Everything’s on the up - input costs, inflation and, more positively, building operatives’ wages and construction earnings. Peter Fordham of Davis Langdon, an Aecom company, reports

01 / KEY CHANGES

- Construction cost measures mostly below long-term trends but all increasing at a rising rate

- Commodity prices behind most cost increases

- The Monetary Policy Committee shows no inclination to dampen consumer price inflation, believing it will fall back to target by the end of 2012

- Manufacturing input costs continue to rise but output price rises lag behind

- Construction materials prices accelerate in the first half of 2011

- Construction earnings show small rise over the last year

- ļŕ∂ī…Á«Ý operatives secure small wage increase from September, their first since June 2008

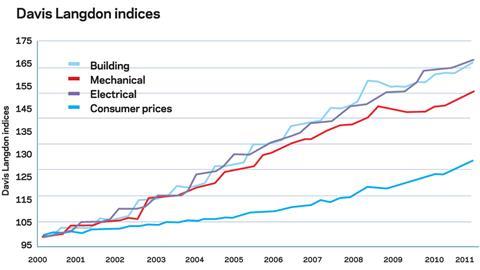

Percentage change year-on-year (Q2 2010 to Q2 2011)

- ļŕ∂ī…Á«Ý cost index 3.0

- Mechanical cost index 4.1

- Electrical cost index 2.4

- Consumer prices index 4.4

(Second quarter 2011 figures are provisional)

ļŕ∂ī…Á«Ý cost index

Year-on-year change remains well below the average over the last decade but materials price rises in the first six months of this year push the annualised rate up to 5%.

Mechanical cost index

Materials price inflation in the first half of 2011 ensures that the trend is even higher than the 4.1% increase recorded over the last year.

Electrical cost index

Inflation in the electrical cost index over the last year is only half the average annual inflation seen over the last ten years largely because electricians’ wage rates have been frozen since January 2010.

Consumer prices index

The increase in consumer prices over the last year is higher than any of the construction measures for the first time in the last 10 years. Second quarter prices were pushed higher largely by transport costs and increased excise duties on alcohol and tobacco.

02 / PRICE ADJUSTMENT FORMULAE FOR CONSTRUCTION CONTRACTS

Price adjustment formulae indices, compiled by the ļŕ∂ī…Á«Ý Cost Information Service, are designed for the calculation of increased costs on fluctuating or variation of price contracts. They provide useful guidance on cost changes in trade and industry sectors.

Over the last 12 months between August 2010 and August 2011, the 60 ļŕ∂ī…Á«Ý Work categories have recorded an average rise of 4.6%, an increase from 4.0% three months ago.

Price movements have generally been more equitable than for some time but some work categories have still recorded significant increases over the last year:

August 2010 - August 2011 % change

- Pipes and accessories: aluminium 17.3

- Finishes: bitumen, resin and rubber latex flooring 16.4

- Cladding & covering: lead 14.0

- Cladding & covering: copper 13.2

- Pipes and accessories: copper 12.9

- Waterproofing: asphalt 10.1

The increase in the cost of aluminium pipework has been almost entirely since the beginning of 2011. Aluminium prices rose almost 40% between June 2010 and April 2011 and that has now fed into the cost of aluminium components. Increases in the price of other non-ferrous metals since the middle of 2010 has also resulted in significant rises in cladding costs as well as other pipework.

The increase in the cost of bitumen floorings has largely occurred since March of this year and was a response to the 50% increase in oil prices that occurred in the eight months to April, which has also driven up the cost of asphalt waterproofing.

No work categories have recorded a decrease in cost over the last year for the first time since 2008.

MATERIALS

Input and materials price rise as output prices struggle to keep up

03 / EXECUTIVE SUMMARY

- Consumer price inflation predicted to rise to 5% before falling back to target by the end of 2012

- Industries’ input costs continue to rise

- Industries’ output prices rise but fail to keep track

- Metals prices fall in recent economic turmoil

- Construction materials prices rose sharply in first half of year

- Substantial price rises for commodity-based products such as fuel for plant and steel reinforcement but weak demand forces lower prices for basic materials such as plaster and aggregates

04 / KEY INDICATORS

Percentage change (July 10 to July 11)

- Consumer prices index 4.4

The CPI has now been at or more than double the government’s 2% target for the seven months of 2011. However the index has been virtually flat for the last four months. The retail prices index has been at or above 5% all year.

Industry input costs

- Materials and fuels purchased by manufacturing industry 18.5

- Materials and fuels purchased by manufacturing industry excluding food, beverages, tobacco and petroleum industries (FBT&P) 13.1

Industry has been unable to reflect the input cost rises in output prices charged. Output prices have risen slightly and have been above 5% all year with the increased price of petroleum products accounting for 30% of the year’s rise. Output prices for materials excluding food, beverages, tobacco and petroleum have been more restrained but leather goods are up 13%, chemicals up 10% and paper up 9% over the year.

Metals prices

Metals prices have had a volatile three months with a commodities ‚Äúprice crash‚ÄĚ in May followed by a recovery and then a second crash in August as economic measures dive bombed around the world at concerns about sovereign debt and its effect on the global recovery. However, prices (except for nickel) still remain generally well above their level a year ago:

August 2010-August 2011

- Copper +21%

- Aluminium +9%

- Lead +12%

- Zinc +4%

- Nickel -1%

Based on LME prices 17 August 2011

Construction industry

Materials price increases for the construction industry over the last year are detailed below:

June 2010-June 2011

Construction materials generally

- New housing +5.1

- Non-housing new work +7.2

- Repair and maintenance +6.0

Overall construction materials prices rose by 6.6% over the year to June 2011. All three measures above continue to rise although the year-on-year percentage increases have come down since peaking in March at 9.1% (all work). However the increases in the first six months of 2011 exceed the annual figures shown above in that

overall prices have increased by 7.0% and materials prices for non-housing new work by 8.4% since last December.

July 2010-July 2011

Mechanical services materials

- Housing only +7.4

- Non-housing +4.8

- Electrical services materials +4.6

Mechanical and electrical services materials prices rose sharply between December and April in response to steel and copper price movements but have since slowed or even fallen slightly.

Materials showing the most significant price variation from the average change over the last 12 months are shown below:

July 2010 - July 2011

- Gas oil fuel 33.8

- Electric wires and cables 15.6

- Steel for reinforcement 12.0

- Clay bricks and tiles 0.7

- Office and shop furniture 0.7

- Glass -0.2

- Ceramic tiles -0.3

- Aggregates -0.6

- Lime and plaster -4.5

(Data sources: ONS and BIS. July 2011 figures provisional)

World commodity prices are responsible for the items at the top of the table. Oil prices are responsible for the 34% rise in gas oil fuel for site plant. The inexorable rise in copper prices until the recent dip is behind the 16% rise in electric cables and the steel price surge at the beginning of the year is reflected in the cost of reinforcement.

Plaster and aggregate prices have fallen as demand remains depressed.

LABOUR

Average earnings in construction rose by 0.6%, with a 2.6% rise nationally

05 / LABOUR MARKET STATISTICS

- Average earnings throughout the whole economy in Great Britain between April and June 2011 were 2.6% higher than last year

- Average earnings in construction over the same period rose by 0.6%

- Average pay in construction in June 2011 was £544 per week

- The number of construction jobs recorded in the first quarter 2011 was 2,105,000, 5% lower than a year before, 11% down from the peak in Q3 2008 and the lowest figure since 2003.

06 / WAGE AGREEMENTS

Demolition industry

Operatives working in the demolition industry have been the beneficiaries of a 3% wage increase from 20 July, the second part of a two year agreement reached in June 2010, giving a topman £9.66 an hour and a groundman £8.90 an hour (plain hour rates).

ļŕ∂ī…Á«Ý and civil engineering operatives

The Construction Industry Joint Council has adopted a one year agreement that will see building and civil engineering operatives, who have had their wage rates frozen since June 2008, receive an increase in basic wages of 1.5% from 5 September 2011. Fare and subsistence allowances rose by 5.3% from 27 June 2011.

The new basic rates will be:

| Rate per 39 hour week | Rate per hour | |

| Craft rate | £407.94 | £10.46 |

| Skill rate 1 | £388.83 | £9.97 |

| Skill rate 2 | £374.40 | £9.60 |

| Skill rate 3 | £350.22 | £8.98 |

| Skill rate 4 | £330.72 | £8.48 |

| General operative | £306.93 | £7.87 |

The agreement emphasises that these rates are agreed and formally declared on the basis that any increase shall not be reduced by any adjustment in existing contractual bonus schemes to ensure that all operatives receive the full increase.

ļŕ∂ī…Á«Ý operatives in Northern Ireland received a similar 1.5% increase but from 1 August 2011, following a two-year wage freeze.

Operatives working under the BATJIC wage agreement for member companies of the Federation of Master Builders will receive a 1% wage increase from 12 September 2011.

Electricians

Electricians’ wage rates remain frozen at January 2010 levels.

Wage agreement summary

The following table summarises the wage agreements currently in force for the principal wage fixing bodies within the industry:

| Operatives | Agreement body | Current basic hourly rate | Effective since | Details in | Date of next review |

| Builders and civil engineering operatives |

Construction IndustryJoint Council | Craft Rate: £10.30 / hour |

30 June 2008 | Cost update 30 May 2008 / Spon’s Architects’ and Builders’ Price Book 2011 | 12 September 2011 - rates will rise by 1.5% (see above) |

| ļŕ∂ī…Á«Ý & Allied Trades Joint Industrial Council (BATJIC) | S/NVQ3 Advanced Craft: ¬£10.62 / hour | 13 September 2010 | Cost update 3 September 2010 / Spon‚Äôs Architects‚Äô and Builders‚Äô Price Book 2011 | 12 September 2011 - rates will rise by 1% | |

| Plumbers | The Joint Industry Board for Plumbing Mechanical Engineering Services in England and Wales | Advanced Plumber: £13.11 / hour | 3 January 2011 | Cost update 25 February 2011 | 2 January 2012 - rates will rise by 3% |

| Scottish and Northern Ireland Joint Industry Board for the Plumbing Industry |

Advanced Plumber: £12.89 / hour | 6 June 2011 | Cost update 27 May 2011 | 4 June 2012 | |

| H&V operatives | Joint Conciliation Committee of the Heating, Ventilating and Domestic Engineering Industry |

Craftsman: £11.38 / hour |

4 October 2010 | Cost update 26 November 2010 | 3 October 2011 (negotiations underway) |

| Electricians | The Joint Industry Board for the Electrical Contracting Industry / Scottish Joint Industry Board for the Electrical Contracting Industry | Approved electrician: £14.35 / hour (own transport) | 4 January 2010 | Cost update 26 February 2010 / Spon’s Mechanical and Electrical Services Price Book 2011 | Wages remain frozen |

No comments yet