�ڶ����� costs rose in the first quarter, but consumer inflation is falling, metal prices are sliding and manufactured goods are slowing down. Peter Fordham of Davis Langdon, an Aecom company reports

01 / KEY CHANGES

- Construction cost measures higher due to wage awards for building operatives and electricians and higher costs for heating and ventilating employers

- Rate of consumer price inflation shows higher than expected fall in April

- Industry input and output cost inflation fall sharply

- Commodity prices, including metals, in decline since February

- The decline in the value of sterling over the winter partially reversed

- Construction materials prices remain subdued

- Short-lived recovery in steel prices at the beginning of the year reversed

- Small wage awards at the beginning of 2013 after periods of freeze

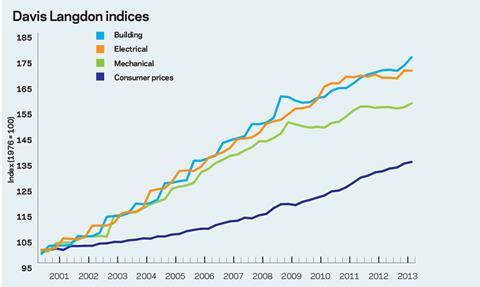

The following chart shows how Davis Langdon’s index series, reflecting cost movements in different sectors of the construction industry, have fared since 2000, with the movement of the Consumer Prices Index for comparison.

Percentage change year-on-year (Q1 2012 to Q1 2013)

| % | Direction | |

|---|---|---|

| �ڶ����� cost index | 3.0 | ▲ |

| Mechanical cost index | 1.0 | ▲ |

| Electrical cost index | 1.6 | ▲ |

| Consumer prices index | 2.8 | ▼ |

| (Q1 2013 figures are provisional) |

�ڶ����� cost index

Increase of 1.9% in the first quarter 2013, leading to a jump in the annual figure to 3.0%. Largely the result of a 2% pay award to building operatives in January.

Mechanical cost index

Index rose by 1.0% in the first quarter of 2013, resulting in the same percentage increase year on year. Partly due to increased pension payments byemployers for operatives.

Electrical cost index

Year-on-year increase of 1.6% is the highest since early 2011. Electricians received a 1.5% pay rise in January.

Consumer prices index

Consumer price inflation held at 2.7-2.8% between October 2012 and March 2013 but has fallen to 2.4% in April.

02 / PRICE ADJUSTMENT FORMULAE FOR BUILDING CONTRACTS

Price Adjustment Formulae indices, compiled by the �ڶ����� Cost Information Service (previously by the Department for Business, Innovation and Skills) are designed for the calculation of increased costs on fluctuating or variation of price contracts. They provide useful guidance on cost changes in various trades and industry sectors and on the differential movement of work sections in Spon’s Price Books.

Over the last 12 months between April 2012 and April 2013, the 60 building work categories recorded an average rise of 1.1%, down marginally from the 1.3% reported three months ago.

The largest price increases over the last year have been in the following work categories:

| April 2012 - April 2013 | % change |

|---|---|

| Cladding and covering: lead | 5.1 |

| Linings and partitions: plasterboard | 5.0 |

| Finishes: screeds | 3.6 |

| Finishes: painting and decorating | 3.3 |

| Finishes: plaster | 3.2 |

| Boards, fittings and trims: manufactured | 3.2 |

Lead cladding has risen the most because lead prices rose steeply in the second half of last year.

The biggest price falls are associated with steel materials, with reinforcement prices dropping the most.

The largest fallers over the last year have been:

| April 2012 - April 2013 | % change |

|---|---|

| Pipes and accessories: spun and cast iron | -1.2 |

| Windows and doors: softwood | -1.2 |

| Insulation | -1.5 |

| Finishes: bitumen, resin and rubber latex flooring | -2.4 |

| Scaffolding materials | -3.0 |

| Metal: decking | -3.5 |

| Concrete: reinforcement | -4.6 |

Materials: Most industry key indicators are on a downward trajectory

03 / EXECUTIVE SUMMARY

- Industry input costs fall sharply ▼

- Output prices at lowest annual increase rate for nearly eight years ▼

- Metals prices slide ▼

- The fall in the value of the pound has started to recover ▲

- Construction materials prices subdued ▶

- Steel prices declining again ▼

04 / KEY INDICATORS

| Consumer prices | % change Apr 12 - Apr 13 | Direction |

|---|---|---|

| Consumer prices index | +2.4 | ▼ |

The annual rate in April fell to 2.4% from 2.8% in March. The index has risen 0.7% since the end of 2012. The rate of increase in the retail prices index declined from 3.3% to 2.9%.

| Industry input costs | ||

|---|---|---|

| Materials and fuels purchased by manufacturing industry | -0.1 | ▼ |

| Materials and fuels purchased by manufacturing industry excluding food, beverages,tobacco and petroleum industries | +1.1 | ▼ |

Input prices fell sharply in April by 2.3%, led by a 7.6% reduction in gas prices, a 6.3% fall in petroleum prices and 2.6% in imported materials prices generally. Key price movements over the last year have been:

| Electricity | + 3.0 |

| Gas | +14.1 |

| Imported metals | -5.0 |

| Imported plastic products | +5.6 |

| Imported wood and wood products | + 2.1 |

| Imported glass and glass products | +2.2 |

| Industry output prices | ||

|---|---|---|

| Output prices of manufactured products | +1.1 | ▼ |

| Output prices of manufactured products excluding food, beverages, tobacco and petroleum | +0.8 | ▼ |

The annual rate of increase fell from 1.8% in March to 1.1% in April, its lowest rate since September 2009. The narrower core index fell from 1.3% in March to 0.8% in April, its lowest rate since September 2005.

| Metal prices | May 12 - May 13 | |

|---|---|---|

| Copper | -9 | ▲ |

| Aluminium | -9 | ▼ |

| Lead | 3 | ▼ |

| Zinc | -6 | ▼ |

| Nickel | -13 | ▼ |

Metals prices were generally on a rising trend from last summer but have fallen back quite sharply since February due to concerns over the speed of Chinese growth. Copper prices have begun a small recovery over the last month but all other metals have continued to fall.

| Exchange rate | May 2012 average | 24 May 2013 | % change |

|---|---|---|---|

| Euro to sterling | 1.244 | 1.168 | -6.1 |

| US dollar to sterling | 1.591 | 1.511 | -5.0 |

The most recent trend is for the pound to strengthen against the euro but fall against the dollar as the European recession deepens and the US economy shows further signs of improvement.

Construction industry

Materials price increases for the construction industry over the last year (to March 2013) are detailed below:

| Construction materials generally: | ||

| New housing | +0.5 | ▶ |

| Non-housing new work | +0.6 | ▶ |

| Repair and maintenance | +0.3 | ▶ |

| Mechanical services materials: | ||

| Housing only | -0.9 | ▶ |

| Non-housing | -0.5 | ▶ |

| Electrical services materials | -0.5 | ▶ |

A few materials have shown above or below average price movement:

| Apr 12 - Apr 13 | |

|---|---|

| Particle boards and similar | +5.5 |

| Veneer sheets and wood-based panels | +5.1 |

| Imported ceramic tiles | +4.9 |

| Stone: cut, shaped and finished | +3.9 |

| Valves: gate, globe, process control | +3.6 |

| Structural steelwork | -3.7* |

| Sheet steel piling | -3.7* |

| Steel pipes | -4.1 |

| Metal sections | -4.9* |

| Steel for reinforcement | -7.6* |

| * Mar 12 - Mar 13 | |

| (April/March 2013 figures provisional, sources: ONS and BIS) |

The table demonstrates the decline in steel prices that has occurred over the last year. European steel prices fell by 15% between spring 2012 and the end of the year. A recovery at the beginning of the year was short-lived and prices are back in decline.

Labour The construction workforce has fallen to 2001 levels, with earnings at a five-year low

05 / EXECUTIVE SUMMARY

- Average weekly earnings in the construction industry fell in the first quarter of this year to £522, a reduction of 2.2% over the same period in 2012. This represents the lowest weekly figure since January 2008

- Average earnings throughout the whole economy rose by 0.4% over the same period

- In the final quarter of 2012, the number of people in construction jobs fell to 1,989,000, the lowest number since 2001

06 / WAGE AGREEMENTS

Heating and ventilating

Employees in the heating, ventilating, air-conditioning, piping and domestic engineering industry secured a new wage agreement for 2013-14 shortly before Christmas last year.

From 28 January the contractual pension contribution paid by employers on behalf of operatives increased from 1% to 2% but they had to wait until 1 April before receiving an increase in hourly wage rates, two-and-a-half years after their last increase. From 1 April, all hourly wage rates rose by 1.5% with corresponding increases in premium rates, responsibility and daily travelling allowances. The agreement also provided for a further increase in the level of contractual pension contributions paid by employers from 2% to 3% of all basic pay from 7 October 2013, followed by an increase from 3% to 4% in October 2014.

The hourly rates of wages that came into effect on 1 April 2013 were:

| Foreman | £15.23 |

| Senior craftsman | £12.59 |

| Craftsman | £11.55 |

| Installer | £10.46 |

| Adult trainee | £8.82 |

| Mate (18 and over) | £8.82 |

| Mate (16 and over) | £4.09 |

| Responsibility allowance | |

| - second welding skill or gas responsibility | £0.52 |

| - supervisory responsibility (senior craftsman) | £1.04 |

| - supervisory responsibility (craftsman) | £0.52 |

Local authorities

The pay of local authority craft and associated employees was caught in the government’s three-year pay freeze for local authority workers. With no pay review since April 2009, employees received a 1% wage increase from April 2013. New weekly rates of pay became:

| �ڶ����� craft operative | £280.03 |

| Labourer | £246.27 |

| Plumber (craftsman) | £299.89 |

| Engineering (craftsman) | £309.54 |

| Electrician | £309.54 |

WAGE AGREEMENT SUMMARY

The following table summarises the wage agreements currently in force for the principal wage fixing bodies within the construction industry

| Operatives | Agreement body | Current basic hourly rate | Effective since | Details in | Date of next review |

|---|---|---|---|---|---|

| Builders and civil engineering operatives | Construction Industry Joint Council | Craft rate: £10.67 / hour | 7 January 2013 | Cost Update 1 March 2013 | Not before 2 January 2014 |

| �ڶ����� and Allied Trades Joint Industrial Council (BATJIC) | S/NVQ3 advanced craft: £10.73 / hour | 12 September 2011 | Spon’s Architects’ and Builders’ Price Book 2013 | 17 June 2013 - rates will rise by 2-3% | |

| Plumbers | The Joint Industry Board for Plumbing Mechanical Engineering Services in England and Wales | Advanced plumber: £13.50 / hour | 2 January 2012 | Spon’s Architects’ and Builders’ Price Book 2013 | Expected 7 January 2013 - discussions continue |

| Scottish and Northern Ireland Joint Industry Board for the Plumbing Industry | Advanced plumber: £12.89 / hour | 6 June 2011 | Spon’s Architects’ and Builders’ Price Book 2013 / Cost Update 27 May 2011 | Negotiations ongoing for 2013-14 | |

| H&V operatives | Joint Conciliation Committee of the Heating, Ventilating and Domestic Engineering Industry | Craftsman: £11.55 / hour | 1 April 2013 | See above | 7 April 2014 |

| Electricians | The Joint Industry Board forthe Electrical Contracting Industry / Scottish Joint Industry Board for the Electrical Contracting Industry | Approved electrician: £14.57 / hour (own transport) | 7 January 2013 | Cost Update 1 March 2013 | 6 January 2014 |

No comments yet