, welders and scaffolders) received an increase in rates and allowances of 4.7% from 4 January 2011. This was based on the increase in the Retail Prices Index, averaged over July to September 2010.

ASHE weekly pay rates for construction employees

Results from the 2010 Annual Survey of Hours and Earnings (ASHE) compiled by the Office for National Statistics were delayed and only published in December. The ASHE data is based on a sample of employee PAYE records taken in April of each year.

The 2010 survey revealed that median gross weekly earnings for full-time employees in the UK were £499, up 2.1% on the figure from 2009. Earnings in construction rose by 1.9% over the same period with median gross earnings of £508 per week. Within that figure, earnings of building workers rose by 2.5% but those employed in civil engineering activities saw earnings fall by 2.2%. The following table shows median gross weekly pay for various construction occupations at April 2010 and the percentage change over the year:

The survey showed that skilled construction and building trades typically worked 40 hours per week, the same as the previous three years.

Latest figures from the Office of National Statistics show that, over the three months October to December 2010, average earnings in construction were 3% lower than in the same period of 2009 , compared with an increase of 1.8% in the economy as a whole.

Last week’s cost model was credited as being by Stephen Frood and Steve Lacey. This was an error - the authors were Paul Zuccherelli and Ben McCafferty.

Downloads

Wage agreement summary table

Other, Size 1.4 mb

No comments yet