�ڶ����� costs rose overall, with materials cost inflation increasingly contributing to this - labour costs are rising too but at a lower rate. David Holmes of Aecom reports

01 / Key changes

Percentage change year-on-year (Q3 2015 to Q3 2016)

| % | Direction | |

|---|---|---|

| �ڶ����� cost Index | +2.0 | ▲ |

| Mechanical cost Index | +3.4 | ▲ |

| Electrical cost Index | +2.7 | ▲ |

| Consumer prices index | +0.9 | ▲ |

(Q3 2016 figures are provisional)

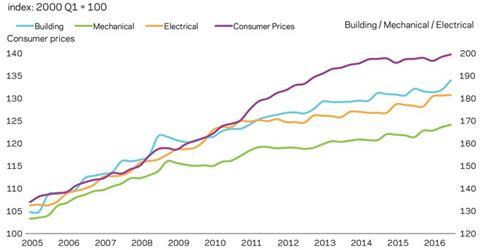

�ڶ����� cost index

A composite measure of building costs increased over the past 12 months by 2% at Q3 2016. Labour costs are still rising albeit at a slightly lower rate, and materials cost inflation is now increasing its contribution to the overall increase.

Mechanical cost index

The rate of annual change increased to 3.4% at Q3 2016 from 2.2% in the preceding quarter. Labour costs remain the primary driver of inflationary trends in this index with materials once again showing upward movement.

Aecom indices

Electrical cost index

The electrical cost index increased by 2.7% over the year. Rises in labour costs are still the main driver with materials showing early signs of increasing in more recent months.

Consumer prices index

Consumer price inflation picked up slightly in Q3 2016, recording 0.9% annual change. The rate was slightly lower in September 2016, but still remained higher than the rates otherwise seen since 2014.

The following chart shows AECOM’s index series since 2005, reflecting cost movements in different sectors of the construction industry and consumer prices.

02 / Price adjustment formulae for construction contracts

Price adjustment formulae indices, compiled by the �ڶ����� Cost Information Service (previously by the Department for Business Innovation & Skills), are designed for the calculation of increased costs on fluctuating or variation of price contracts. They provide guidance on cost changes in various trades and industry sectors and on the differential movement of work sections in Spon’s price books.

The 60 building work categories recorded an average increase of 2.8% on a yearly basis; 57 of the 60 categories showed an increase. Highest rises were recorded in the following categories:

Price adjustment formulae

| October 2015-October 2016 | % change |

|---|---|

| Cladding and covering: zinc | 8.8 |

| Cladding and covering: lead | 8.1 |

| Windows and doors: steel | 7.8 |

| Pipes and accessories: copper | 7.3 |

| Cladding and covering: aluminium | 5.6 |

| Cladding and covering: plastics | 4.9 |

| Pipes and accessories: aluminium | 4.7 |

Only two trades have shown a decrease for the period:

Price adjustment formulae

| October 2015–October 2016 | % change |

|---|---|

| Insulation | -1.1 |

| Pavings: coated macadam and asphalt | -0.8 |

Materials

03 / Summary

- Consumer price inflation increased by 0.9% in October 2016 compared with the same month a year earlier ▲

- Manufacturing input prices increased 12.2% in the year to October 2016 ▲

- Factory gate prices (output prices) rose 2.1% in the year to October 2016 ▲

- Commodity prices have continued to post notable annual increases ▲

- Construction materials prices decreased slightly on a monthly basis in September but rose overall on an annual basis ▲

04 / Key Indicators

Construction industry

The All Work material price index increased by 1.3% in the year to September 2016, although the index decreased by 0.7% compared with August. Housing-related materials increased by 1.9% over the past 12 months. Non-housing materials prices also show a small increase over the year, increasing by 0.6%. All mechanical and electrical categories posted small annual increases.

Construction materials

| % change, September 2015-September 2016* | ||

|---|---|---|

| New housing | 1.9 | ▲ |

| Non-housing new work | 0.6 | ▲ |

| Repair and maintenance | 2.1 | ▲ |

*provisional

Note: the numbers in the table above do not include mechanical or electrical materials

| Mechanical services materials | % change, September 2015-September 2016* | |

|---|---|---|

| Housing only | 3.5 | ▲ |

| Non-housing | 2.7 | ▲ |

| Electrical services materials | 1.6 | ▲ |

*provisional

Materials showing the largest cost movement are:

| % change, September 2015-September 2016* | |

|---|---|

| Imported sawn or planed wood | +6.6 |

| Sanitaryware | +5.9 |

| Electric water heaters | +4.9 |

| Fabricated structural steel | +4.4 |

| Precast concrete products (blocks, bricks, tiles and flagstones) | +4.1 |

| Paint (aqueous) | -2.8 |

| Paint (non-aqueous) | -2.9 |

| Particle board | -3.2 |

| Builders’ ironmongery | -3.4 |

| Lighting equipment for roads | -4.5 |

*provisional

Data sources: ONS and BEIS

UK economy

| Consumer prices | % change October 2015-October 2016 | |

|---|---|---|

| Consumer prices index (CPI) | 0.9 | ▲ |

Consumer price inflation rose by 0.9% in October compared with 1% in September. Transport prices provided downward pressure during 2015 and early 2016 but have now become the largest upward pressure on inflation. Bank of England governor Mark Carney has stated recently that he is willing to see inflation overshoot to help keep the UK economy from stalling.

| Industry input costs | % change October 2015 – October 2016 | |

|---|---|---|

| Materials and fuels purchased by manufacturing industry | 12.2 | ▲ |

| Materials and fuels purchased by manufacturing industry excluding food, beverages, tobacco and petroleum industries | 9.9 | ▲ |

Source: ONS

The total input price index increased 4.6% between September and October, the largest monthly increase since comparable records began to be collated by the ONS. The upward drivers to the index came from crude oil, other imported parts and equipment and metals.

| Industry output costs | % change October 2015 – October 2016 | |

|---|---|---|

| Output prices of manufactured products | 2.1 | ▲ |

| Output prices of manufactured products excluding food, beverages, tobacco and petroleum | 1.9 | ▲ |

Source: ONS

Factory gate inflation rose 2.1% in the year to October 2016, compared with a rise of 1.3% in the year to September. This is the fourth consecutive increase following two years of falling prices and the largest increase since April 2012.

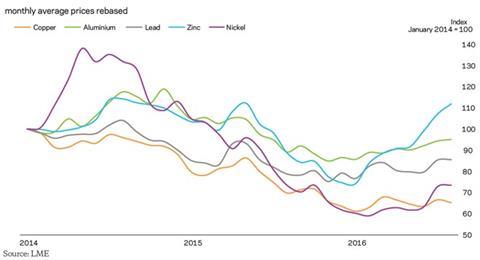

Metal prices

| % change October 2015–October 2016 | ||

|---|---|---|

| Aluminium | 9.2 | ▲ |

| Copper | -9.4 | ▼ |

| Lead | 18.2 | ▲ |

| Zinc | 33.9 | ▲ |

| Nickel | -0.8 | ▼ |

Source: LME

Commodities price trends continue to show signs of life with a reversal of the long-established downward trend of the past two years. Apparent efforts to address production overcapacity with mine closures in a number of countries and production cuts have provided support to prices, along with some improvement in aggregate demand.

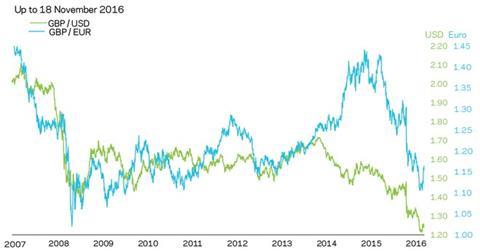

Exchange rates

| September 2015 average | September 2016 average | % change | |

|---|---|---|---|

| GBP/EUR | 1.723 | 1.3665 | -14.2 |

| GBP/USD | 1.3142 | 1.5326 | -14.3 |

The pound fell after the referendum, then stabilised before falling again in October on fears that the UK was heading for a hard Brexit. This month, the pound has been buoyed by some upbeat economic news and UK government announcements that it is targeting a soft Brexit.

The general movement in the pound in November has been upward, registering an advance against the dollar, climbing around 1.6% against the US currency in November. Sterling also gained against the Euro in November.

Labour

05 / Labour market statistics

- Average weekly earnings (total pay including bonuses) in construction rose to £615 in September 2016 from £605 a month earlier. Annually, total earnings increased 3.4% in September on a single-month basis, and 3.7% annually on a three-month average basis (values for the three months ending in September compared with the same period a year earlier). Regular pay (excluding bonuses and arrears) increased to £592 per week in September, with annual rates of 4.4% on a single-month basis and 3.6% using a three-month average.

- Construction industry regular and total pay continues to exceed changes to average earnings for the whole economy classification, which was 2.4% at September 2016.

- Real average weekly earnings for the whole economy increased by 2.7% (regular pay) in September 2016.

06 / Wage agreements

Construction Industry Joint Council

Following negotiations between the parties to CIJC, the council has agreed a two-year agreement on pay and other conditions. Hourly pay rates will increase by 2.5% from 25 July 2016 and then by a further 2.75% in June 2017. Industry sick pay and subsistence allowance will also increase in line with the basic pay rate increases. Workers will receive an extra day’s holiday from 1 January 2017, which is worth an additional 0.4%. For more details on apprentice rates, daily fare and travelling allowance and other rates, refer to CIJC document IR.2016.19.

Joint Council Committee of the Heating, Ventilating and Domestic Engineering Industry

A two-phase agreement has been agreed between BESA and Unite trade unions. Phase 1 includes 2.0% and 2.50% increases in the hourly wage rate effective from 3 October 2016 and 2 October 2017 respectively. Phase 2 covers the periods 2018-19 and 2019-20 involving increases in index and other benefits agreed in July 2016. 2018 and 2019 hourly wage rate discussions will take place towards the end of 2016. Introduction of calculating daily fare and travel allowances has been changed from kilometres to miles. Workers’ annual holiday entitlement is to increase from 23 to 24 days effective from February 2020. For more information on agreement, refer to JCC letter 117 of BESA.

The Joint Industry Board for the Electrical Contracting Industry

The electrical contracting industry has agreed a four-year wage deal, effective from January 2017. Hourly wage increases of 2% in 2017, 2.50% in 2018, 2.75% in 2019 and 3.0% in 2020. Introduction of a new mileage allowance and rate to replace travel allowance and travel time also comes into effect. Annual holidays increase to 23 days in 2019 and 24 days in 2020. For more information on the agreement, refer to the electricals’ and Unite wage agreement document – July 2016.

�ڶ����� and Allied Trades Joint Industry Council

The �ڶ����� and Allied Trades Joint Industrial Council (BATJIC) agreed a two-year pay deal effective from 27th June 2016. Workers will receive a 2.5% pay rise this year and a further 2.5% increase in 2017.

Lower paid operatives will get a bigger boost of 4% this year, followed by 2.5% next year. The agreement includes a commitment that, if inflation in early 2017 is higher than 2.5%, then the 2017 pay rise will match this up to a limit of 3%.

The Joint Industry Board for Plumbing, Mechanical Engineering Services in England and Wales

A 2.5% increase in hourly rates came into effect from 4 January 2016. Employee rates of pay, allowances entitlements and benefits are published in promulgation no 171 of JIB for Plumbing, Mechanical Engineering Services in England and Wales agreement.

The BATJIC rates of wages effective from 27 June 2016 are:

| Standard rates of pay for 39 hours per week | Per week | Per hour |

|---|---|---|

| S/NVQ3: Advanced | £459.81 | £11.79 |

| S/NVQ2: Intermediate | £395.85 | £10.15 |

| Adult General Operative | £351 | £9 |

| For entrants aged 19 years and over | ||

| • Third 12 months with NVQ2 | £374.01 | £9.59 |

| • Third 12 months without NVQ | £325.65 | £8.35 |

| Apprentices under 19 years of age | ||

| • 18 years of age with NVQ2 | £307.71 | £7.89 |

| • 18 years of age without NVQ2 | £325.65 | £8.35 |

WAGE AGREEMENT SUMMARY

The following table summarises the wage agreements currently in force for the principal wage fixing bodies within the construction industry.

| Operatives | Agreement body | Current basic hourly rate | Effective since | Details in | Date of next review |

|---|---|---|---|---|---|

| Builders and civil engineering operatives | Construction Industry Joint Council | Craft rate: £11.61 / hour | 25 July 16 | Spon’s Architects’ and Builders’ Price Book 2017 | June 18 |

| �ڶ����� and Allied Trades Joint Industrial Council (BATJIC) | S/NVQ3 Advanced Craft: £11.79 / hour | 27 June 16 | Spon’s Architects’ and Builders’ Price Book 2017 | June 17 | |

| Plumbers | The Joint Industry Board for Plumbing Mechanical Engineering Services in England and Wales | Advanced Plumber: £14.41 / hour | 04 January 16 | Spon’s Architects’ and Builders’ Price Book 2017 | January 17 |

| Scottish and Northern Ireland Joint Industry Board for the Plumbing Industry | Advanced Plumber: £13.68 / hour | 04 July 16 | Spon’s Architects’ and Builders’ Price Book 2017 | July 17 | |

| H&V operatives | Joint Conciliation Committee of the Heating, Ventilating and Domestic Engineering Industry | Craftsman: £12.46 / hour | 03 October 16 | Joint Conciliation Committee of the Heating, Ventilating and Domestic Engineering Industry | End of 2016 for years 2018 and 2019 |

| Electricians (national) | The Joint Industry Board for the Electrical Contracting Industry | Approved electrician: £15.92 / hour (own transport) | 02 January 17 | JIB for the Electrical Contracting Industry | A four-year agreement 2021 |

| Scottish Joint Industry Board for the Electrical Contracting Industry | Approved electrician: £15.61 / hour (own transport) | 04 January 16 | SJIB for the Electrical Contracting Industry | January 17 |

Guide to data

Aecom’s cost indices track movements in the input costs of construction work in various sectors, incorporating national wage agreements and changes in materials prices as measured by government index series.

They are intended to provide an underlying indication of price changes and differential movements in the various work sectors but do not reflect changes in market conditions affecting profit and overheads provisions, site wage rates, bonuses or materials’ price discounts/premiums. Market conditions and commentary are outlined in Aecom’ s quarterly Market Forecast (last published November 2016).

No comments yet